The Aussie dollar looks under a bit of pressure and comments from the RBA did the bulls no favours. We may see a pull back from the recent movement, however, a touch of the bearish trend line should see a strong movement downwards.

Data out today from China helped the Aussie dollar to maintain its bearish channel. The HSBC Manufacturing PMI showed a reading of 50.3, down from 51.7 a month ago and well below the 51.5 the market had anticipated. The impact comes as no surprise given the nature of Australia’s mining led economy and its reliance on exports to China.

Yesterday we saw the Reserve Bank of Australia Governor Glenn Stevens give a speech. He said he believed the Aussie dollar had further to fall and he was becoming concerned about the unemployment rate. He also told parliament that low interest rates were not enough, indicating they will stay low for some time.

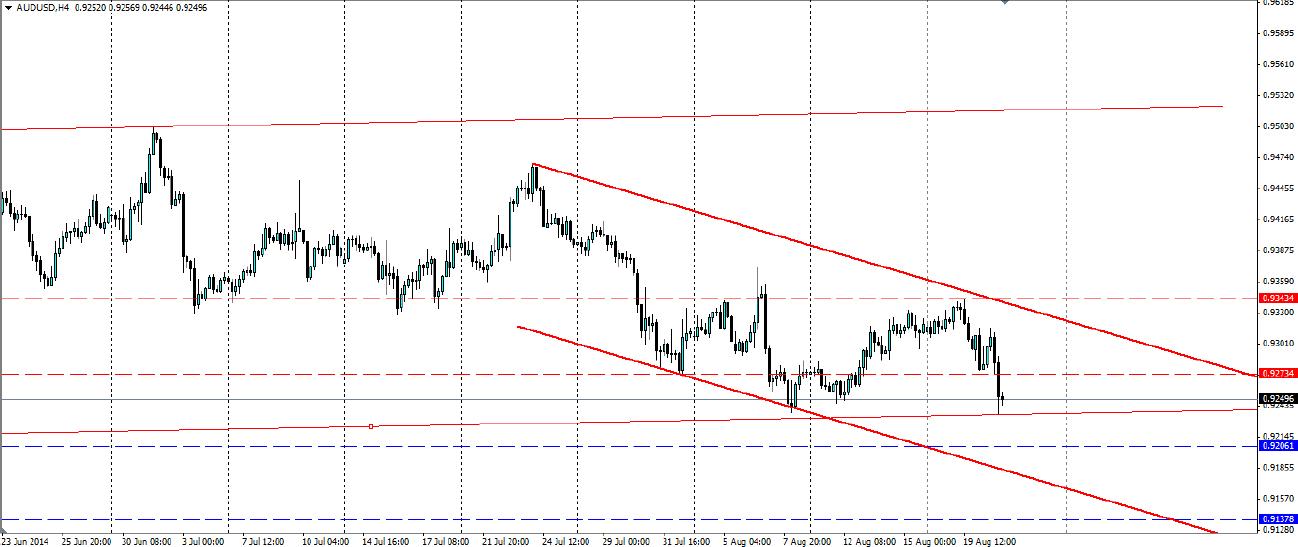

From a technical point of view the bearish channel is looking rather solid on the H4 chart. The price looks likely to break through the bottom of the ranging channel it has been following for the past three months. We could see the price use this as support, however, the bearish sentiment looks strong as we see on the below daily chart.

The MACD is certainly still looking bearish and it would pay to wait for the price to break through the larger channel before taking this pair short. Once confirmed, levels of support can be found at 0.9206, 0.9138 and 0.8995 and may act as possible exit points, with the bearish channel acting as dynamic support. If the price bounces higher it will find resistance at 0.9273 and 0.9343, with the upper level of the bearish channel acting as dynamic resistance.

The Aussie dollar is looking rather bearish at the moment and a bearish channel has confirmed this. Look for a breakout of the larger channel before a serious movement to the downside.

Forex and CFDs are leveraged financial instruments. Trading on such leveraged products carries a high level of risk and may not be suitable for all investors. Please ensure that you read and fully understand the Risk Disclosure Policy before entering any transaction with Blackwell Global Investments Limited.

Recommended Content

Editors’ Picks

AUD/USD hovers around 0.6500 amid light trading, ahead of US GDP

AUD/USD is trading close to 0.6500 in Asian trading on Thursday, lacking a clear directional impetus amid an Anzac Day holiday in Australia. Meanwhile, traders stay cautious due ti risk-aversion and ahead of the key US Q1 GDP release.

USD/JPY finds its highest bids since 1990, near 155.50

USD/JPY keeps breaking into its highest chart territory since June of 1990 early Thursday, testing 155.50 for the first time in 34 years as the Japanese Yen remains vulnerable, despite looming Japanese intervention risks. Focus shifts to Thursday's US GDP report and the BoJ decision on Friday.

Gold price lacks firm intraday direction, holds steady above $2,300 ahead of US data

Gold price remains confined in a narrow band for the second straight day on Thursday. Reduced Fed rate cut bets and a positive risk tone cap the upside for the commodity. Traders now await key US macro data before positioning for the near-term trajectory.

Injective price weakness persists despite over 5.9 million INJ tokens burned

Injective price is trading with a bearish bias, stuck in the lower section of the market range. The bearish outlook abounds despite the network's deflationary efforts to pump the price. Coupled with broader market gloom, INJ token’s doomed days may not be over yet.

Meta Platforms Earnings: META sinks 10% on lower Q2 revenue guidance Premium

This must be "opposites" week. While Doppelganger Tesla rode horrible misses on Tuesday to a double-digit rally, Meta Platforms produced impressive beats above Wall Street consensus after the close on Wednesday, only to watch the share price collapse by nearly 10%.