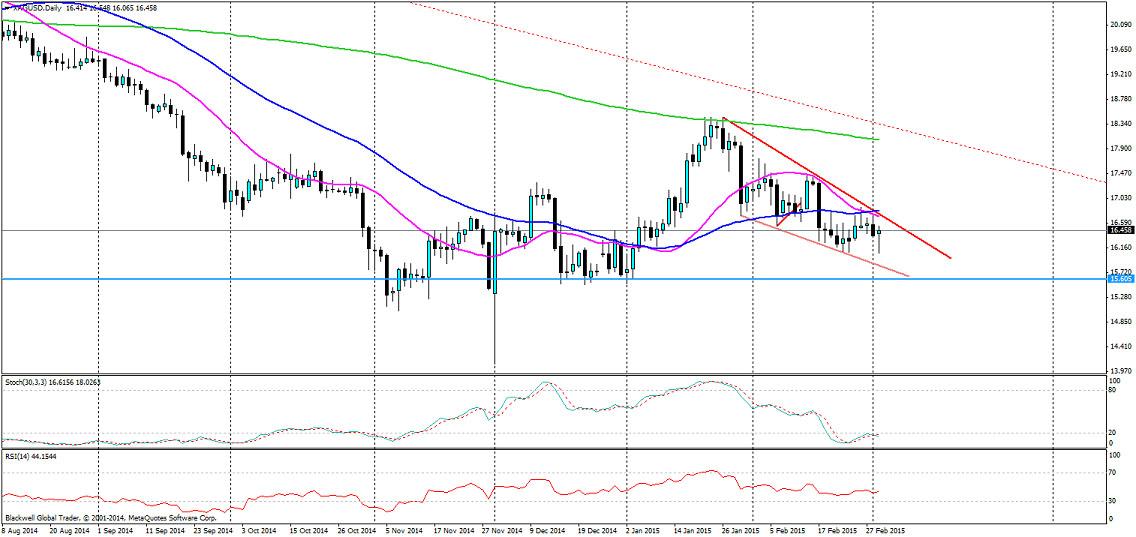

The silver wedge continues to tighten as markets look to shift into a lower gear and drop down the charts.

The question is how much further can we drop at present with the silver market looking very timid. Not much further I feel as currently we have seen a strong resistance patch at 15.065 and the market will most certainly be looking to play to this level at least.

What the market this week will be focused on is labour data and the build-up for FED action. The labour market has so far been quite positive, and as a result the market will be looking for driving points to get it lower. Each time we have the prospect of rate rises on the horizon in a talk we see silver shift lower and non-farm this week is expected to be 238K, a rather weak reading to previous ones, so there its certainly room for a large drop lower.

So with Yellen wanting to talk up the prospect of interest rate rises to the market, it’s inevitable that we will see lower lows in silver, at least down to the 15.065 level. But from a technical perspective, we have a solid wedge forming and we also have a golden cross forming as the 20 MA crosses through the 50 MA pointing to bearish sentiment picking up the pace.

Long term a descending wedge is a breakout pattern upwards, however, we have some more time to go before that is a reality and once we have a touch on the 15.065 level, there will be scope for a breakout higher for the silver market; just not right now while we continue to trend lower.

Recommended Content

Editors’ Picks

EUR/USD holds gains above 1.0700, as key US data loom

EUR/USD holds gains above 1.0700 in the European session on Thursday. Renewed US Dollar weakness offsets the risk-off market environment, supporting the pair ahead of the key US GDP and PCE inflation data.

GBP/USD extends recovery above 1.2500, awaits US GDP data

GBP/USD is catching a fresh bid wave, rising above 1.2500 in European trading on Thursday. The US Dollar resumes its corrective downside, as traders resort to repositioning ahead of the high-impact US advance GDP data for the first quarter.

Gold price edges higher amid weaker USD and softer risk tone, focus remains on US GDP

Gold price (XAU/USD) attracts some dip-buying in the vicinity of the $2,300 mark on Thursday and for now, seems to have snapped a three-day losing streak, though the upside potential seems limited.

XRP extends its decline, crypto experts comment on Ripple stablecoin and benefits for XRP Ledger

Ripple extends decline to $0.52 on Thursday, wipes out weekly gains. Crypto expert asks Ripple CTO how the stablecoin will benefit the XRP Ledger and native token XRP.

US Q1 GDP Preview: Economic growth set to remain firm in, albeit easing from Q4

The United States Gross Domestic Product (GDP) is seen expanding at an annualized rate of 2.5% in Q1. The current resilience of the US economy bolsters the case for a soft landing.