FX markets are braced today for some very important data releases. Non-Farm Payrolls will be released this afternoon at 13:30 GMT and are expected to give further clues as to when the Federal Reserve (Fed) may raise interest rates. Economic data has not been as strong as expected and global economic weakness have both cooled down expectations of a rate hike any time soon. However as Yellen has repeatedly mentioned Employment figures as one of the key metrics the Fed is using in timing the start of restrictive monetary policy, this data release is of particular interest.

The previous NFP figure last month was 173k and for today’s release the market consensus is at 203k. Any figure that is below the market consensus could weaken the US Dollar, as a low Employment figure would mean even smaller chances of interest rates rising any time soon. The market has already priced in the forecast so large deviations from that may see price correcting to reflect the latest data. If you think NFP data will be lower than expected and that EURUSD will see price rally then all you need to do is buy a Call option which gives you the right to buy EURUSD at a preset rate (strike) and at a preset date (expiry) for an amount of your choice. Stronger than expected data on the other hand would give the US Dollar new momentum and may send price of this pair further south (see option trade examples below).

This morning also saw European data released for Producer Price Index, this data was lower than expected at -0.8% MoM and -2.6% YoY compared to previous data of -0.1% MoM and -2.1%, indicating that the Euro area is still a long way from recovery as prices continue to fall. This data is not a big market driver but it is useful in indicating possible inflation pressure and the general state of the economy. Weak European data has been driving the Euro lower, taking price from its open on September 29th at 1.12283 to its most recent low at 1.11336 yesterday. That happened despite the absence of a near term interest rate increase which has been fueling the USD over the past months.

Levels of Support and Resistance

The near support levels for this pair are the previous lows at 1.11038 followed by 1.10859 and 1.10159, resistance levels are on the respective Fibonacci lines at 1.11871, 1.12395 and 1.12811. The corrective rally that took price from its recent low at 1.11038 to 1.12811 seems to be exhausted. It would take a break above the resistance level at 1.12811 to signal a possible continuation of a rally.

Option trade examples

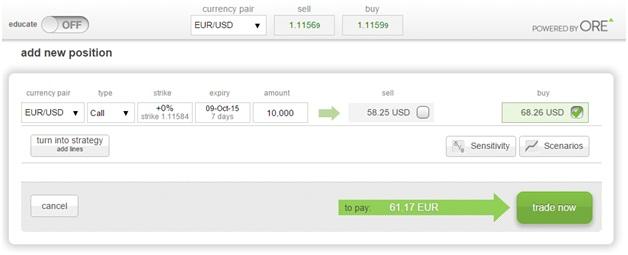

Trade 1: If you expect the pair to trade above 1.1158 (current market price) and retrace higher, you may buy a Call option which gives you the right to buy EUR/USD at a certain price until a future date. For example, you may purchase a Call to buy 10,000 EUR at 1.1158 over the next week. An image of this trade is below, you can see it would cost you a 68.26USD premium to buy this option.

If EUR/USD rises above 1.1158 the option’s value will increase and, for example, if the price reaches 1.1358 (200 pips higher) by expiry the option will payout 200 USD. But, if price remains below current market price then the option will not payout and you lose the 68.26 premium paid.

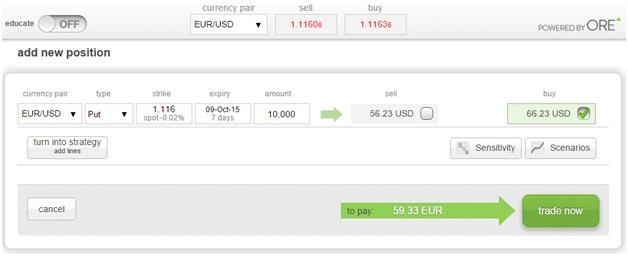

Trade 2: If you expect thepair to trade down, you may buy a Put option which gives you the right to sell EUR/USD at a certain price until a future date. For example, you may buy a Put to sell 10,000 EUR at 1.1160 (current market price) until October 9 2015. An image of this trade is below, you can 1.1160 is the 'strike price' and October 9th is the 'expiry date'. It would cost you a 66.23 USD premium to buy this option.

If EUR/USD falls below 1.1160 the option’s value will increase and, for example, if the price reaches 1.0960 (200 pips lower) by expiry the option will payout 200 USD. But, if price remains above 1.1160 then the option will not payout and you lose the 124.93 USD premium paid.

The content provided is made available to you by ORE Tech Ltd for educational purposes only, and does not constitute any recommendation and/or proposal regarding the performance and/or avoidance of any transaction (whether financial or not), and does not provide or intend to provide any basis of assumption and/or reliance to any such transaction.

Recommended Content

Editors’ Picks

AUD/USD remained bid above 0.6500

AUD/USD extended further its bullish performance, advancing for the fourth session in a row on Thursday, although a sustainable breakout of the key 200-day SMA at 0.6526 still remain elusive.

EUR/USD faces a minor resistance near at 1.0750

EUR/USD quickly left behind Wednesday’s small downtick and resumed its uptrend north of 1.0700 the figure, always on the back of the persistent sell-off in the US Dollar ahead of key PCE data on Friday.

Gold holds around $2,330 after dismal US data

Gold fell below $2,320 in the early American session as US yields shot higher after the data showed a significant increase in the US GDP price deflator in Q1. With safe-haven flows dominating the markets, however, XAU/USD reversed its direction and rose above $2,340.

Bitcoin price continues to get rejected from $65K resistance as SEC delays decision on spot BTC ETF options

Bitcoin (BTC) price has markets in disarray, provoking a broader market crash as it slumped to the $62,000 range on Thursday. Meanwhile, reverberations from spot BTC exchange-traded funds (ETFs) continue to influence the market.

US economy: slower growth with stronger inflation

The dollar strengthened, and stocks fell after statistical data from the US. The focus was on the preliminary estimate of GDP for the first quarter. Annualised quarterly growth came in at just 1.6%, down from the 2.5% and 3.4% previously forecast.