The US Congress faces a deadlock as the political impasse over lifting the debt ceiling worsens and short term Treasury bond yields start to rise.

Monday saw a sharp increase to selling of short term dated bills due for maturity within the next month. In fact, the yield for Treasury Bills due to mature on November 12th rose as high as 0.178% before easing towards the end of the trading day. However, without a resolution to the debt ceiling crisis in sight, distortions to the bond market are likely to continue.

As we near the top range of the US government debt limit, congressional leaders appear to be no closer to reaching a deal. Failure to reach a deal for an extension by the 3rd of November would likely see the superpower potentially run out of cash to meet its obligations. In fact, Treasury Secretary Jacob Lew has stated that the US will exhaust their cash management measures by the expiry of the deadline.

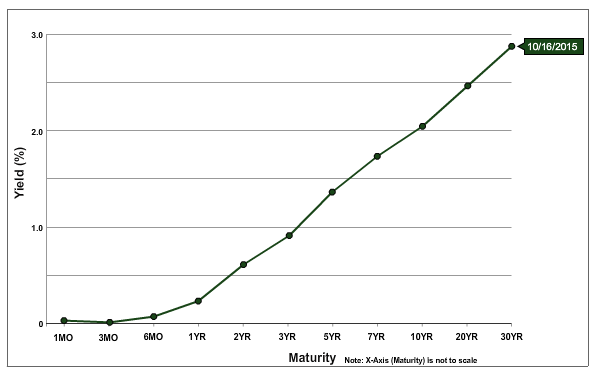

Treasury Yield Curve

At this point, it is largely the short term dated Treasury instruments that are being impacted by the uncertainty. However, as we approach the debt ceiling deadline the yield curve is likely to steepen for a wider range of maturity dates. Despite the absence of a deal, a new issuance of 3 and 6-month dated bonds drew strong demand from the market.

The most likely scenario is that congressional leaders will reach a compromise at the 11th hour that would see the debt limit extended for some time in exchange for a range of spending concessions. Given the previous debt ceiling show-downs, we are likely to see November bond yields spike as we near the deadline and then decline sharply as a deal is reached. In fact, this scenario has plenty of support given that December and January Treasuries have traded at rates below those maturing in November indicating that the market does not expect a default.

Ultimately, a deal extending the debt ceiling is highly likely to be reached and the resultant fall-out within the bond market will be limited to spiking yields. However, never underestimate the ability of Congress to cause volatility within the debt markets as they vacillate over the outcome.

Risk Warning: Any form of trading or investment carries a high level of risk to your capital and you should only trade with money you can afford to lose. The information and strategies contained herein may not be suitable for all investors, so please ensure that you fully understand the risks involved and you are advised to seek independent advice from a registered financial advisor. The advice on this website is general in nature and does not take into account your objectives, financial situation or needs. You should consider whether the advice is suitable for you and your personal circumstances. The information in this article is not intended for residents of New Zealand and use by any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation. Knight Review is not a registered financial advisor and in no way intends to provide specific advice to you in any form whatsoever and provide no financial products or services for sale. As always, please take the time to consult with a registered financial advisor in your jurisdiction for a consideration of your specific circumstances.

Recommended Content

Editors’ Picks

EUR/USD holds steady near 1.0650 amid risk reset

EUR/USD is holding onto its recovery mode near 1.0650 in European trading on Friday. A recovery in risk sentiment is helping the pair, as the safe-haven US Dollar pares gains. Earlier today, reports of an Israeli strike inside Iran spooked markets.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD is rebounding toward 1.2450 in early Europe on Friday, having tested 1.2400 after the UK Retail Sales volumes stagnated again in March, The pair recovers in tandem with risk sentiment, as traders take account of the likely Israel's missile strikes on Iran.

Gold price defends gains below $2,400 as geopolitical risks linger

Gold price is trading below $2,400 in European trading on Friday, holding its retreat from a fresh five-day high of $2,418. Despite the pullback, Gold price remains on track to book the fifth weekly gain in a row, supported by lingering Middle East geopolitical risks.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Geopolitics once again take centre stage, as UK Retail Sales wither

Nearly a week to the day when Iran sent drones and missiles into Israel, Israel has retaliated and sent a missile into Iran. The initial reports caused a large uptick in the oil price.