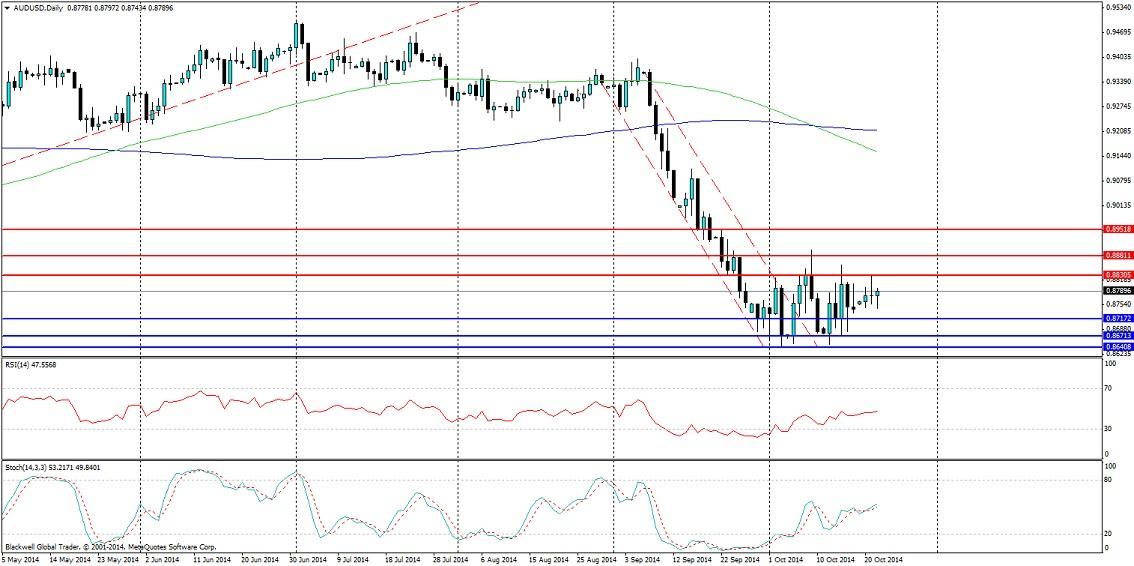

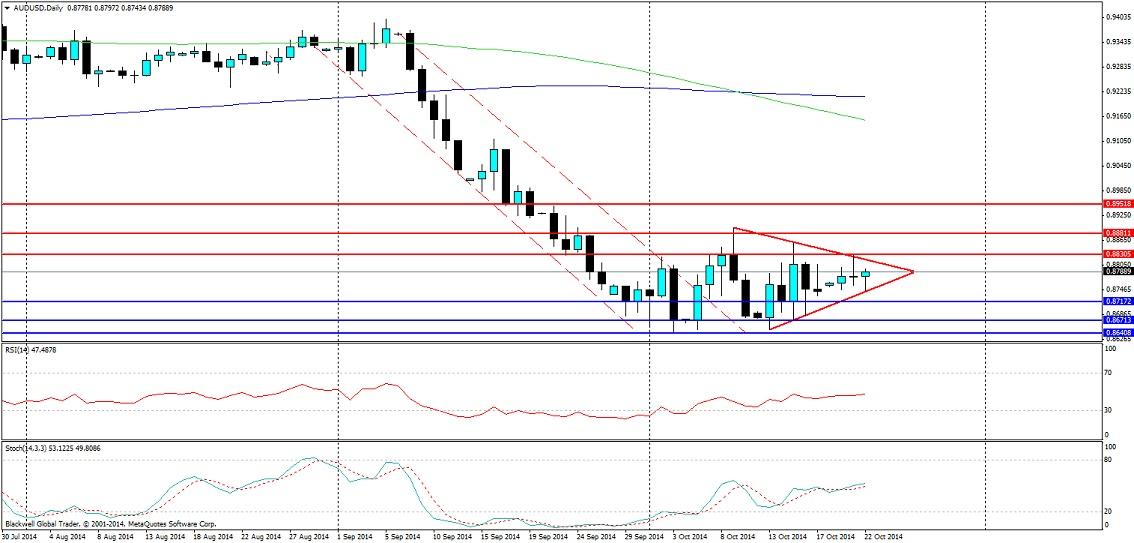

The Australian dollar has been extremely volatile as of late, and this comes on the back of commodity currencies being in total fluctuation as the USD weakens and strengthens sharply. The Aussie dollar has been one of the most mixed in terms of performance, and is currently holed up in the 88-86 cent range.

People should be positive about the Australian dollar as it has a habit of breaking trends, and being very aggressive at times. And the recent data out of China for GDP and Industrial Production are likely to help the bulls out there. Recent y/y GDP data came in at 7.3% (strong growth for any nation), while Industrial production came in at a whopping 8.0% - much higher than the expected 7.5% and 6.9% in the previous month.

So today’s recent CPI data is actually quite nice for the Australian dollar. With CPI q/q coming in at 0.5%, it means we are likely to see markets smile once again on the Australian dollar and be a little more upbeat about economic data in the future.

The only threat to further Aussie appreciation is the RBA governor who is set to speak at 21:00 GMT. This is the real threat, as jaw boning is a typical central bank action that central bank governors like to use to talk down a currency from time to time, and so far with a neutral stance it really is the only option they have to get it any lower.

What is curious, technically speaking, about the Aussie dollar is the current pennant/symmetrical triangle that has formed on the AUDUSD chart. When it comes to technical patterns this is generally a continuation pattern of the previous trend, and we could see a breakout lower for it tomorrow when the RBA governor looks to speak.

A nice play would be to try and catch either side. From a fundamental point of view, I could certainly be a bit bullish, but from a technical point of view, this is a continuation pattern for going lower and we may see a drop. Either I would way to see the drop of jump higher and confirm it before looking to momentum trade such a pattern.

Recommended Content

Editors’ Picks

EUR/USD stays below 1.0700 ahead of US data

EUR/USD stays in a consolidation phase slightly below 1.0700 in the European session on Wednesday. Upbeat IFO sentiment data from Germany helps the Euro hold its ground as market focus shifts to US Durable Goods Orders data.

USD/JPY refreshes 34-year high, attacks 155.00 as intervention risks loom

USD/JPY is renewing a multi-decade high, closing in on 155.00. Traders turn cautious on heightened risks of Japan's FX intervention. Broad US Dollar rebound aids the upside in the major. US Durable Goods data are next on tap.

Gold manages to hold above $2,300

Gold struggles to stage a rebound following Monday's sharp decline but manages to hold above $2,300. The benchmark 10-year US Treasury bond yield stays in the green above 4.6% ahead of US data, not allowing XAU/USD to gain traction.

Worldcoin looks set for comeback despite Nvidia’s 22% crash Premium

Worldcoin price is in a better position than last week's and shows signs of a potential comeback. This development occurs amid the sharp decline in the valuation of the popular GPU manufacturer Nvidia.

Three fundamentals for the week: US GDP, BoJ and the Fed's favorite inflation gauge stand out Premium

While it is hard to predict when geopolitical news erupts, the level of tension is lower – allowing for key data to have its say. This week's US figures are set to shape the Federal Reserve's decision next week – and the Bank of Japan may struggle to halt the Yen's deterioration.