Gold reached a new most recent low at $1064.50 on November 18th and is currently trading at levels not seen since February 2010. There has been a lot of talk about the possibility of the shiny metal turning the down trend around and starting a new Bull trend. Despite all the talk this commodity like many others knows only one direction.

There are various factors pushing the price of Gold south. The main ones are excess supply, threat of higher interest rates and a strong stock market. Excess supply is able to continue despite price having fallen on a fairly constant basis because of a strong US dollar. Gold exporting producers are paid in US dollars so if the price of Gold goes, down but the local currency depreciates, then they are still getting the required price in local currency. A strengthening US dollar may actually help push Gold price lower too.

Higher interest rates means that initially investors will find fixed income investments more interesting, as Gold does not pay a coupon. This has been driving Gold sharply south over the past 7 months as talk of a rate hike has begun to build up. Now it all depends on how fast interest rates will increase. The first hike for December has already been priced in, as it is highly expected. Any further momentum to the downside will depend heavily on what is said at the press conference after the 2 day Federal Reserve monetary policy meeting on December 16th. The market will be looking for clues as to how quickly the next rounds of hikes will happen.

The strong stock market hasn’t helped Gold take an attractive appearance over the past years with such a strong performance. If the interest rate hikes are deemed too quick that may cause the stock markets to reverse their upward trend. This may make the shiny metal more attractive again as it is considered a safe haven in times of general market stress.

If you think Gold may reverse its current Bear trend then you may buy a Put option which gives you the right to sell Gold at a pre‐set price (strike) for a set date (expiry) and an amount of your choice.

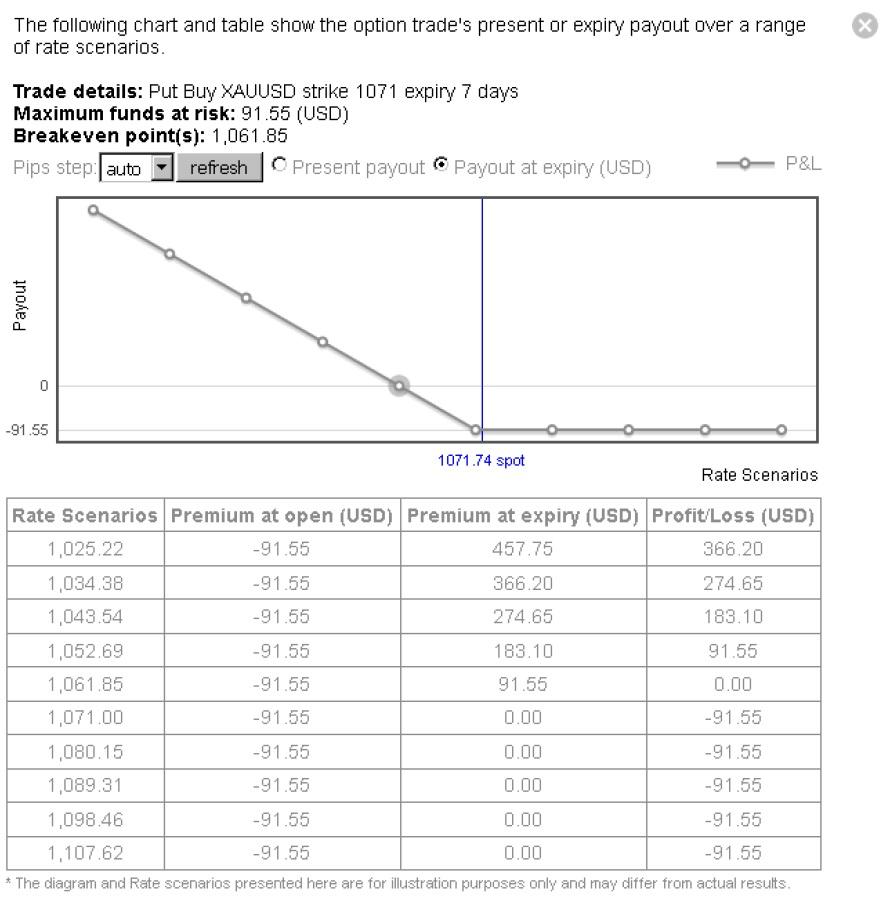

The screenshot below shows the cost of a Gold Put option, with 1071.00 strike, expiry 7 days for 10 ounces would cost $90.90, which is also the maximum possible loss on the trade.

This screenshot shows the profit and loss profile for the above option, and is obtained by clicking the Scenarios button.

If on the other hand you think Gold will reverse its downward trend and turn it into a Bull trend over the coming days then you may buy a Call option.

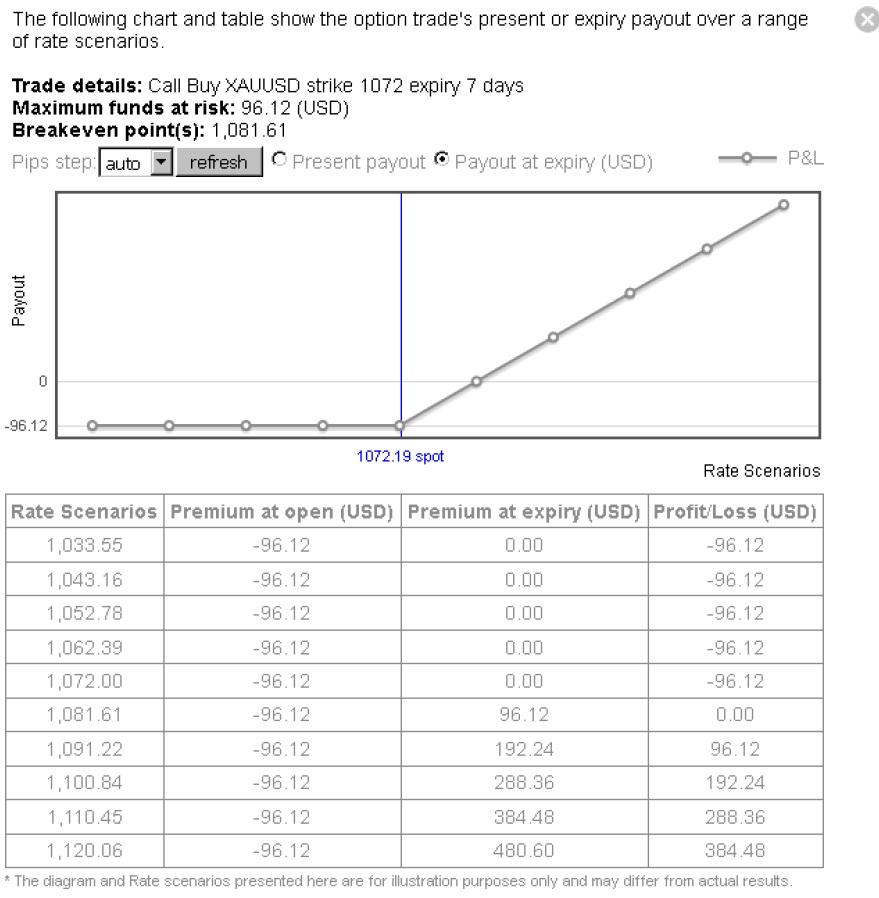

The screenshot below shows that a Gold Call option with 1072.00 strike, expiry 7 day and for 10 ounces would cost $94.81.

The screenshot below shows the profit and loss profile of the above option.

The content provided is made available to you by ORE Tech Ltd for educational purposes only, and does not constitute any recommendation and/or proposal regarding the performance and/or avoidance of any transaction (whether financial or not), and does not provide or intend to provide any basis of assumption and/or reliance to any such transaction.

Recommended Content

Editors’ Picks

EUR/USD retreats below 1.0700 after US GDP data

EUR/USD came under modest bearish pressure and retreated below 1.0700. Although the US data showed that the economy grew at a softer pace than expected in Q1, strong inflation-related details provided a boost to the USD.

GBP/USD declines below 1.2500 as USD rebounds

GBP/USD declined below 1.2500 and erased the majority of its daily gains with the immediate reaction to the US GDP report. The US economy expanded at a softer pace than expected in Q1 but the price deflator jumped to 3.4% from 1.8%.

Gold holds near $2,330 despite rising US yields

Gold stays in positive territory near $2,330 in the second half of the day on Thursday. The benchmark 10-year US Treasury bond yield is up more than 1% on the day above 4.7% after US GDP report, making it difficult for XAU/USD to extend its daily rally.

XRP extends its decline, crypto experts comment on Ripple stablecoin and benefits for XRP Ledger

Ripple extends decline to $0.52 on Thursday, wipes out weekly gains. Crypto expert asks Ripple CTO how the stablecoin will benefit the XRP Ledger and native token XRP.

After the US close, it’s the Tokyo CPI

After the US close, it’s the Tokyo CPI, a reliable indicator of the national number and then the BoJ policy announcement. Tokyo CPI ex food and energy in Japan was a rise to 2.90% in March from 2.50%.