The European Union is looking like the contender for this week's biggest move as Mario Draghi sets to feed the banks loans in order to prop up the European Union. Many economists are expecting Draghi to give banks 700 billion euros in additional lending power, in order to help to provide cheap loans to households and small businesses. Banks will also be eager to take up anything that is essentially a free lunch for them, and cheap money for them is something they would never shy away from.

The Germans who are normally the ones demanding austerity are in an awkward position with deflation, so for once they are interested to see the results of such a lending programme; as long as it keeps to their mandated rules.

The Euro-zone as a whole, might seem like a failed experiment at times, but the currency itself is very strong nevertheless – and the charts show weakness yet again.

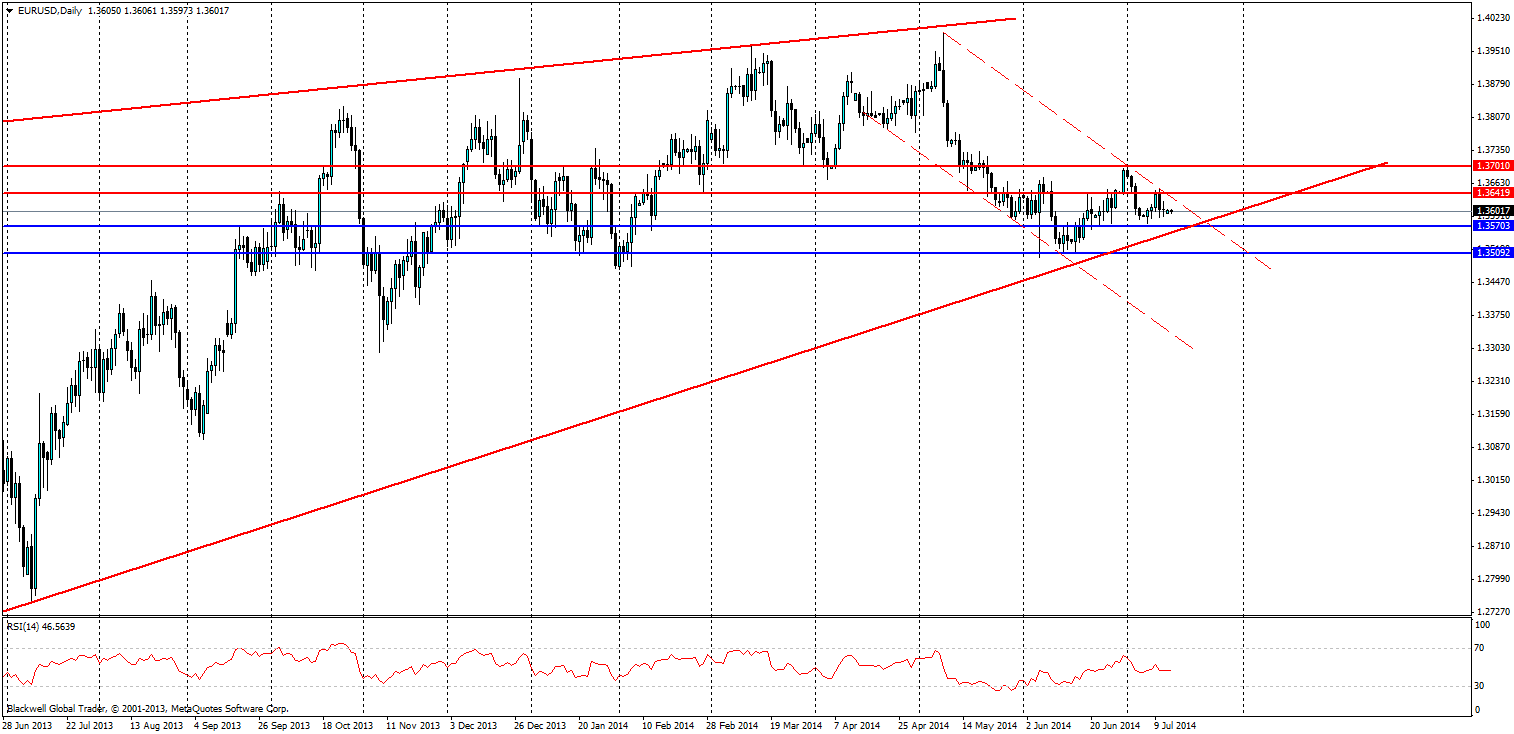

As of late, there has been bullish trend upwards for the Euro, which has so far defied many serious market economists' predictions of a fall. This in part has been led by a very weak US dollar, which is yet to recover from the global financial crisis. However, the time may soon be up for the Euro, as a bearish channel has started to appear in the short term, and is barrelling down the charts and putting pressure on the long term bullish trend line.

So with a downward slopping EURUSD, we may see it crack through, but what has further added fuel to the fire is the weakness in the Portuguese banking sector. As recently one of its banks came under a large amount of stress as seen in the news. While Draghi’s loans will certainly help banks and prop up the Euro.

Either way the bears are starting to circle on the EURUSD and it's probably a little overdue as of late.

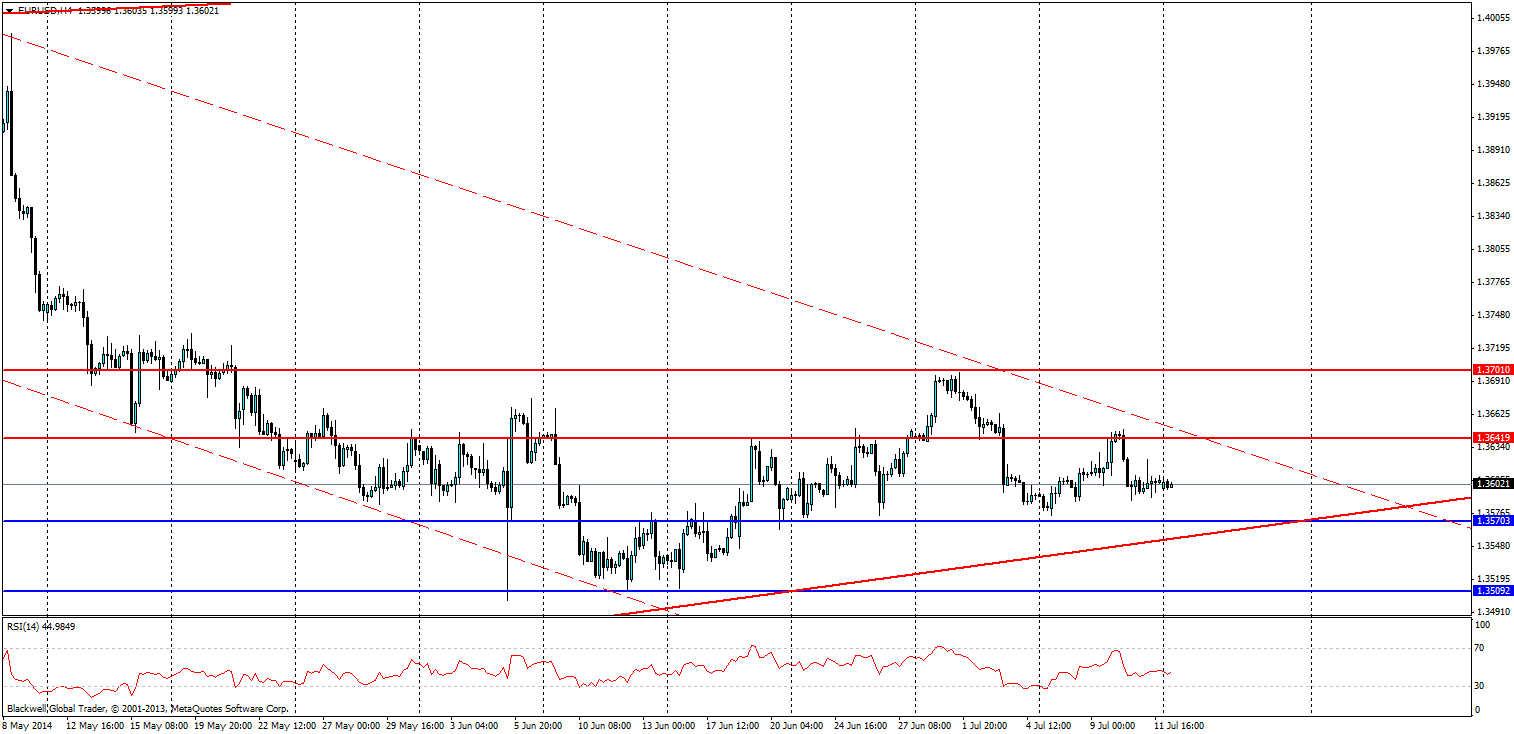

The H4 chart shows some clear support and resistance levels on the chart that will be worth watching over the next few days. Current resistance levels can be found at 1.3641 and 1.3700; resistance can also be found on the current bearish channel. Support levels can be found at 1.3570 and 1.3509, these are likely to be tested as the euro shifts lower, but the current bullish trend line will likely also act as dynamic support as it pushes lower.

So with all the drama in the Euro-zone it’s no surprise that the Euro has slipped lower. The question is how long and how much further can it fall? The trend line though on the daily chart is the first real test for this pair, after that the bears could certainly jump and push the currency much lower against the USD. But whatever happens, we may have to wait a few more days before we see the bears take control.

Recommended Content

Editors’ Picks

EUR/USD regains traction, recovers above 1.0700

EUR/USD regained its traction and turned positive on the day above 1.0700 in the American session. The US Dollar struggles to preserve its strength after the data from the US showed that the economy grew at a softer pace than expected in Q1.

GBP/USD returns to 1.2500 area in volatile session

GBP/USD reversed its direction and recovered to 1.2500 after falling to the 1.2450 area earlier in the day. Although markets remain risk-averse, the US Dollar struggles to find demand following the disappointing GDP data.

Gold holds around $2,330 after dismal US data

Gold fell below $2,320 in the early American session as US yields shot higher after the data showed a significant increase in the US GDP price deflator in Q1. With safe-haven flows dominating the markets, however, XAU/USD reversed its direction and rose above $2,340.

XRP extends its decline, crypto experts comment on Ripple stablecoin and benefits for XRP Ledger

Ripple extends decline to $0.52 on Thursday, wipes out weekly gains. Crypto expert asks Ripple CTO how the stablecoin will benefit the XRP Ledger and native token XRP.

After the US close, it’s the Tokyo CPI

After the US close, it’s the Tokyo CPI, a reliable indicator of the national number and then the BoJ policy announcement. Tokyo CPI ex food and energy in Japan was a rise to 2.90% in March from 2.50%.