The EURUSD saw an increase in volatility yesterday when it dropped 118 pips, or 1.03%, to go from its high yesterday at 1.13906 to close at 1.12723. As mentioned previously we had been expecting volatility to pick up again as the market for this pair had been trading in a fairly tight range over several trading sessions.

Yesterday also saw the release of Retail Sales data for the US and although it was lower than expected at 0.2%, the Euro saw no relief and price continued to fall 30 minutes after the number. There are renewed fears of how fast the Federal Reserve may hike interest rates, and any signs of higher inflation in the US can only weigh on the likeliness of hikes happening at a faster rate.

Today we saw Consumer Price Index (CPI) released for the Euro area which was 0.0%, last month’s number was at minus 0.1%.CPI is a metric for gauging inflation and both policy makers and traders watch this number closely. The markets don’t seem to have given this small increase in CPI any weight as EURUSD price continues to trade relatively flat to pre-data release.

And later on today at 1:30pm we have CPI data for the US, the previous month’s number was 1.0% and the forecast for today’s number is for an increase to 1.2%. As CPI is a gauge for inflation the markets will be watching this number closely, in the case of a substantial deviation from the forecast we can expect an increase in volatility.

Friday at 2:15pm will see the release of Capacity Utilization and Industrial Production, these numbers are not considered as having an immediate impact on market volatility, but they are indicators of economic activity, and the higher the numbers the more likely it is to create bullish sentiment for the US dollar.

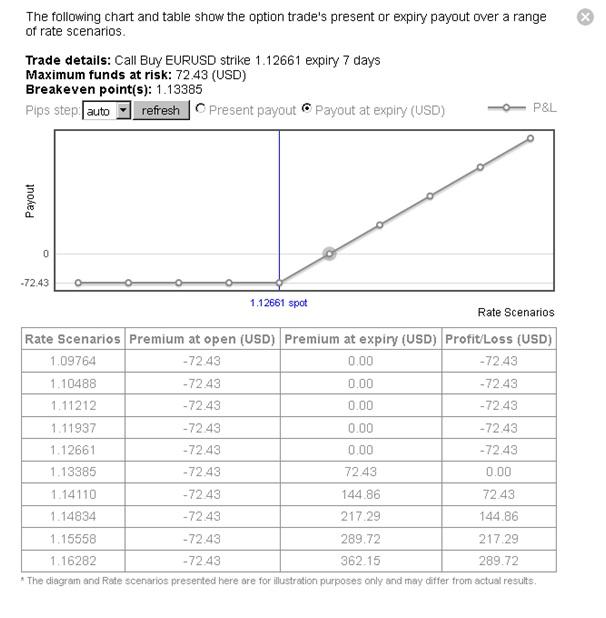

If you think the EURUSD will revert its downward trend and increase in price over the next week, then you may buy a Call option, which gives you the right to buy EURUSD at a pre-determined price (strike) on a specific date (expiry) and for an amount of your choice.

The screenshot below shows a EURUSD Call option with a 1.12653 strike, 7 day expiry and for €10,000 would cost $72.43, which would also be the maximum risk.

This screenshot shows the profit and loss profile of the above Call option, just press the Scenarios button.

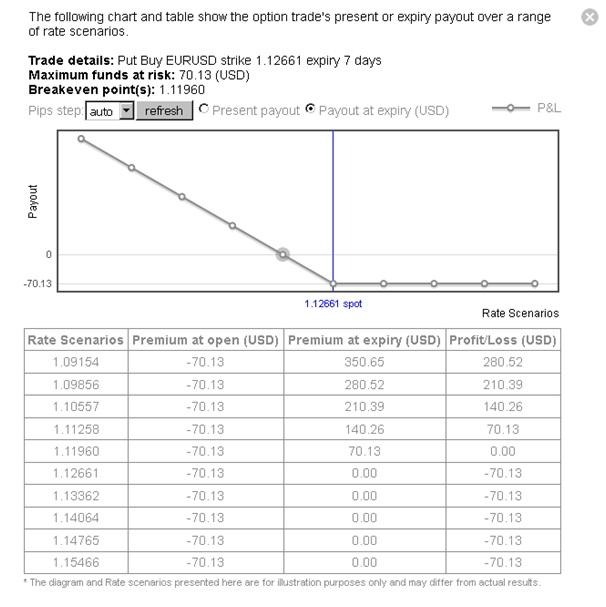

On the other hand, if you think the price of EURUSD will continue to fall over the next week,then you may buy a Put option which gives you the right to sell the pair at a specific strike and expiry and for an amount of your choice.

The screenshot below shows a EURUSD Put option with a 1.1265 strike, 7 day expiry and for €10,000 would cost $70.13, which would also be the maximum risk.

This screenshot shows the profit and loss profile of the above Put option.

The content provided is made available to you by ORE Tech Ltd for educational purposes only, and does not constitute any recommendation and/or proposal regarding the performance and/or avoidance of any transaction (whether financial or not), and does not provide or intend to provide any basis of assumption and/or reliance to any such transaction.

Recommended Content

Editors’ Picks

AUD/USD keeps the red below 0.6400 as Middle East war fears mount

AUD/USD is keeping heavy losses below 0.6400, as risk-aversion persists following the news that Israel retaliated with missile strikes on a site in Iran. Fears of the Israel-Iran strife translating into a wider regional conflict are weighing on the higher-yielding Aussie Dollar.

USD/JPY recovers above 154.00 despite Israel-Iran escalation

USD/JPY is recovering ground above 154.00 after falling hard on confirmation of reports of an Israeli missile strike on Iran, implying that an open conflict is underway and could only spread into a wider Middle East war. Safe-haven Japanese Yen jumped, helped by BoJ Governor Ueda's comments.

Gold price pares gains below $2,400, geopolitical risks lend support

Gold price is paring gains to trade back below $2,400 early Friday, Iran's downplaying of Israel's attack has paused the Gold price rally but the upside remains supported amid mounting fears over a potential wider Middle East regional conflict.

WTI surges to $85.00 amid Israel-Iran tensions

Western Texas Intermediate, the US crude oil benchmark, is trading around $85.00 on Friday. The black gold gains traction on the day amid the escalating tension between Israel and Iran after a US official confirmed that Israeli missiles had hit a site in Iran.

Dogwifhat price pumps 5% ahead of possible Coinbase effect

Dogwifhat price recorded an uptick on Thursday, going as far as to outperform its peers in the meme coins space. Second only to Bonk Inu, WIF token’s show of strength was not just influenced by Bitcoin price reclaiming above $63,000.