The oil market has been very volatile in recent months, if not weeks. But there is certainly no reason to take your eye off the ball when it comes to oil markets.

There has been a lot of talk about fundamentals in the market, and so far they really have very little impact in the long run apart from the fact that demand is just not there. Many have talked about OPEC and Saudia Arabia and for the most part that should not worry the market unless anything does happen and it has not so far.

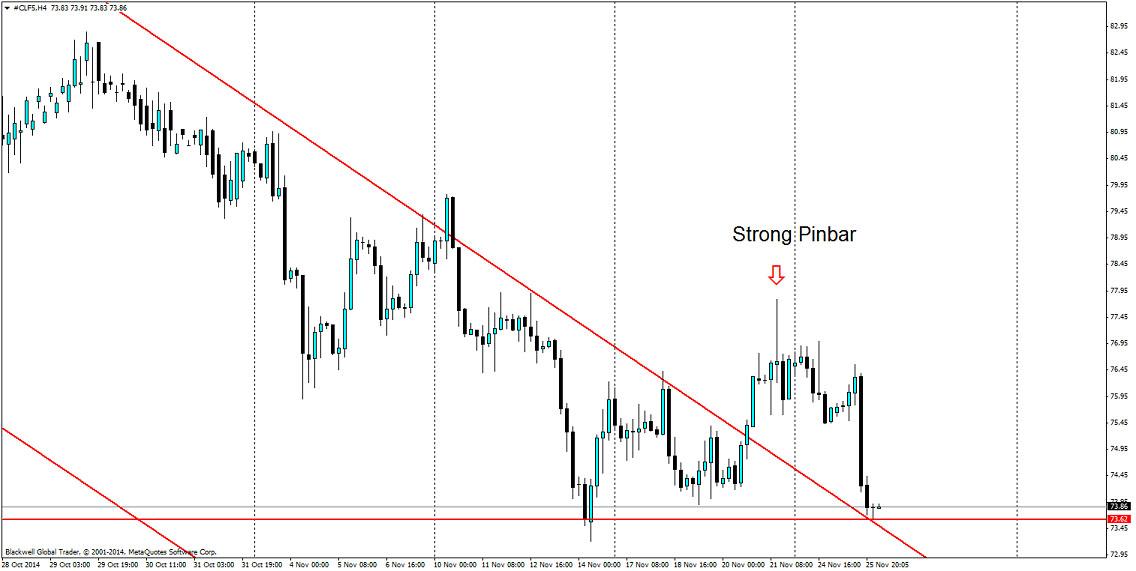

On the charts is where it matters, and what we have seen is a trending market step up the pace and become steeper and more aggressive as of late. However, last week we saw a slight reprieve and a possible false breakout which has since looked to start falling again as demand is still not there in the market.

When looking for price targets 73.62 is the support floor, which is holding up quite nicely at present, it’s likely it may act as solid support for some time. However, market pressure lower is still there and we may be looking for the next major level for oil. This level can be found at 68.56 and is likely to be a strong turning point for oil if we get there, and we may actually find some more bulls in this market for a change.

On the H4 chart, we can see the price action as it pushes the bulls out of the market. We’ve seen a strong pin bar on the charts, followed by aggressive selling as a result and that level holding up as a strong area of resistance.

Overall, oil looks to still be under the pump and until we saw a confirmed amount of momentum driving higher oil looks likely to stay under the bears control. If you’re an oil trader, I would strongly be looking to the sell side of things in the short term, as it looks like the bulls are still not there for traders.

Forex and CFDs are leveraged financial instruments. Trading on such leveraged products carries a high level of risk and may not be suitable for all investors. Please ensure that you read and fully understand the Risk Disclosure Policy before entering any transaction with Blackwell Global Investments Limited.

Recommended Content

Editors’ Picks

EUR/USD extends gains above 1.0700, focus on key US data

EUR/USD meets fresh demand and rises toward 1.0750 in the European session on Thursday. Renewed US Dollar weakness offsets the risk-off market environment, supporting the pair ahead of the key US GDP and PCE inflation data.

USD/JPY keeps pushing higher, eyes 156.00 ahead of US GDP data

USD/JPY keeps breaking into its highest chart territory since June of 1990 early Thursday, recapturing 155.50 for the first time in 34 years as the Japanese Yen remains vulnerable, despite looming intervention risks. The focus shifts to Thursday's US GDP report and the BoJ decision on Friday.

Gold closes below key $2,318 support, US GDP holds the key

Gold price is breathing a sigh of relief early Thursday after testing offers near $2,315 once again. Broad risk-aversion seems to be helping Gold find a floor, as traders refrain from placing any fresh directional bets on the bright metal ahead of the preliminary reading of the US first-quarter GDP due later on Thursday.

Injective price weakness persists despite over 5.9 million INJ tokens burned

Injective price is trading with a bearish bias, stuck in the lower section of the market range. The bearish outlook abounds despite the network's deflationary efforts to pump the price.

US Q1 GDP Preview: Economic growth set to remain firm in, albeit easing from Q4

The United States Gross Domestic Product (GDP) is seen expanding at an annualized rate of 2.5% in Q1. The current resilience of the US economy bolsters the case for a soft landing.