The US June non-farm payrolls report is due for release today. It is widely expected to show the US economy added 230K jobs in June after 280K job additions seen in May. The unemployment rate is seen falling to 5.4% in June from 5.5% in May. Average hourly earnings are seen rising 0.2% month-on-month in June, after rising 0.3% in May.

Dollar bullish scenario: NRP print above 200K with rise in average hourly earnings

Job gains above 200K accompanied by a rise in the hourly earnings could trigger a fresh bull run in the USD index.

A point worth noting is the sharp uptick in the personal spending (0.9%) last month, which triggered hopes that US consumer is finally returning to markets on the back of sustained job gains and lower borrowing costs.

Consequently, an uptick in the average hourly earnings (leading to increased personal spending) would further cement the expectations of a September rate hike and lead to strength in the USD index. Add to that, the uncertainty surrounding Greek referendum and trading holiday tomorrow and we could have a big up move in the USD.

In such a case, the EUR and the NZD could turn out to be the biggest losers.

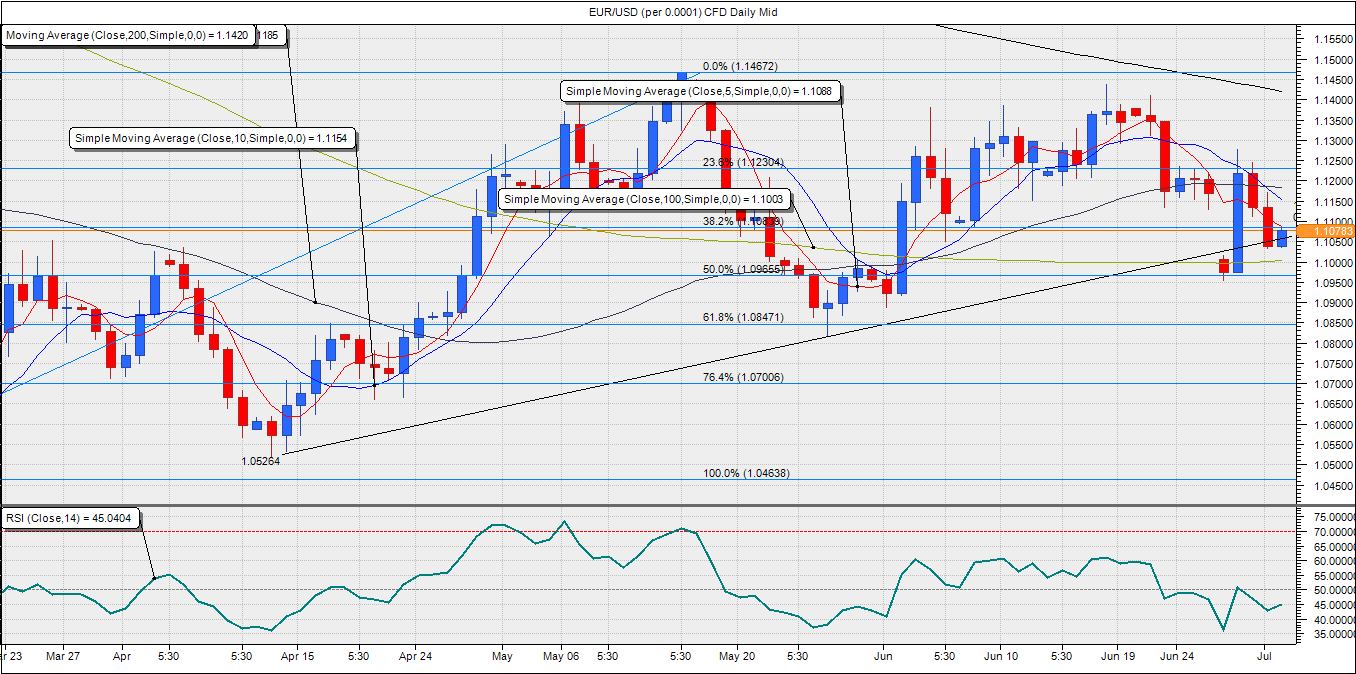

EUR/USD: Could drop to 1.0965 (50% Fib R of 1.0462-1.1467)

The shared currency is obviously at risk as the ECB is at odds with the Fed with regards to monetary policy path. The ECB just announced the inclusion of more assets in its monthly QE program, while a strong data would increase the Fed rate hike possibility. Add to that the Greek referendum on sunday

The pair currently trades at 1.1072. The gains are being capped at 1.1087 (5-DMA)

The spot is also trading below the 1.1084 (38.2% Fib R of 1.0462-1.1467)

The daily chart also shows a bearish daily close on Wednesday ( below the rising trend line)

Consequently, the pair could be pushed to 1.10 (100-DMA), a break below the same could open doors for 1.0965 (50% Fib R 1.0462-1.1467).

NZD/USD: Doors open for 0.6560 (May 2010 low)

The GDT price index fell sharply on Wednesday, with mil powder price falling more than 5% at Fonterra’s GDT price auction. The RBNZ cut rates last month and said it could undo the rate hikes witnessed last year.

USD bearish scenario: NFP print weaker-than-expected and a drop in average hourly earnings

The optimism generated by a rise in the personal spending and last month’s NFP report could be erased if the average hourly earnings fall in June. Moreover, even an NFP print below 230K accompanied by a drop in the average hourly earnings could turn out to be a bearish USD scenario. Meanwhile, a positive average hourly earnings may not be able to support the USD in case the NFP print is under 200K.

In such a case, the obvious choice is the British Pound, since the BOE is the only other major central bank, which is widely perceived to be telegraphing a rate hike. The Pound could also find support due to the sell-off in the EUR/GBP pair ahead of Sunday’s Greek referendum.

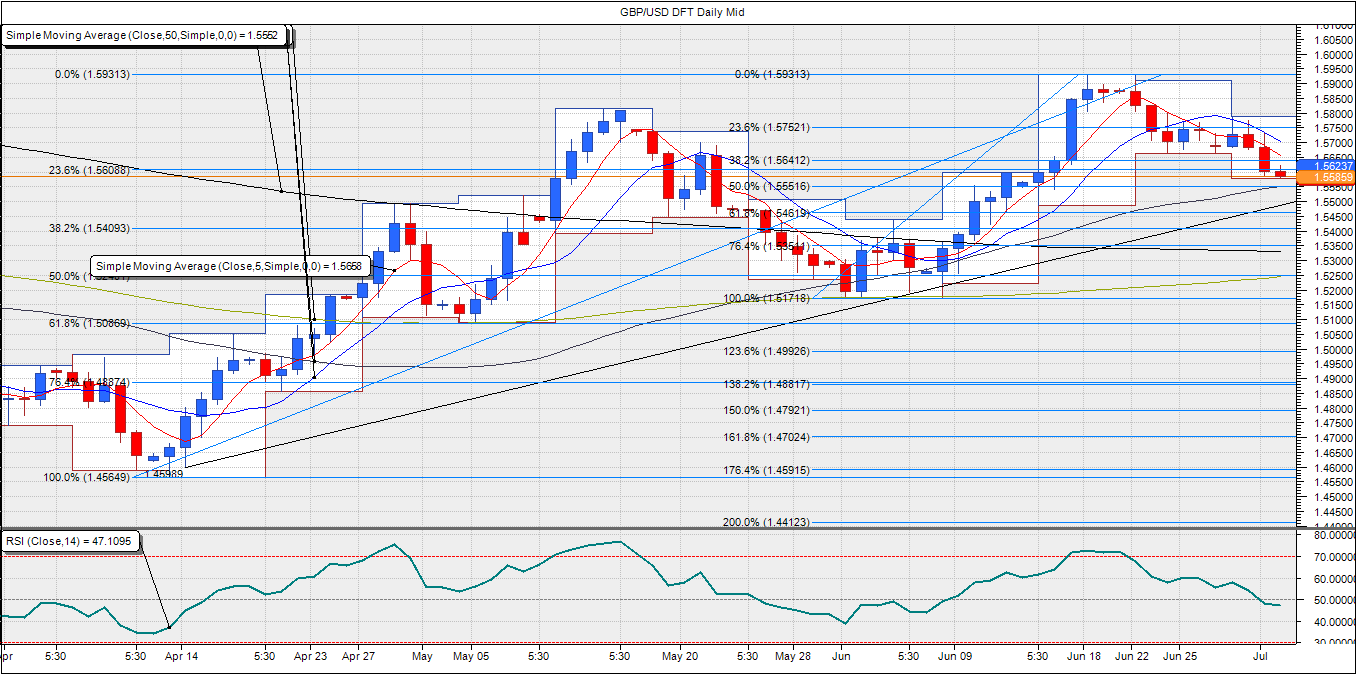

GBP/USD: Could break above 1.5638 (38.2% Fib R of June rally)

The technical chart is indicating a further bearish move to 1.5550 (50% Fib R), after having failed to sustain above 1.5606 (23.6% Fib R of Apr-June rally)

However, in case of the weak NFP data, the pair could rise above 1.5606 to break above 1.5638. A daily close above the same could lead to re-test of 1.57 on Friday on a possible sell-off in EUR/GBP ahead of Sunday’s referendum.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

AUD/USD pressures as Fed officials hold firm on rate policy

The Australian Dollar is on the defensive against the US Dollar, as Friday’s Asian session commences. On Thursday, the antipodean clocked losses of 0.21% against its counterpart, driven by Fed officials emphasizing they’re in no rush to ease policy. The AUD/USD trades around 0.6419.

EUR/USD extends its downside below 1.0650 on hawkish Fed remarks

The EUR/USD extends its downside around 1.0640 after retreating from weekly peaks of 1.0690 on Friday during the early Asian session. The hawkish comments from Federal Reserve officials provide some support to the US Dollar.

Gold price edges higher on risk-off mood hawkish Fed signals

Gold prices advanced late in the North American session on Thursday, underpinned by heightened geopolitical risks involving Iran and Israel. Federal Reserve officials delivered hawkish messages, triggering a jump in US Treasury yields, which boosted the Greenback.

Runes likely to have massive support after BRC-20 and Ordinals frenzy

With all eyes peeled on the halving, Bitcoin is the center of attention in the market. The pioneer cryptocurrency has had three narratives this year already, starting with the spot BTC exchange-traded funds, the recent all-time high of $73,777, and now the halving.

Billowing clouds of apprehension

Thursday marked the fifth consecutive session of decline for US stocks as optimism regarding multiple interest rate cuts by the Federal Reserve waned. The downturn in sentiment can be attributed to robust economic data releases, prompting traders to adjust their expectations for multiple rate cuts this year.