Headline & core inflation revisit their lows

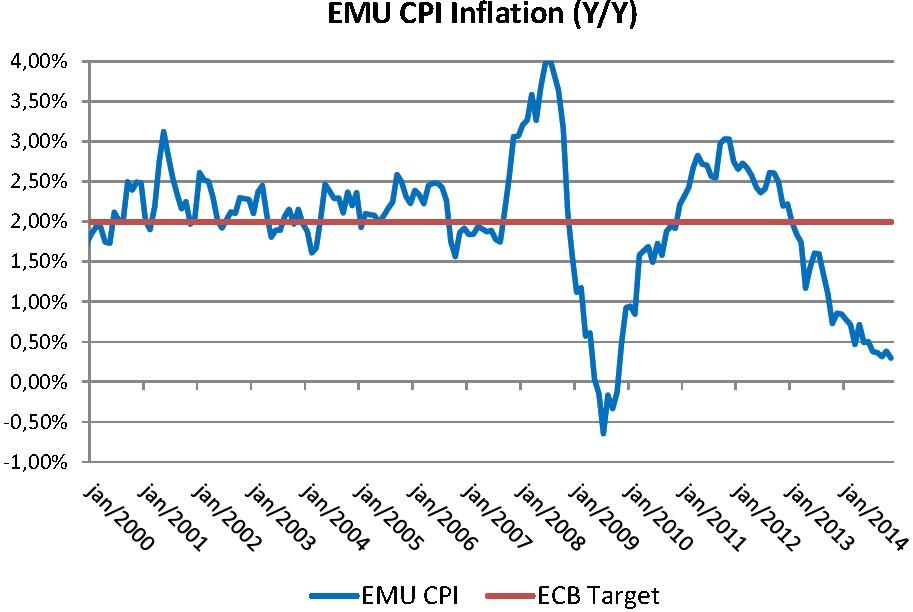

Deflation fears have intensified again in recent weeks as the sell-off in the oil price continues unabatedly, affecting also prices of other commodities. While the drop in the oil price can also be seen as a positive supply shock, markets tend to look at it from a negative side, especially in Europe where deflation fears are most acute, with inflation back at a 5-year low and just a touch above zero.

After an uptick in October, euro zone CPI inflation dropped again to its cyclical low of 0.3% Y/Y in November, edging closer to negative territory. The sell-off in the oil price will push inflation further down in the coming months, to new multi-year lows. To overlook the effect of the lower oil price, we will keep a close eye on core inflation in the coming months. Since the start of the year, core inflation showed signs of bottoming out, which was encouraging, but in the meantime, core inflation is again at its record low level of 0.7% Y/Y. It will be interesting to see whether second-round effects will also push core inflation further down, to new record lows in the coming months.

Also interesting is to take look at goods versus services inflation, which clearly shows that downward price pressures are led by the goods producing sector.

Remarkably however, the downtrend in goods inflation did not continue during the last few months. Inflation in the services sector extended its downward trend, albeit very slowly. A further slowdown in inflation in the services sector would be a worrying, signalling that deflationary pressures are spreading.

The breakdowns by product groups shows that low inflationary pressures are broad-based. Looking more into detail, also here, there were poor signs in both October and November as the number of product groups with negative annual inflation rates picked up again and reached a new high. Currently the number of product groups with negative annual inflation rates stands at 31%, indicating that one in three product groups is observing negative inflation. While there is no deflation in the meaning of a prolonged period of broad-based declining prices, deflation risks are increasing as downward price pressures are spreading across products groups.

In the meantime, market-based measures of inflation expectations remain on a firm downward trend, falling to ever new lows, indicating that markets believe the latest ECB actions will be insufficient to tackle deflation risks. The steep downtrend in the ECB’s closely-watched 5yr 5yr forward indicates that inflation expectations are no longer “firmly anchored”, which keeps the ECB under pressure to take further action.

Inflation might even become negative

The euro zone headline inflation rate dropped ever lower in recent months and is very close to negative territory.

Inflation was expected to gradually pick up in the second half of the year, but the recent drop in the oil price will delay any stabilization in EMU inflation. Early next year it is even not excluded that inflation might temporary fall into negative territory, before picking up later in the year. To overlook the impact of the oil price, we will keep a close eye on core inflation, which might eventually reach new all-time lows too. The continued downtrend in headline inflation and a new slowdown in the core reading is likely to trigger further action by the ECB, especially as demand from the second TLTRO was disappointing too.

This non-exhaustive information is based on short-term forecasts for expected developments on the financial markets. KBC Bank cannot guarantee that these forecasts will materialize and cannot be held liable in any way for direct or consequential loss arising from any use of this document or its content. The document is not intended as personalized investment advice and does not constitute a recommendation to buy, sell or hold investments described herein. Although information has been obtained from and is based upon sources KBC believes to be reliable, KBC does not guarantee the accuracy of this information, which may be incomplete or condensed. All opinions and estimates constitute a KBC judgment as of the data of the report and are subject to change without notice.

Recommended Content

Editors’ Picks

EUR/USD hovers around 1.0700 ahead of German IFO survey

EUR/USD is consolidating recovery gains at around 1.0700 in the European morning on Wednesday. The pair stays afloat amid strong Eurozone business activity data against cooling US manufacturing and services sectors. Germany's IFO survey is next in focus.

USD/JPY refreshes 34-year high, attacks 155.00 as intervention risks loom

USD/JPY is renewing a multi-decade high, closing in on 155.00. Traders turn cautious on heightened risks of Japan's FX intervention. Broad US Dollar rebound aids the upside in the major. US Durable Goods data are next on tap.

Gold: Defending $2,318 support is critical for XAU/USD

Gold price is nursing losses while holding above $2,300 early Wednesday, stalling its two-day decline, as traders look forward to the mid-tier US economic data for fresh cues on the US Federal Reserve interest rates outlook.

Worldcoin looks set for comeback despite Nvidia’s 22% crash Premium

Worldcoin (WLD) price is in a better position than last week's and shows signs of a potential comeback. This development occurs amid the sharp decline in the valuation of the popular GPU manufacturer Nvidia.

Three fundamentals for the week: US GDP, BoJ and the Fed's favorite inflation gauge stand out Premium

While it is hard to predict when geopolitical news erupts, the level of tension is lower – allowing for key data to have its say. This week's US figures are set to shape the Federal Reserve's decision next week – and the Bank of Japan may struggle to halt the Yen's deterioration.