As the ongoing war between OPEC and US shale oil producers continues to rage, so too does the collateral damage of the global supply glut. The latest casualty of the commodity war appears to be Canadian oil producers as activity in the Alberta tar sands area declines rapidly.

As OPEC moved to counter the growing threat from US producers, a strategy of maintaining an over-supply was pursued. The strategy was designed to damage the higher cost basis of the US producers but 17 months later the gamble continues as the US Shale industry remains resilient. However, given the difference between the cost structures between the countries, it has primarily been Alberta based producers that have felt the pinch of low prices.

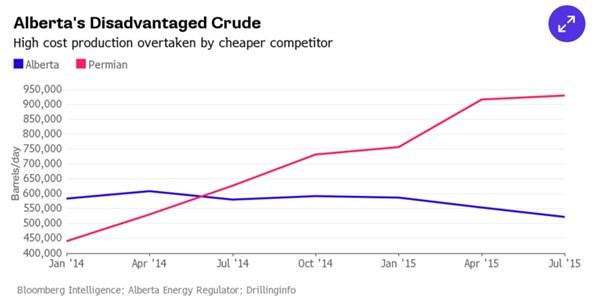

Canada’s bitumen oil industry has struggled to find new efficiencies given the intensive production process. Subsequently,it has been difficult for the fledging industry to compete in a commodity market largely dominated by a growing supply glut. In contrast, US producers in the Permian Basin have discovered new efficiency and, as a result, US Shale production continues to rise.

Subsequently, oil production in the Alberta region has taken a strong nose-dive over the past 12 months from a high of over 600,000 barrels per day to levels well below 450,000.This year alone, bitumen production has fallen over 13% and the production figure is likely to continue falling into 2016 as long as extraction costs remain above market prices.

If OPEC continues to pursue the current strategy, global oil supply is likely to be indelibly damaged for years to come. However, the damage is unlikely to remain evenly spread across the industry and US shale producers are likely to persist as a thorn in the side of OPEC. Subsequently, when oil markets eventually return to some level of normality, the operating landscape could significantly differ from what exists today.

In closing, OPEC clearly views the current strategy as working in crimping off the western supply of crude. However, all the strategy has managed to achieve is a transition of production from Canada to the US where the Bakken and Permian basin operators are incentivised to discover new and more efficient production methods. These advances are significant enough that OPEC might just rue the day they failed to take a long term view of the oil industry.

Risk Warning: Any form of trading or investment carries a high level of risk to your capital and you should only trade with money you can afford to lose. The information and strategies contained herein may not be suitable for all investors, so please ensure that you fully understand the risks involved and you are advised to seek independent advice from a registered financial advisor. The advice on this website is general in nature and does not take into account your objectives, financial situation or needs. You should consider whether the advice is suitable for you and your personal circumstances. The information in this article is not intended for residents of New Zealand and use by any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation. Knight Review is not a registered financial advisor and in no way intends to provide specific advice to you in any form whatsoever and provide no financial products or services for sale. As always, please take the time to consult with a registered financial advisor in your jurisdiction for a consideration of your specific circumstances.

Recommended Content

Editors’ Picks

EUR/USD steady near 1.0650 as markets gear up for PMI-heavy Tuesday

EUR/USD is testing the waters near 1.0650 after a quiet Monday saw the major pair flatline ahead of a densely-packed economic data docket. Both the US and the wider Eurozone area will see updates to Purchasing Managers Index (PMI) figures on Tuesday.

GBP/USD: Flat lines around mid-1.2300s, bearish potential seems intact

GBP/USD holds steady on Tuesday amid subdued USD demand, albeit lacks bullish conviction. The divergent Fed-BoE policy expectations turn out to be a key factor acting as a headwind. The technical setup suggests that the path of least resistance for the pair is to the downside.

Gold could see a rebound before resuming the correction

Gold price sees a fresh leg down in Asia on Tuesday even as risk flows dissipate. Receding fears over Middle East escalation offset subdued US Dollar and Treasury bond yields. Gold remains heavily oversold on the 4H chart, rebound appears in the offing.

PENDLE price soars 10% after Arthur Hayes’ optimism on Pendle derivative exchange

Pendle price is among the top performers in the cryptocurrency market today, posting double-digit gains. Its peers in the altcoin space are not as forthcoming even as the market enjoys bullish sentiment inspired by Bitcoin price.

After Monday's relief rally, attention shifts to earnings and policy fronts

With the easing of tensions in the Middle East, safe-haven demand reversed course; global stock markets experienced a modicum of relief. Indeed, in a classic relief rally fashion, Monday saw a rebound in the S&P 500, snapping a six-day losing streak.