WTI crude oil has been in a sustained rally for the past 9 weeks. Its most recent low was on January 20th at $27.70 a barrel, while last Friday saw price reach its most recent high at $42.52. That rally makes for an increase in price of 53.50%. It is has also recovered the ground lost from the beginning of the year where it opened at $38.34, for a YTD gain of 10.9%, making it one of the best performing commodities this year.

The oil rig count has been falling steadily over the past year as crude oil prices continued their one way decline to levels not seen since 2008. Over the past week, according to data from BakerHughes.com, another 4 rigs were shut down in the US and 27 internationally. The total rig count in the US compared to last year is down by 593 for a total of 476 operating rigs.

Concern therefore comes in light of the fact that the most recent sharp increase in WTI prices may not have reached extraction operators yet, but if should if price remains at these levels or rises further. Adding more rigs as higher crude prices since more operations become profitable again, will increase supply and possibly diminish the current bull trend. If supply increased sufficiently without a concurrent increase in demand then we could see this bull trend reverse again or at least correct to the downside.

Investment banks like Goldman Sachs had predicted crude oil prices below $20 a barrel for 2016, and although we are only in the first months, current market movements make that forecast look less likely without new factors coming into play.

Today at 2:30 pm the Energy Information Administration will release weekly Crude oil stocks for the US. The expected number is 1.317 million barrels of new stock, any large variation in this data release can cause considerable volatility.

If you think the data release for today will be smaller than expected and that the bull trend will remain intact over the next week then you may buy a Call option, which gives you the right to buy WTI oil at a set price (strike) for a set date (expiry) and a specific amount.

The screenshot below shows that a WTI oil Call option with $41.39, expiry 7 days and for 100 barrels would cost $97.15, which would also be the maximum risk.

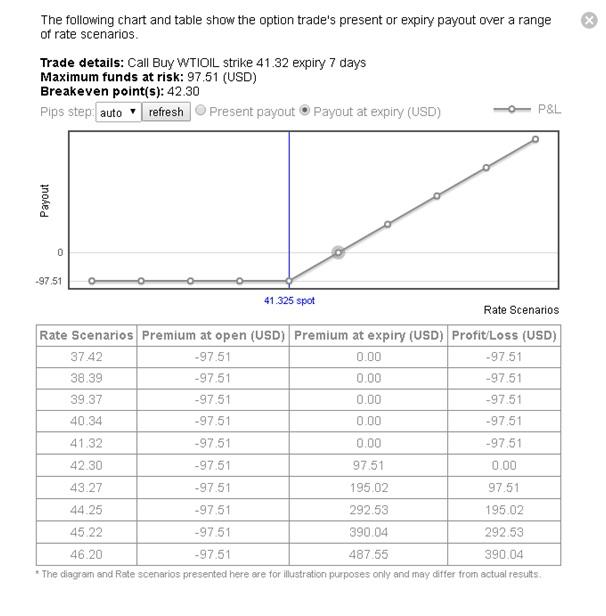

This screenshot shows the profit and loss profile of the above Call option, which you can get by clicking the Scenarios button.

On the other hand, if you think the bear trend has come to an end and price will correct to the downside over the next week, then you may buy a Put option. The screenshot below shows that a WTI oil Put option with $41.26 strike, 7 day expiry and for 100 barrels would cost $97.33, which would also be the maximum possible loss.

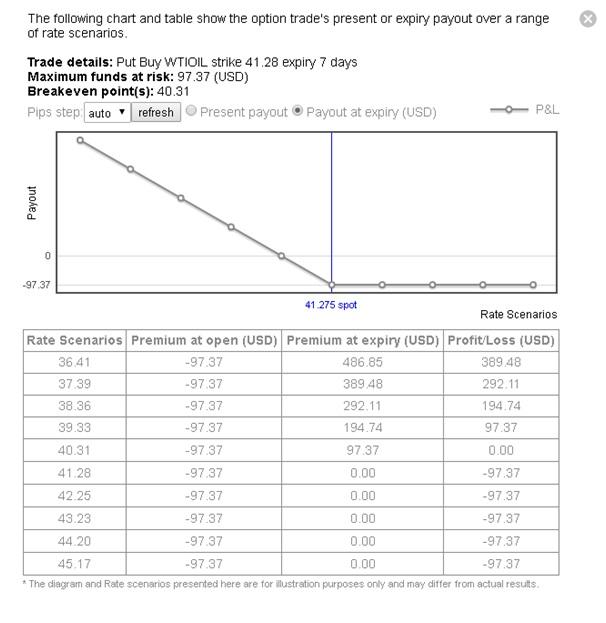

This screenshot shows the profit and loss profile of the above Put option.

The content provided is made available to you by ORE Tech Ltd for educational purposes only, and does not constitute any recommendation and/or proposal regarding the performance and/or avoidance of any transaction (whether financial or not), and does not provide or intend to provide any basis of assumption and/or reliance to any such transaction.

Recommended Content

Editors’ Picks

EUR/USD holds above 1.0650 after US data

EUR/USD retreats from session highs but manages to hold above 1.0650 in the early American session. Upbeat macroeconomic data releases from the US helps the US Dollar find a foothold and limits the pair's upside.

GBP/USD retreats toward 1.2450 on modest USD rebound

GBP/USD edges lower in the second half of the day and trades at around 1.2450. Better-than-expected Jobless Claims and Philadelphia Fed Manufacturing Index data from the US provides a support to the USD and forces the pair to stay on the back foot.

Gold is closely monitoring geopolitics

Gold trades in positive territory above $2,380 on Thursday. Although the benchmark 10-year US Treasury bond yield holds steady following upbeat US data, XAU/USD continues to stretch higher on growing fears over a deepening conflict in the Middle East.

Ripple faces significant correction as former SEC litigator says lawsuit could make it to Supreme Court

Ripple (XRP) price hovers below the key $0.50 level on Thursday after failing at another attempt to break and close above the resistance for the fourth day in a row.

Have we seen the extent of the Fed rate repricing?

Markets have been mostly consolidating recent moves into Thursday. We’ve seen some profit taking on Dollar longs and renewed demand for US equities into the dip. Whether or not this holds up is a completely different story.