The data in the US triggered some action in the different US pairs. The EURUSD has rallied slightly more than 100pips since the start of the week now trading at 1.24916.

With today’s action and the coming thanksgiving weekend in the US, we can expect volatility to drop between today’s data releases and the end of the trading day in the US.

In the options market when you’re short an option, you will profit from market stability.

One trading idea can be to sell at‐the‐money options (and volatility) and limit your loss by buying cheaper, out‐of‐the‐money options for the long thanksgiving weekend.

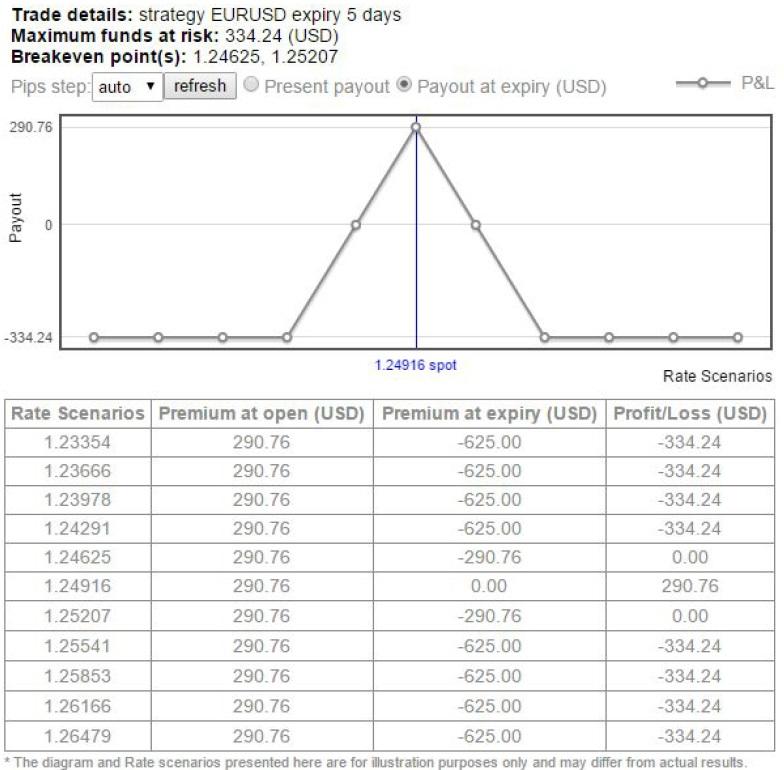

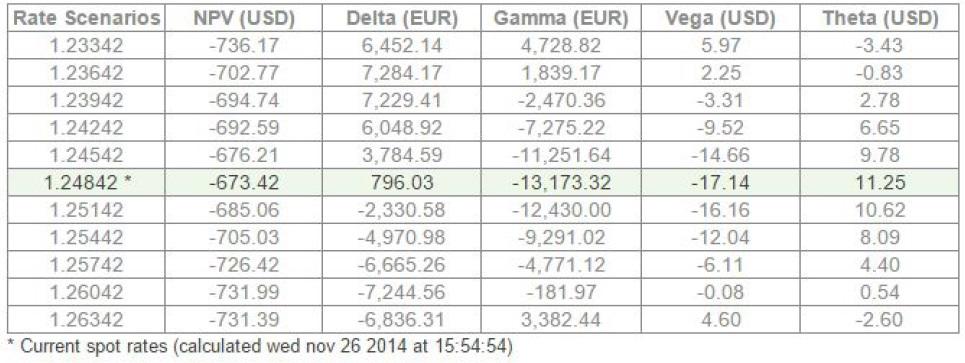

An example for a butterfly strategy that will profit as long as the EURUSD will trade 1.25207‐1.24625. Recently the 1.2465 level was broken and the new target became 1.25206. You can view this strategy in the ORE market place under strategy name: fxstreet thanksgiving. This is not a recommendation to trade but a trading idea.

You can see in the example, on the amount of a 1lot EURUSD your profit at open = $290. You’re possible loss on expiry if the spot traded out of range = $334.

The content provided is made available to you by ORE Tech Ltd for educational purposes only, and does not constitute any recommendation and/or proposal regarding the performance and/or avoidance of any transaction (whether financial or not), and does not provide or intend to provide any basis of assumption and/or reliance to any such transaction.

Recommended Content

Editors’ Picks

AUD/USD holds hot Australian CPI-led gains above 0.6500

AUD/USD consolidates hot Australian CPI data-led strong gains above 0.6500 in early Europe on Wednesday. The Australian CPI rose 1% in QoQ in Q1 against the 0.8% forecast, providing extra legs to the Australian Dollar upside.

USD/JPY sticks to 34-year high near 154.90 as intervention risks loom

USD/JPY is sitting at a multi-decade high of 154.88 reached on Tuesday. Traders refrain from placing fresh bets on the pair as Japan's FX intervention risks loom. Broad US Dollar weakness also caps the upside in the major. US Durable Goods data are next on tap.

Gold price struggles to lure buyers amid positive risk tone, reduced Fed rate cut bets

Gold price lacks follow-through buying and is influenced by a combination of diverging forces. Easing geopolitical tensions continue to undermine demand for the safe-haven precious metal. Tuesday’s dismal US PMIs weigh on the USD and lend support ahead of the key US macro data.

Crypto community reacts as BRICS considers launching stablecoin for international trade settlement

BRICS is intensifying efforts to reduce its reliance on the US dollar after plans for its stablecoin effort surfaced online on Tuesday. Most people expect the stablecoin to be backed by gold, considering BRICS nations have been accumulating large holdings of the commodity.

US versus the Eurozone: Inflation divergence causes monetary desynchronization

Historically there is a very close correlation between changes in US Treasury yields and German Bund yields. This is relevant at the current juncture, considering that the recent hawkish twist in the tone of the Fed might continue to push US long-term interest rates higher and put upward pressure on bond yields in the Eurozone.