Surprisingly the Reserve Bank of Australia (RBA) left interest rates unchanged at 2.25%. The market priced in a 0.25% cut and, before the announcement, AUD/USD traded low as $0.7751. Following the RBA's no-change, the pair rallied over 1% to $0.7841.

Tomorrow, the Australian GDP will be released at 00:30 GMT and is expected to be 2.6% versus previous months 2.7%. Later this week we have the release of the employment situation in the US which leaves the US Dollar under pressure.

Currently AUD/USD is trading at 0.7820 and the 1 day ATM (at-the-money) AUD/USD option volatility is around 13.3%. This is relatively very high; the equivalent EUR/USD volatility is around 10.55%.

A positive GDP figure plus the growing pressure on US Dollar towards Friday’s employment data may cause AUD/USD to rise. If you expect Australia’s GDP to be in line with expectations or better, an interesting position to take is the Bull spread.

A Bull spread is used to profit from an increase in market rate with limited risk and no stop-out. To set-up this strategy, you buy an OTM (out-of-the-money) Put option and, at the same time, sell an ATM (at-the-money) or ITM (in-the-money) Put. As the market rises towards the sell Put's strike rate the positions payout rises.

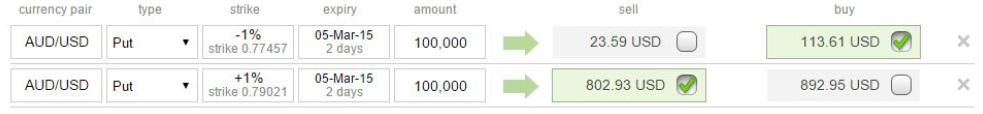

The below is an example of a Bull spread strategy:

In the top line, we buy a Put option with strike 1% below market (out-the-money) at 0.7745. In the second line, we sell a Put 1% above market (in-the-money) at 0.7902. Both options have amount 100,000 and expire in 2 days. Note that expiry is after tomorrow’s Australian GDP and before Friday’s Non-Farm Payrolls. By selling the more expensive, in-the-money option, we receive money when placing the position.

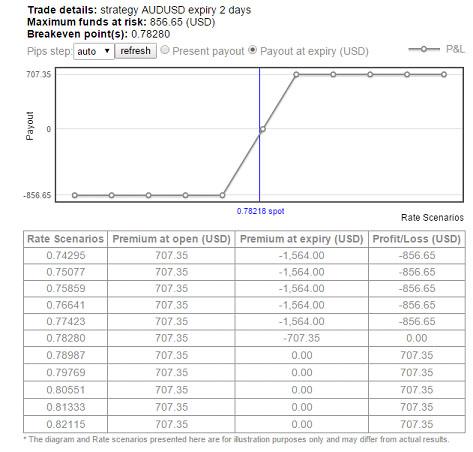

The payout scenario at expiry is shown in the chart and table below. If the AUD/USD is trading above 0.7828 there is profit which reaches its maximum return of $707 above 0.7898. If the pair trades below 0.7828 there is a loss and a maximum loss of $856 is reached below 0.7742.

The content provided is made available to you by ORE Tech Ltd for educational purposes only, and does not constitute any recommendation and/or proposal regarding the performance and/or avoidance of any transaction (whether financial or not), and does not provide or intend to provide any basis of assumption and/or reliance to any such transaction.

Recommended Content

Editors’ Picks

EUR/USD hovers around 1.0700 ahead of German IFO survey

EUR/USD is consolidating recovery gains at around 1.0700 in the European morning on Wednesday. The pair stays afloat amid strong Eurozone business activity data against cooling US manufacturing and services sectors. Germany's IFO survey is next in focus.

GBP/USD steadies near 1.2450, awaits mid-tier US data

GBP/USD is keeping its range at around 1.2450 in European trading on Wednesday. A broadly muted US Dollar combined with a risk-on market mood lend support to the pair, as traders await the mid-tier US Durable Goods data for further trading directives.

Gold: Defending $2,318 support is critical for XAU/USD

Gold price is nursing losses while holding above $2,300 early Wednesday, stalling its two-day decline, as traders look forward to the mid-tier US economic data for fresh cues on the US Federal Reserve interest rates outlook.

Crypto community reacts as BRICS considers launching stablecoin for international trade settlement

BRICS is intensifying efforts to reduce its reliance on the US dollar after plans for its stablecoin effort surfaced online on Tuesday.

Three fundamentals for the week: US GDP, BoJ and the Fed's favorite inflation gauge stand out Premium

While it is hard to predict when geopolitical news erupts, the level of tension is lower – allowing for key data to have its say. This week's US figures are set to shape the Federal Reserve's decision next week – and the Bank of Japan may struggle to halt the Yen's deterioration.