The CPI data announcement takes place at 13:30 GMT and is expected to be -0.1%.

The CPI is one of the most important data figures in the US. As it indicates the inflation rate, many investors depend on this data to adjust their cash flow and investments. The effect on currencies paired with the USD is usually strong. For example, when interest rates rise, foreign and local investors want to invest their money with higher rates on their investment, this may cause higher demand for the USD resulting in a stronger USD versus other currencies.

One way to employ options is to hedge on your existing portfolio as insurance. For example, if you are long the EURUSD spot and fear short term spot fluctuations which might stop out your positions, you can buy a PUT option on the EURUSD. There are a few elements in an option that affect its price. One being the strike of the option. The further the strike will be from the current spot rate, the cheaper the option. This is because there is less probability of the spot expiring below the strike and giving returns on the investment (opposite of a call option where the spot needs to expire above the strike in order to be of value).

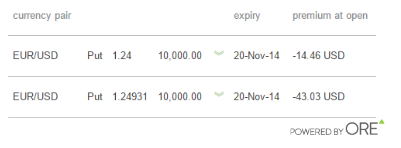

If towards this CPI, you want to be hedged against a move of the spot below the 1.24 strike, because above it you will not risk a stop out and/or do not mind a relatively small loss before 1.24, you can buy a put with 1.24 as a strike. You will pay less than if you bought a put that is at the money, where the strike equals the current spot at 1.24931. These two options are identical except their strike. You can view the difference in the premium at open where the out-of-the-money option is drastically cheaper than the at–the-money option:

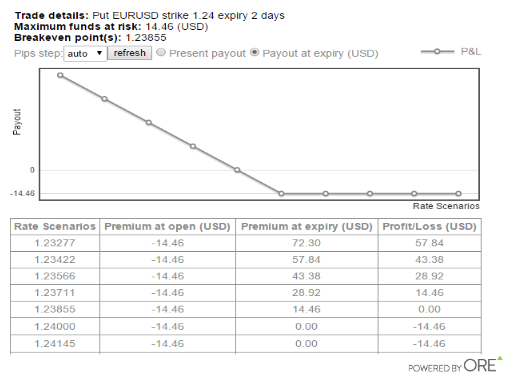

Below you can view the example (this is not a recommendation to trade) of the payout of an out-of-the-money EURUSD put. Notice you are not at risk of losing more than the option price and with potential to profit much more than invested.

Recommended Content

Editors’ Picks

AUD/USD hovers around 0.6500 amid light trading, ahead of US GDP

AUD/USD is trading close to 0.6500 in Asian trading on Thursday, lacking a clear directional impetus amid an Anzac Day holiday in Australia. Meanwhile, traders stay cautious due ti risk-aversion and ahead of the key US Q1 GDP release.

USD/JPY finds its highest bids since 1990, near 155.50

USD/JPY keeps breaking into its highest chart territory since June of 1990 early Thursday, testing 155.50 for the first time in 34 years as the Japanese Yen remains vulnerable, despite looming Japanese intervention risks. Focus shifts to Thursday's US GDP report and the BoJ decision on Friday.

Gold price lacks firm intraday direction, holds steady above $2,300 ahead of US data

Gold price remains confined in a narrow band for the second straight day on Thursday. Reduced Fed rate cut bets and a positive risk tone cap the upside for the commodity. Traders now await key US macro data before positioning for the near-term trajectory.

Injective price weakness persists despite over 5.9 million INJ tokens burned

Injective price is trading with a bearish bias, stuck in the lower section of the market range. The bearish outlook abounds despite the network's deflationary efforts to pump the price. Coupled with broader market gloom, INJ token’s doomed days may not be over yet.

Meta Platforms Earnings: META sinks 10% on lower Q2 revenue guidance Premium

This must be "opposites" week. While Doppelganger Tesla rode horrible misses on Tuesday to a double-digit rally, Meta Platforms produced impressive beats above Wall Street consensus after the close on Wednesday, only to watch the share price collapse by nearly 10%.