Current stimilus too little to lift de-anchoring inflation expectations

ECB follows in the footsteps of BoJ, BoE and Fed

Draghi expected to announce sovereign QE-programme

Devil will be in the details: Size? Scope? Pari Passu? Risk sharing?

Unilateral positioning of markets opens scope for profit taking

Both in case of a strong commitment and in case of a disappointment

Market expectations are running very high ahead of Thursday’s ECB policy meeting. In part, this reflects the tone of recent comments by senior ECB officials that suggest a significant policy imitative will be announced this week. The sense that something momentous will be announced has been heightened by several recent and surprising developments such as the Swiss National Bank’s decision to abandon its currency ceiling against the Euro. We emphasise the scale of expectations from the outset because on many occasions in the past, ECB policy pronouncements have significantly disappointed markets. There can be little doubt that Mr Draghi and his colleagues are acutely aware of the risks in this regard. However, whether he can exceed expectations is unclear. As trading sentiment looks to be particularly nervous at present and probably too dependent on a continuing stream of good news from central banks, Thursday has the potential to be very important for markets as well as the broader economic outlook for the Euro area.

Conditions for ECB QE met

Scope for a major new ECB initiative has been created by recent developments on two fronts. Starting at the November ECB meeting (and repeated on many occasions in the interim), President Draghi indicated that the ECB is looking at two ‘contingencies’ which could trigger additional easing. The first contingency is that the measures currently in place are insufficient to reach the intended increase in the ECB’S balance sheet back to early 2012 levels of around €3000B. The second contingency is if the medium‐term outlook for inflation expectations worsens. In these circumstances, “the Governing Council is unanimous in its commitment to using additional unconventional instruments within its mandate”. Going into the first ECB meeting of 2015, both conditions have been met.

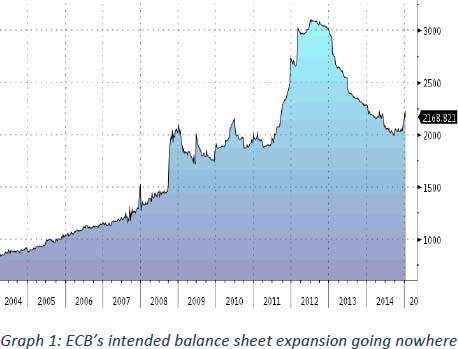

Regarding the first contingency, it’s clear that current programmes are falling considerably short of the stated balance sheet goal. To return the balance sheet to early 2012 levels would require a net liquidity injection of about €1000B. The covered bond purchases programme (CBPP3) has so far conducted €31.29B purchases (three months after the start). The asset backed securities programme (ABSPP2) bought €1.8B. At the first two (of eight) targeted long‐term refinancing operations (TLTRO’s), banks took up a combined €212.6B. These liquidity injections are however counterbalanced by maturing 3‐yr LTRO’s and maturing bonds in the ECB’s SMP portfolio. Therefore, the net effect on the ECB’s balance sheet thus far is negligible (see graph 1) and significant repayments of maturing LTRO’s at the end of January and February will push the intended €3000B balance sheet size again further away.

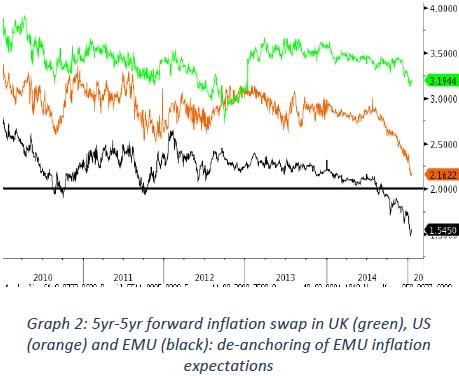

The second contingency outlined by Mr Draghi as requiring further policy action has also been met. Headline EMU inflation printed negative in December (‐0.2% y/y) for the first time since October 2009. Core inflation remains at 0.7% y/y, matching the all‐time low since the creation of the euro zone. The ECB’s preferred market‐based measure for inflation expectations, the 5yr‐5yr forward inflation swap, declined further and even dipped temporary below 1.5% last week (see graph 2). That’s a clear indication that inflation expectations are becoming de‐anchored. Finally, in December the ECB downgraded its inflation forecasts to 0.7% in 2015 and 1.3% in 2016. The further decline in oil/commodity prices of late makes these forecasts already outdated (the ECB’s December projections assumed an average oil price of $85.6/barrel in 2014). So, further significant downgrades could be expected in the next published projections in March and in less formal estimates prepared ahead of this week’s meeting. In early January (Handelsblatt interview), ECB president Draghi admitted for the first time that the risk of deflation in EMU cannot be ruled out completely. “The important thing is what inflation rate people expect over the medium term. Since June, we have seen that these expectations have declined. If inflation remains low for a long time, people might expect prices to fall even further and postpone their spending. We are not there yet. But we need to tackle this risk.”

Against this background, we believe that ECB will take an historical step on Thursday by announcing an intention to purchase sovereign debt as the centerpiece of a Quantitative Easing programme. As such, the ECB is about to follow in the footsteps of the Bank of Japan, US Federal Reserve and Bank of England albeit it with a considerable and not un‐important time‐lag.

Possible features ECB QE

While there is almost universal agreement that the ECB will announce significant new policy measures, the key question is what precise form the ECB’s QE‐programme will take.

The details will determine the effectiveness and credibility of the ECB’s commitment to reach its inflation mandate. By looking to the various ‘unconventional’ programmes of the past (SMP, OMT, CBPP, ABSPP), we can try to shed some light on what might be expected on Thursday.

1) Size and scope

Market consensus expects at least a €500B sovereign bond buying programme. Anything short of this, will be considered a major disappointment. Newspaper reports last year suggested unpublished ECB research indicated that a €1000B asset purchase programme undertaken for a year would boost EMU inflation by between 0.2 and 0.8 percentage points. If we take the mid‐point of this inflation range and the ECB’s December projection of an inflation rate of 1.3% in 2016, it would suggest that in very broad terms a programme of at least €1000B billion would be required to push inflation close to the ECB’s goal of below but close to 2%.

We believe that the ECB won’t set out the exact size of the sovereign bond purchase programme they envisage undertaking but they will likely emphasise the intention that it will be adequate to reach their ‘ intended’ level of a €3000B balance sheet and this may prompt Mr Draghi to provide some ‘ball‐park ‘ guidance. A failure to communicate any indication in regard to the likely size of the programme would likely feed market misgivings about the determination and/or capacity of the ECB to achieve either its stated balance sheet goal or its inflation mandate. In the light of last week’s opinion of the advocate‐general in respect of the legality of OMT’S that such measures be ‘proportionate’, we also think the ECB may be inclined to give some guidance even if it equally strives not to be pinned down on the precise implementation of the programme.

We think the implementation of the programme will be structured like the CBPP and ABSPP programmes. Both programmes last until the end of 2016, without preset absolute amounts. By not mentioning an exact amount, the ECB keeps its flexibility to alter weekly/monthly sizes depending on developments in the economy but also on developments in liquidity provision from other easing programmes. If TLTRO’s or ABSPP/CBPP fall short of expectations, the ECB can step up sovereign bond buying and vice versa. To emphasise the willingness to act, the ECB could also change the “intention” to raise the balance sheet to a “target” as Draghi hinted at the December press conference.

Regarding scope, the QE‐programme is expected to include all sovereign bonds with investment grade rating by at least one rating agency. Only Greece and Cyprus fall short on this criterion but ABSPP and CBPP show that it’s easy to circumvent. Lower rated bonds can also be bought if the sovereign falls under EU assistance/oversight (Troika). Of course with the ECB very mindful of Greek event risk and how damaging that could be to the lasting credibility of this programme, it will look for significant wriggle room in this regard. The amount of bonds bought per country is expected to be in line with the ECB’s capital key.

Unlike SMP (average maturity 4.3 years) and OMT (up until 3‐years), we expect the QE‐programme to cover tenors up until 30‐years. Negative yielding sovereign debt (already around 30% of outstanding bonds) might be excluded as it raises questions with regard to direct monetary financing, which is prohibited under the EU treaty. For the same reason, the ECB will not buy sovereign debt at primary auctions but only at the secondary market at market determined prices. Again, this approach will seek to emphasize the consistency of the programme’s mechanics with the advice given last week by one of the European Court of Justice’s advocates‐general in relation to OMT’s.

It is possible that corporate bonds will also be included in the programme, though several ECB governors indicated that the sovereign bond market is preferred over the corporate bond market because of higher volumes and better liquidity.

2) Pari Passu

The pari passu clause means that the ECB is on the same level as other creditors in case of a default. During the 2012 Greek default, the ECB had seniority over other bond holders. As a result, Greek bonds in the SMP‐programme were saved from restructuring/losses. An important feature of the subsequent OMT‐programme was that the ECB waived this seniority and said to be pari passu with other creditors. For the ECJ’s advocates‐general, this was also an important clause to rule OMT legal and not conflicting with the EU Treaty (monetary financing): “the ECB might be obliged to waive, in full or in part, its claims securitized in governance bonds, as a result of the OMT programme being activated, does not mean that the programme amounts to a monetary financing measure”. We expect the ECB to hold the pari passu line. Mandatory collective action clauses on all EMU government bonds (>1yr maturity) issued after 01/01/2013 (ESM Treaty), are an extra reason why the ECB is unlikely to claim seniority status. CAC’s allow a supermajority of bondholders to agree to a debt restructuring that is legally binding on all holders of the bonds. We don’t think that the ECB wants to overrule this and scare other investors out of riskier sovereign bond markets. Currently, already 20% of outstanding EGB’s has a CAC and this amount will of course only increase. Furthermore, the most liquid EGB’s are the “on the run” bonds and those all have a CAC inserted.

3) Risk sharing

Currently, the most uncertain aspect of the expected QEprogramme is whether the bond purchases will entail P&L risk sharing across the national central banks of the eurosystem or whether the programme will stipulate that each national central bank is responsible for their own bond buying and handle potential losses with their own buffers. Under the first scenario, the ECB buys bonds and distributes gains/losses over national central banks according to their capital key. That’s the way the SMPprogramme operated. The second scenario is more in line with the approach adopted in respect of Emergency Liquidity Assistance (ELA), through which a national central bank provides emergency liquidity to domestic credit institutions. In this instance , each national central bank carries all the risks with regard to this form of financing to its domestic institutions.

The second option is seen as a potentially troublesome compromise that is intended to reduce opposition on the part of some ECB Governing council members to any form of QE programme. Recent rumours/press articles suggest that the ECB is effectively moving in this direction. ECB Coeure for example said that: “The discussion is how to design it in a way that woks, in a way that makes sense. If this is a discussion about how best to pool sovereign risk in Europe, and how to make the pooling of sovereign risk take a step forward in an environment where the governments themselves have decided not to do it, then this not the right discussion. That discussion doesn’t take place in Frankfurt, it doesn’t take place at the ECB, it takes place in Brussels among democratically‐elected governments.”

However, this approach is likely to be seen as notably less effective than an approach that entailed risk sharing as it may see national central banks taking a more defensive stance and it also implies increasing fragmentation of the sovereign bond market. It would be even be a sign of distrust in the “euro” project. Moreover, in the event of any notable deterioration in market conditions, it would tend to amplify market worries. For example, in the event of a sovereign default and exit this approach would eventually result in losses for other national central banks as well via Target 2 imbalances. Capital outflow in the run‐up to a sovereign default will be substantial (including most of the liquidity injection from the national central bank under a QE programme) and this approach would result in a claim on other national central banks. So, in the event of a writedown national central banks would eventually share the risk even in the absence of risk‐pooling. Such a tail‐risk event could become the focus of significant and possibly excessive market attention if this approach is adopted particularly given renewed concerns in relation to Greece of late.

Market implications

In an ideal world, ECB‐QE would be unlimited and openended. The ECB would be pari passu with other creditors and national central banks share risks of a default. In that case, markets could initially be in for a buy‐the‐rumour, sell‐the‐fact reaction similar to what we’ve seen after most QE‐programmes launched by the Fed, the BoE or the BoJ. More specifically, investors could take profit on European bond/equity markets and euro short positions.

As the ECB has repeatedly disappointed in the past and its room for manouevre is notably limited by fundamental differences of opinion around the Governing council table, this again seems a strong possibility for Thursday. Certainly, a programme that is regarded as limited either in terms of its size or restrictions that apply to its operation could lead to very sharp market reactions. It could sound somewhat strange but given the extreme market positioning (long bonds/equities, short euro), a disappointing outcome could force investors to take some, short term, chips off the table as well. The details of the QE‐programme will have a final say in how long the move lasts. Longer term, a failing QE‐policy (unable to lift inflation expectations) will nevertheless bring deflation trades back to the market (bull flattening yield curve).

Regardless of the markets immediate reaction, once the QE programme begins, flows will play a very important role on EMU bond markets and act as a key constraining influence on bond yields.

This non-exhaustive information is based on short-term forecasts for expected developments on the financial markets. KBC Bank cannot guarantee that these forecasts will materialize and cannot be held liable in any way for direct or consequential loss arising from any use of this document or its content. The document is not intended as personalized investment advice and does not constitute a recommendation to buy, sell or hold investments described herein. Although information has been obtained from and is based upon sources KBC believes to be reliable, KBC does not guarantee the accuracy of this information, which may be incomplete or condensed. All opinions and estimates constitute a KBC judgment as of the data of the report and are subject to change without notice.

Recommended Content

Editors’ Picks

EUR/USD clings to daily gains above 1.0650

EUR/USD gained traction and turned positive on the day above 1.0650. The improvement seen in risk mood following the earlier flight to safety weighs on the US Dollar ahead of the weekend and helps the pair push higher.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD reversed its direction and advanced to the 1.2450 area after touching a fresh multi-month low below 1.2400 in the Asian session. The positive shift seen in risk mood on easing fears over a deepening Iran-Israel conflict supports the pair.

Gold holds steady at around $2,380 following earlier spike

Gold stabilized near $2,380 after spiking above $2,400 with the immediate reaction to reports of Israel striking Iran. Meanwhile, the pullback seen in the US Treasury bond yields helps XAU/USD hold its ground.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Week ahead – US GDP and BoJ decision on top of next week’s agenda

US GDP, core PCE and PMIs the next tests for the Dollar. Investors await BoJ for guidance about next rate hike. EU and UK PMIs, as well as Australian CPIs also on tap.