Low oil prices are a long‐term phenomenon that may have a positive impact on Central European economies, albeit not a very big one overall….

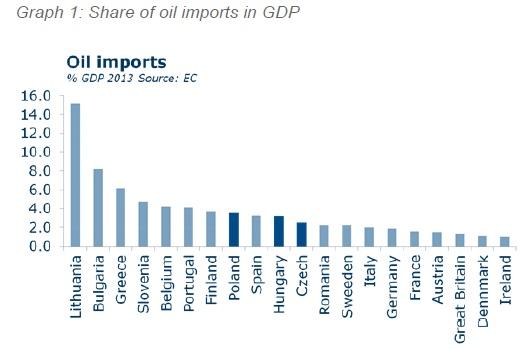

Oil prices have slumped to five‐year lows and are close to US$60 a barrel. In addition, the era of low oil prices is unlikely to peter out soon. In 2015 we expect that the price of Brent crude to remain at around US$65 a barrel on average. Thus low oil prices are a long‐term phenomenon rather than a temporary affair. Central Europe is one of the regions that may benefit most from the low oil prices. The region is a net oil importer, as is its largest trading partner – the euro area countries (see Graph 1).

Lower oil prices may primarily encourage household consumption and real income. However, the extent to which lower oil prices will influence petrol prices partly depends on the specificities of local markets, the share of taxes in the total price, and the effect of the exchange rate. The price of oil influences petrol prices in all Central European countries with approximately a two‐week delay, i.e. a week later than in Germany. Usually half of a change in the dollar price of oil is reflected in the dollar petrol prices at fuel stations in Poland and Hungary. In the Czech Republic the effect is slightly smaller (see the box).

Naturally the price for the consumer is also finally influenced by the exchange rate. This year all Central European currencies have depreciated against the dollar, having curbed the effect of cheap oil. Next year we anticipate an average price of oil of US$65 a barrel (i.e. down by 35%) while Central European currencies should be approximately 8% weaker on average against the USD. With this scenario, the final effects on household budgets should be greatest in Hungary In 2015 we predict that cheaper oil will increase household purchasing power in Hungary most (by 0.6% y/y), because of the stronger impact of oil prices on petrol prices and a greater weight of petrol expenditure in Hungary’s consumer basket. We predict a contribution of +0.2% (see Box 2) in the Czech Republic.

Another beneficial impact of cheap oil is the direct positive effect on the production capacity of industry. However, the effects are not quite clear here. Historically, only declines in oil prices triggered by supply shocks – i.e. higher oil extraction – have had positive effects on Central Europe. There have not been many shocks like this – in the past most oil market volatility has been based on a combination of demand shocks and speculation. However, if we believe that at least part of today’s oil prices slump is due to higher supply, Central European industry may easily benefit from this, with Hungary being relatively the greatest beneficiary once again (see the following Box 3). By and large, however, this effect should not exceed tenths of a percent. Therefore, just in the case of the direct affect on household budgets, the lower price of oil is nice, but no revolutionary phenomenon.

This non-exhaustive information is based on short-term forecasts for expected developments on the financial markets. KBC Bank cannot guarantee that these forecasts will materialize and cannot be held liable in any way for direct or consequential loss arising from any use of this document or its content. The document is not intended as personalized investment advice and does not constitute a recommendation to buy, sell or hold investments described herein. Although information has been obtained from and is based upon sources KBC believes to be reliable, KBC does not guarantee the accuracy of this information, which may be incomplete or condensed. All opinions and estimates constitute a KBC judgment as of the data of the report and are subject to change without notice.

Recommended Content

Editors’ Picks

EUR/USD regains traction, recovers above 1.0700

EUR/USD regained its traction and turned positive on the day above 1.0700 in the American session. The US Dollar struggles to preserve its strength after the data from the US showed that the economy grew at a softer pace than expected in Q1.

GBP/USD returns to 1.2500 area in volatile session

GBP/USD reversed its direction and recovered to 1.2500 after falling to the 1.2450 area earlier in the day. Although markets remain risk-averse, the US Dollar struggles to find demand following the disappointing GDP data.

Gold climbs above $2,340 following earlier drop

Gold fell below $2,320 in the early American session as US yields shot higher after the data showed a significant increase in the US GDP price deflator in Q1. With safe-haven flows dominating the markets, however, XAU/USD reversed its direction and rose above $2,340.

XRP extends its decline, crypto experts comment on Ripple stablecoin and benefits for XRP Ledger

Ripple extends decline to $0.52 on Thursday, wipes out weekly gains. Crypto expert asks Ripple CTO how the stablecoin will benefit the XRP Ledger and native token XRP.

After the US close, it’s the Tokyo CPI

After the US close, it’s the Tokyo CPI, a reliable indicator of the national number and then the BoJ policy announcement. Tokyo CPI ex food and energy in Japan was a rise to 2.90% in March from 2.50%.