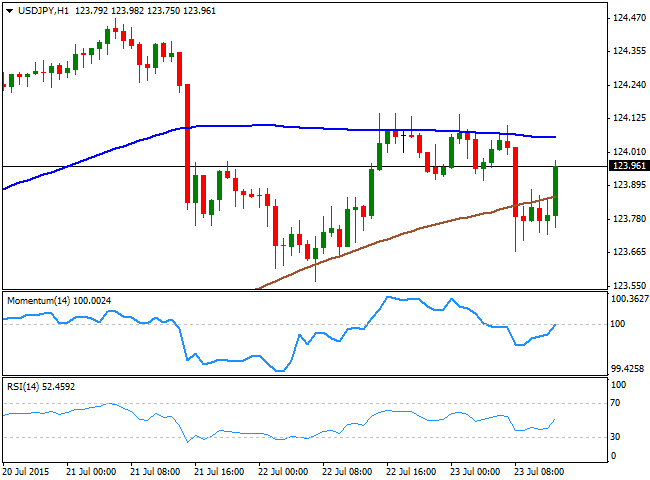

USD/JPY Current price: 123.95

View Live Chart for the USD/JPY

Struggling around 124.00. The USD/JPY pair fell back below the 124.00 figure as the dollar came under selling pressure with the European opening. The pair fell down to 123.67 before bouncing back towards the 124.00 region on the back of US employment data, and the 1 hour chart shows that the price recovered above its 200 SMA, whilst the technical indicators head sharply higher and are crossing their mid-lines towards the upside. In the same chart, the 100 SMA provides a strong dynamic resistance around 124.10, with at least a candle opening above it required to confirm another leg higher. In the 4 hours chart, however, the technical indicators are heading slightly higher below their mid-lines, suggesting there's little buying interest at the time being and confirming the shorter term view.

Support levels: 123.65 123.30 122.90

Resistance levels: 124.10 124.45 124.90

Recommended Content

Editors’ Picks

GBP/USD slides to its lowest level since November, eyes 1.2400 ahead of UK jobs data

GBP/USD drifts lower for the third straight day on Tuesday and drops to its lowest level since November 17 during the Asian session. Spot prices trade around the 1.2420 region as traders now look to the UK monthly employment details for a fresh impetus.

EUR/USD falls toward 1.0600 on higher expectations of the Fed prolonging higher rates

EUR/USD continues to lose ground for the sixth successive session, trading near 1.0610 during the Asian hours on Tuesday. The elevated US Dollar is exerting pressure on the pair, potentially influenced by the higher US Treasury yields.

Gold price holds steady below $2,400 mark, bullish potential seems intact

Gold price oscillates in a narrow band on Tuesday and remains close to the all-time peak. The worsening Middle East crisis weighs on investors’ sentiment and benefits the metal. Reduced Fed rate cut bets lift the USD to a fresh YTD top and cap gains for the XAU/USD.

SOL primed for a breakout as it completes a rounding bottom pattern

Solana price has conformed to the broader market crash, following in the steps of Bitcoin price that remains in the red below the $65,000 threshold. For SOL, however, the sensational altcoin could have a big move in store.

The week ahead: Key economic and earnings releases to watch

The market’s focus may be on geopolitical issues at the start of this week, but there is a large amount of economic data and more earnings releases to digest in the coming days.