The Euro largely took its cues from the US data last week which was less than impressive, especially in the retail sector. Some slightly weaker EU data has led to calls for further stimulus from the ECB and that has limited the Euro's gains. The central bank is set to meet this week to set interest rates and could possibly hint at further stimulus to come.

The Euro gained solidly in the first half of the week thanks to market sentiment swinging away from the US dollar. A fall in US core retail sales by -0.3% m/m has seen a shift in interest rate expectation, with many believing the Fed will not be able to justify a rate rise this year.

Data out of the EU was lacklustre with German ZEW economic sentiment falling from 12.1 to 1.9. Euro CPI also remained on the wrong side of 0 at -0.1% y/y which will be worrying for the ECB. There have been increased calls for more QE from the ECB which caused the Euro to give up the gains in the latter half of the week.

The ECB are set to meet this week to discuss monetary policy, but there is no real expectation of a change. If Draghi is to widen QE this year, he will likely signal well in advance. Certainly this meeting could hold some clues. Draghi has said right from the start that they were prepared to expand QE at any stage if the economy required it. Also keep an eye on the French and German Manufacturing PMI results later in the week as they will give an idea of how that side of the economy is shaping up. So far they have remained relatively solid and are both expected to return expansionary results.

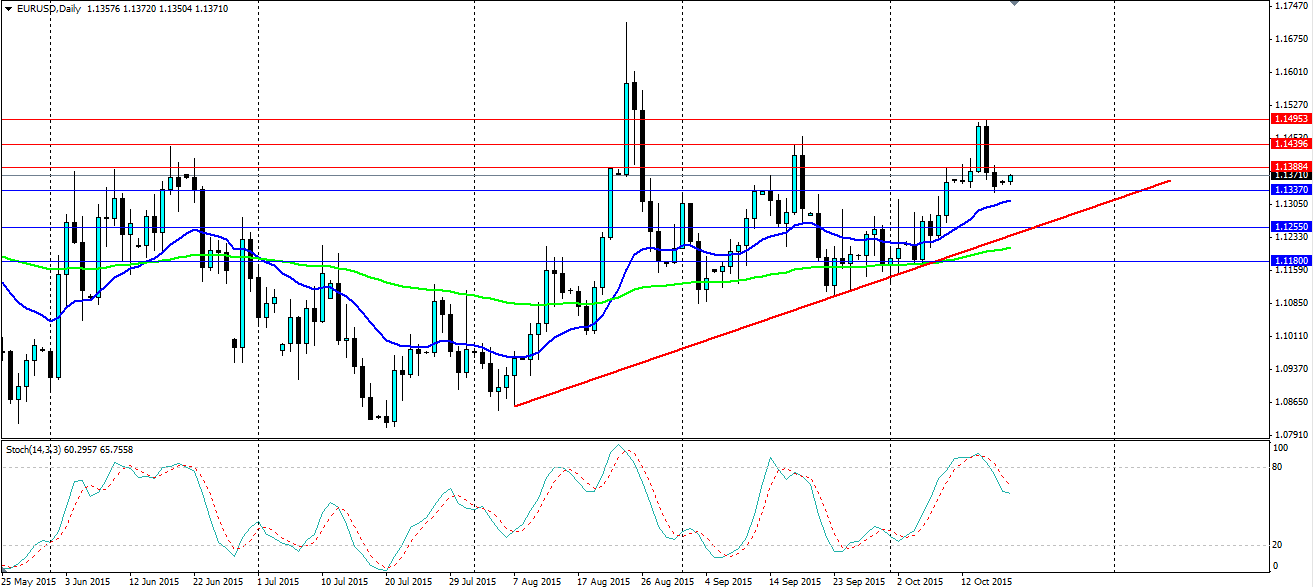

Technicals show the Euro continuing the overall bullish bias against the US dollar. The 20 and 100 day MAs are trending higher with the Stoch dipping out of overbought territory providing further upside room. Watch for support at 1.1337, 1.1255 and 1.1180 with the trend line acting as dynamic support. Resistance is found at 1.1388, 1.1439 and 1.1495.

Forex and CFDs are leveraged financial instruments. Trading on such leveraged products carries a high level of risk and may not be suitable for all investors. Please ensure that you read and fully understand the Risk Disclosure Policy before entering any transaction with Blackwell Global Investments Limited.

Recommended Content

Editors’ Picks

AUD/USD hovers around 0.6500 amid light trading, ahead of US GDP

AUD/USD is trading close to 0.6500 in Asian trading on Thursday, lacking a clear directional impetus amid an Anzac Day holiday in Australia. Meanwhile, traders stay cautious due ti risk-aversion and ahead of the key US Q1 GDP release.

USD/JPY finds its highest bids since 1990, near 155.50

USD/JPY keeps breaking into its highest chart territory since June of 1990 early Thursday, testing 155.50 for the first time in 34 years as the Japanese Yen remains vulnerable, despite looming Japanese intervention risks. Focus shifts to Thursday's US GDP report and the BoJ decision on Friday.

Gold price treads water near $2,320, awaits US GDP data

Gold price recovers losses but keeps its range near $2,320 early Thursday. Renewed weakness in the US Dollar and the US Treasury yields allow Gold buyers to breathe a sigh of relief. Gold price stays vulnerable amid Middle East de-escalation, awaiting US Q1 GDP data.

Injective price weakness persists despite over 5.9 million INJ tokens burned

Injective price is trading with a bearish bias, stuck in the lower section of the market range. The bearish outlook abounds despite the network's deflationary efforts to pump the price. Coupled with broader market gloom, INJ token’s doomed days may not be over yet.

Meta Platforms Earnings: META sinks 10% on lower Q2 revenue guidance Premium

This must be "opposites" week. While Doppelganger Tesla rode horrible misses on Tuesday to a double-digit rally, Meta Platforms produced impressive beats above Wall Street consensus after the close on Wednesday, only to watch the share price collapse by nearly 10%.