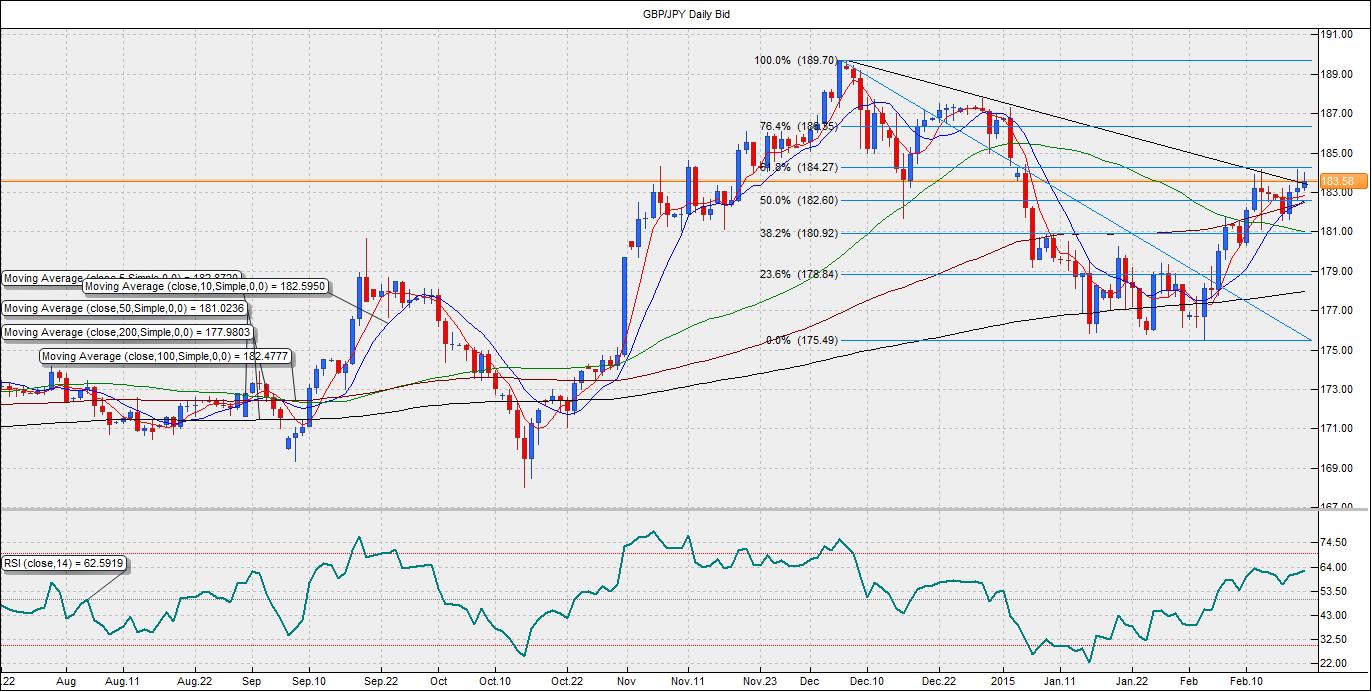

However, the pair could not extend gains above 184.20 and fell to 183.50 levels. The next major trigger is seen from the UK retail sales due for release tomorrow. The headline figure is seen at an impressive 5.9% year-on-year in January. However, month-on-month the retail sales are seen falling 0.2% compared to the previous month’s gain of 0.4%.

GBP to weaken on Retail Sales

The pair could drop to 181.50 levels if the UK retail sales disappoint market expectation. Moreover, a weak number would indicate slow growth in consumption despite a sharp rise in the wage growth data released yesterday. Furthermore, the GBP appears overbought after an upbeat jobs data and the hawkish Bank of England minutes. Hence, a weak retail sales data could trigger a sharp unwinding of GBP longs.Greece led uncertainty to support the Yen

The renewed concerns regarding the Greece debt could support gains in the Japanese Yen. German government rejected Greece’s proposal of loan extension due to which the shared currency was sold-off. The risk aversion would also keep the British Pound under pressure. With the German government’s refusal, we may not see a concrete deal coming through from the Eurogroup meet scheduled tomorrow. Consequently, the pair could take a hit on risk aversion.Technically, the pair appears stuck around 184.20-184.30 levels. Despite an upbeat jobs data and BOE minutes released yesterday, the pair finished well below 182.50 (50% retracement of 175.49-189.70) and 184.26 (61.8% retracement). The pair is also struggling to sustain gains above the falling trend line resistance located at 183.50.

Thus, a weak retail sales print could result in the sharp fall in the GBP/JPY pair to 181.50 levels. However, a strong retail sales print along with a short-term fix to Greece’s debt problem would be enough to send the pair higher to 185 plus levels.

Recommended Content

Editors’ Picks

EUR/USD fluctuates in daily range above 1.0600

EUR/USD struggles to gather directional momentum and continues to fluctuate above 1.0600 on Tuesday. The modest improvement seen in risk mood limits the US Dollar's gains as investors await Fed Chairman Jerome Powell's speech.

GBP/USD stabilizes near 1.2450 ahead of Powell speech

GBP/USD holds steady at around 1.2450 after recovering from the multi-month low it touched near 1.2400 in the European morning. The USD struggles to gather strength after disappointing housing data. Market focus shifts to Fed Chairman Powell's appearance.

Gold retreats to $2,370 as US yields push higher

Gold stages a correction on Tuesday and fluctuates in negative territory near $2,370 following Monday's upsurge. The benchmark 10-year US Treasury bond yield continues to push higher above 4.6% and makes it difficult for XAU/USD to gain traction.

XRP struggles below $0.50 resistance as SEC vs. Ripple lawsuit likely to enter final pretrial conference

XRP is struggling with resistance at $0.50 as Ripple and the US Securities and Exchange Commission (SEC) are gearing up for the final pretrial conference on Tuesday at a New York court.

US outperformance continues

The economic divergence between the US and the rest of the world has become increasingly pronounced. The latest US inflation prints highlight that underlying inflation pressures seemingly remain stickier than in most other parts of the world.