Tomorrow there is the release of the U.S. GDP, expected at 1.0% and the interest rate decision, expected to be unchanged at 0-0.25%. Thursday there is the release of the Euro zone Consumer Price Index (CPI) expected at 0.0%.

EUR/USD has seen some swings this month, ranging between its highs on April 6 at 1.1028 and lows on April 13 at 1.0527 as seen in the graph below.

If you believe these next few days will continue to be volatile, a popular voatility strategy is a long strangle. The strangle is very similar to the straddle with one difference, the strikes of the options. In a straddle, you purchase both a Call and a Put with the same strike and in a strangle, similarily you purchase a Call and a Put bu t they have different strikes andthe strikes are OTM (out-of-the-money. This means the Call will have a strake that is higher than the spot market and the Put will have a strike that is lower. This results in lower cost to buy the stratgy compared with a straddle.

You can trade this position on MT4 using ORE option symbols or on the ORE web solution, OPTIONSREASY.

The position with the MT4 symbols:

BUY symbol C#EURUSDw+2, with strike = 1.0915

BUY symbol P#EURUSDw+0, with strike = 1.0815

By purchasing both these options, you are creating a strangle that will expire Friday, May 1st.

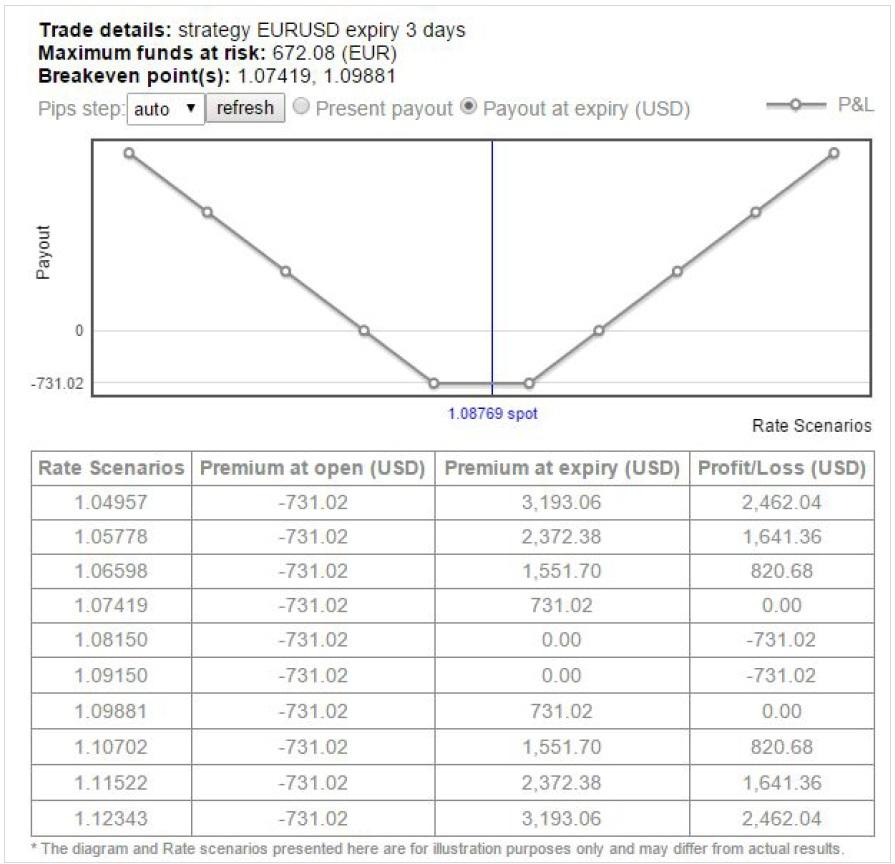

The graph below shows the strategies profit or loss at expiry over a range of EUR/USD rates. The total cost of this position of an amount of 1 lot (100,000 EUR), at the time of writing = $731.

If the market trades back to its month highs, the position will profit $400, more than 50% of its value at open. You will also receive a profit if the market trades down below 1.0741. If the market does not move out of the range 1.0741 - 1.0988, you will make a loss with maximum risk $731.

The content provided is made available to you by ORE Tech Ltd for educational purposes only, and does not constitute any recommendation and/or proposal regarding the performance and/or avoidance of any transaction (whether financial or not), and does not provide or intend to provide any basis of assumption and/or reliance to any such transaction.

Recommended Content

Editors’ Picks

EUR/USD hovers around 1.0700 after German IFO data

EUR/USD stays in a consolidation phase at around 1.0700 in the European session on Wednesday. Upbeat IFO sentiment data from Germany helps the Euro hold its ground as market focus shifts to US Durable Goods Orders data.

USD/JPY refreshes 34-year high, attacks 155.00 as intervention risks loom

USD/JPY is renewing a multi-decade high, closing in on 155.00. Traders turn cautious on heightened risks of Japan's FX intervention. Broad US Dollar rebound aids the upside in the major. US Durable Goods data are next on tap.

Gold price trades with mild negative bias, manages to hold above $2,300 ahead of US data

Gold price (XAU/USD) edges lower during the early European session on Wednesday, albeit manages to hold its neck above the $2,300 mark and over a two-week low touched the previous day.

Worldcoin looks set for comeback despite Nvidia’s 22% crash Premium

Worldcoin price is in a better position than last week's and shows signs of a potential comeback. This development occurs amid the sharp decline in the valuation of the popular GPU manufacturer Nvidia.

Three fundamentals for the week: US GDP, BoJ and the Fed's favorite inflation gauge stand out Premium

While it is hard to predict when geopolitical news erupts, the level of tension is lower – allowing for key data to have its say. This week's US figures are set to shape the Federal Reserve's decision next week – and the Bank of Japan may struggle to halt the Yen's deterioration.