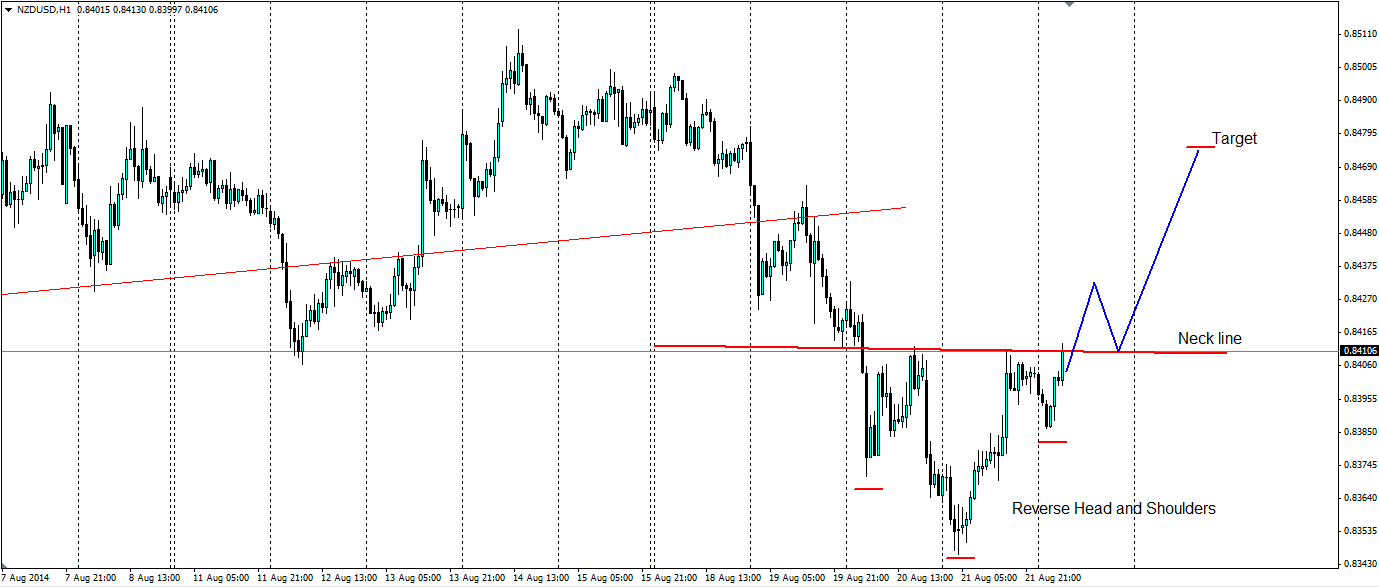

A reverse head and shoulders pattern has all but formed on the NZDUSD chart that could signal an end to the long and arduous bearish slide the kiwi has suffered over the last month and a half.

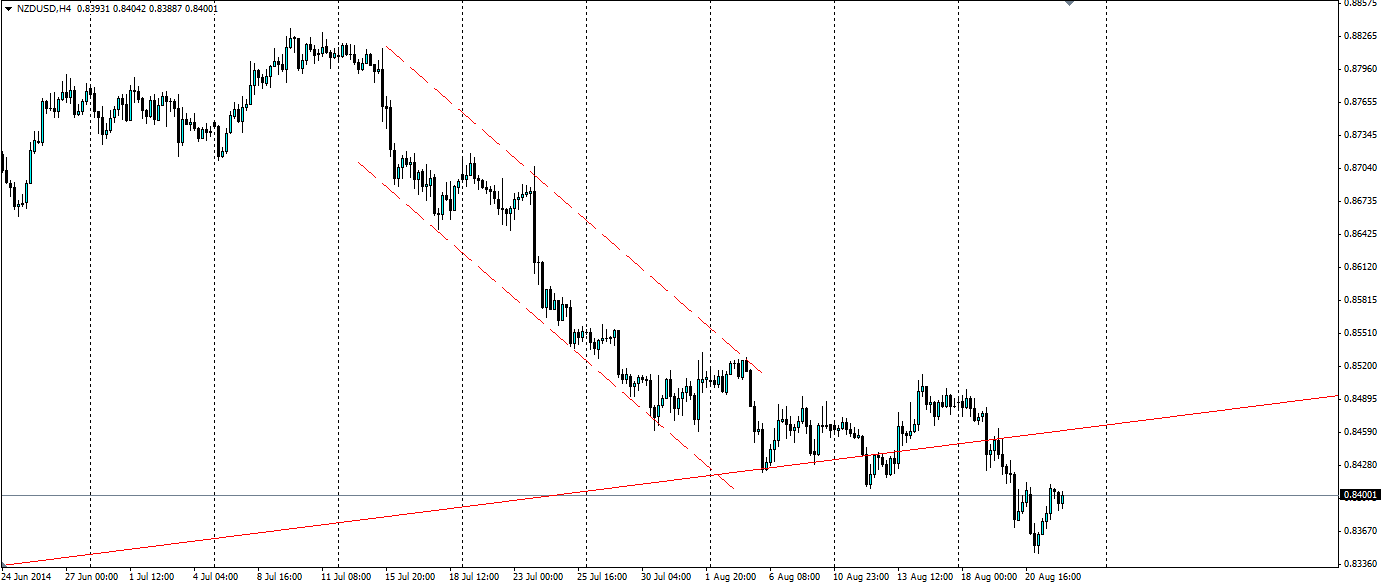

It’s been a tough six weeks for the Kiwi dollar. The primary reason is that the Reserve Bank of New Zealand (RBNZ) has taken a break from raising interest rates amid some disappointing economic data and the markets have punished the NZD, taking over 400 pips off its value against the US Dollar. The markets had been anticipating interest rates to hit 4.50% by mid next year from 2.50% at the beginning of 2014. The loss of potential return has seen a flight of capital, however, the NZD still makes a good carry trade with interest rates currently at 3.50%.

We do not need to look far to find the disappointing data mentioned above. The New Zealand economy relies heavily on exports of dairy products and these have been fetching disappointing returns as of late. The global dairy index has slid over 40% since February, wiping billions of dollars off the value of New Zealand’s exports. Furthermore inflation expectations were downgraded from 2.4% to 2.2% as the RBNZ released the results of a survey.

The silver lining for the Kiwi is that it is still an attractive carry trade with interest rates at 3.50% and unlikely to be reduced unless things take a drastic turn for the worse. Contrast this will the major central banks around the world and it becomes clear just how much the Kiwi is returning. The US interest rate is <0.25%, the Euro is 0.15%, the Swiss is 0.0% and Japan is 0.10%. This carry trade could explain why the Kiwi may be about to reverse its downward slide with a reverse head and shoulders pattern.

The above chart shows the potential reverse head and shoulders pattern forming. The ideal outcome (in blue) will be for the price to break through the neck line and come back to test it, using it as support before a larger movement up towards the target. The target for the movement is 65 pips above the neck line. This is our target because the ‘head’ of the structure is 65 pips below the neck line.

Traders looking to take advantage of this formation must wait for the neck line to be breached and for the price to pull back to it. If the neck line, acting as support, holds then it will be game on and we should see a big movement off it towards the target at 0.8475. Be wary of previous levels of resistance at 0.8438 and 0.8463 as these may hold up the price. Ensure a stop loss is set below the neck line in case the market has other ideas about this structure.

The NZDUSD pair looks to be forming a head and shoulders pattern that could see a reversal of the recent bearish trend the kiwi has been following recently. If it forms, it could prove lucrative for anyone bullish on the Kiwi.

Forex and CFDs are leveraged financial instruments. Trading on such leveraged products carries a high level of risk and may not be suitable for all investors. Please ensure that you read and fully understand the Risk Disclosure Policy before entering any transaction with Blackwell Global Investments Limited.

Recommended Content

Editors’ Picks

EUR/USD holds steady near 1.0650 amid risk reset

EUR/USD is holding onto its recovery mode near 1.0650 in European trading on Friday. A recovery in risk sentiment is helping the pair, as the safe-haven US Dollar pares gains. Earlier today, reports of an Israeli strike inside Iran spooked markets.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD is rebounding toward 1.2450 in early Europe on Friday, having tested 1.2400 after the UK Retail Sales volumes stagnated again in March, The pair recovers in tandem with risk sentiment, as traders take account of the likely Israel's missile strikes on Iran.

Gold price defends gains below $2,400 as geopolitical risks linger

Gold price is trading below $2,400 in European trading on Friday, holding its retreat from a fresh five-day high of $2,418. Despite the pullback, Gold price remains on track to book the fifth weekly gain in a row, supported by lingering Middle East geopolitical risks.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Geopolitics once again take centre stage, as UK Retail Sales wither

Nearly a week to the day when Iran sent drones and missiles into Israel, Israel has retaliated and sent a missile into Iran. The initial reports caused a large uptick in the oil price.