I love the silver market. If you read my articles you can understand why, because when it comes to the technical side of things it loves to play along and has done so for some time.

In the current period silver has been going through a strong technical pattern of consolidation. This has been after a steep down trend over the previous months, where a lot of metal traders took full advantage of the situation. The reason for this down trend was the appreciation of the USD and the outlook remaining positive for the US economy – nothing keeps the speculators further away than a booming economy for a change.

With a ceiling at 17.55 and a floor at 17.07, the markets will be eyeing up the possibility of a fall below the 17.07 level, a solid bearish candle below this level could bring the bears back into the market to swipe down silver once more. This is not something that is unreasonable either when you think about it, despite some recent US woes the labour market and consumer sentiment is still very strong. The prospect of rates is ever more increasing as a result.

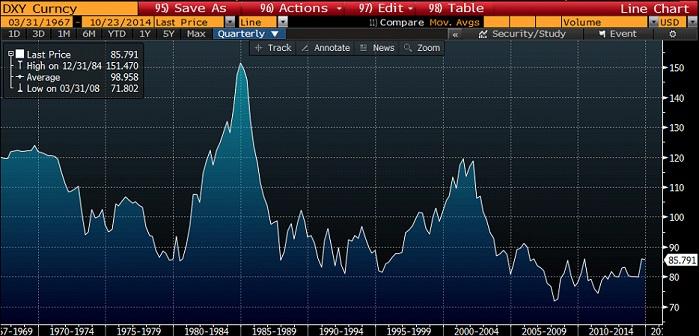

To put it in an even better perspective long term; we have seen the dollar index well below its average against other trade weighted indexes. This is unlikely to remain the same in the long term as other currencies look to devalue themselves in an effort to stimulate their economies. In the long term metals will likely fall against the US dollar as a result.

Overall, silver in the long term looks likely it will drop further and it is just a matter of time. In regards to justification, I look fundamentally to the US dollar strengthening and demand for precious metals tapering off further. From a technical point of view we have seen silver consolidate a few times before a large drop, and this looks no different.

Recommended Content

Editors’ Picks

EUR/USD clings to daily gains above 1.0650

EUR/USD gained traction and turned positive on the day above 1.0650. The improvement seen in risk mood following the earlier flight to safety weighs on the US Dollar ahead of the weekend and helps the pair push higher.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD reversed its direction and advanced to the 1.2450 area after touching a fresh multi-month low below 1.2400 in the Asian session. The positive shift seen in risk mood on easing fears over a deepening Iran-Israel conflict supports the pair.

Gold holds steady at around $2,380 following earlier spike

Gold stabilized near $2,380 after spiking above $2,400 with the immediate reaction to reports of Israel striking Iran. Meanwhile, the pullback seen in the US Treasury bond yields helps XAU/USD hold its ground.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Geopolitics once again take centre stage, as UK Retail Sales wither

Nearly a week to the day when Iran sent drones and missiles into Israel, Israel has retaliated and sent a missile into Iran. The initial reports caused a large uptick in the oil price.