In a sign that the recent stimulatory policy has failed, the Central Bank of Nigeria (CBN) has cut their benchmark interest rates by over 200 basis points. However, the rate cut could just be the tip of the ice berg as the Nigerian economy faces a self-imposed, diminished growth environment.

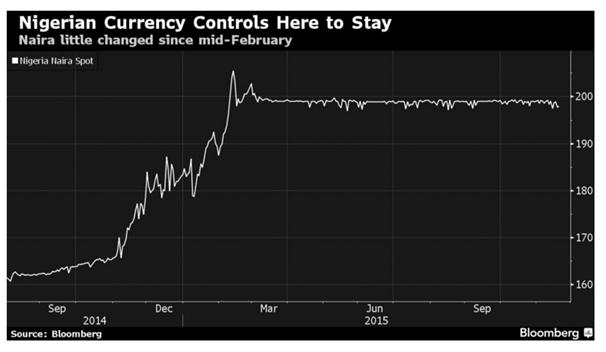

It is largely no surprise that the central bank has been forced into action given the recent schizophrenic fiscal policy, including capital controls, undertaken by the national government. February saw the scraping of the bi-weekly currency auction and a subsequent peg being applied at 198 between the Naira and Dollar. This action was followed closely by the CBN taking up arms to defend any devaluation of the Naira through the introduction of foreign exchange capital controls.

Subsequently, the reduction of interest rates by over 200 basis points to 11.00% demonstrates a central bank that has largely lost control over monetary policy. The concept of stimulating economic activity and growth through a decrease in rates typically only works if you allow capital to flow freely throughout the economy. Adding additional bottle necks, in the form of foreign exchange capital controls, acts only as a disincentive to foreign investment in the region, and is unsustainable in the long run.

In addition, the joint failure of both government and central banking policy hides a deeper underlying problem, a lack of fiscal discipline. The Nigerian government has a problem not only with their external debt load but also with internal expenditure. As their foreign currency reserves dwindle, so too does their ability to raise additional funds on international debt markets at reasonable yields. The simple truth is that the current state of the Nigerian economy is such that government expenditure cannot be maintained at the current level.

In the short run, lower interest rates may assist the government in borrowing to fund an expanding budget but it fails to address systemic failures in the Nigerian economy. Moving forward, Nigeria requires a stable economy based upon incentives for entrepreneurs who drive economic activity rather than central planning and continued government meddling in the economy. Without some radical changes, the debt load will continue to increase to unsustainable levels, whilst economic growth will remain elusive.

Risk Warning: Any form of trading or investment carries a high level of risk to your capital and you should only trade with money you can afford to lose. The information and strategies contained herein may not be suitable for all investors, so please ensure that you fully understand the risks involved and you are advised to seek independent advice from a registered financial advisor. The advice on this website is general in nature and does not take into account your objectives, financial situation or needs. You should consider whether the advice is suitable for you and your personal circumstances. The information in this article is not intended for residents of New Zealand and use by any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation. Knight Review is not a registered financial advisor and in no way intends to provide specific advice to you in any form whatsoever and provide no financial products or services for sale. As always, please take the time to consult with a registered financial advisor in your jurisdiction for a consideration of your specific circumstances.

Recommended Content

Editors’ Picks

AUD/USD hovers around 0.6500 amid light trading, ahead of US GDP

AUD/USD is trading close to 0.6500 in Asian trading on Thursday, lacking a clear directional impetus amid an Anzac Day holiday in Australia. Meanwhile, traders stay cautious due ti risk-aversion and ahead of the key US Q1 GDP release.

USD/JPY finds its highest bids since 1990, near 155.50

USD/JPY keeps breaking into its highest chart territory since June of 1990 early Thursday, testing 155.50 for the first time in 34 years as the Japanese Yen remains vulnerable, despite looming Japanese intervention risks. Focus shifts to Thursday's US GDP report and the BoJ decision on Friday.

Gold stays firm amid higher US yields as traders await US GDP data

Gold recovers from recent losses, buoyed by market interest despite a stronger US Dollar and higher US Treasury yields. De-escalation of Middle East tensions contributed to increased market stability, denting the appetite for Gold buying.

Injective price weakness persists despite over 5.9 million INJ tokens burned

Injective price is trading with a bearish bias, stuck in the lower section of the market range. The bearish outlook abounds despite the network's deflationary efforts to pump the price. Coupled with broader market gloom, INJ token’s doomed days may not be over yet.

Meta Platforms Earnings: META sinks 10% on lower Q2 revenue guidance Premium

This must be "opposites" week. While Doppelganger Tesla rode horrible misses on Tuesday to a double-digit rally, Meta Platforms produced impressive beats above Wall Street consensus after the close on Wednesday, only to watch the share price collapse by nearly 10%.