Although EUR/JPY bounced-off a dip to 133.75 and recovered nearly 500 pips on the same day itself early this week, the cross struggles to hold near 138 barrier, falling back on the 136 handle on every attempt to the upside. The offered tone in the cross remains intact as the cross receives double blow from the recent chaos surrounding Greece. While the European currency remains pressured on Greek default and possiblity of Grexit with Sunday’s Greek bailout referndum in the spotlight now. The Japanese currency also gained support recently on risk-off sentiment spurred by Greek uncertainty, keeping the cross undermined.

As for today’s trade so far, EUR/JPY treads water around 136.50 levels amid ongoing dozens of Greecxe headlines. The pair once again faced rejection at 137.41 and rebounded lower finding good support at 136.07 levels. The cross trades modestly flat as markets digest the latest Tsipras’ letter stating that the Greek Government will accept the creditors' bailout conditions proposed last weekend with some minor changes.While on JPY-side of the story, the USD/JPY pair seems firmer, extending its recovery mode after the recent weakness. Hence, the downside remains cushioned on a weaker yen as traders await key US releases for further USD moves.

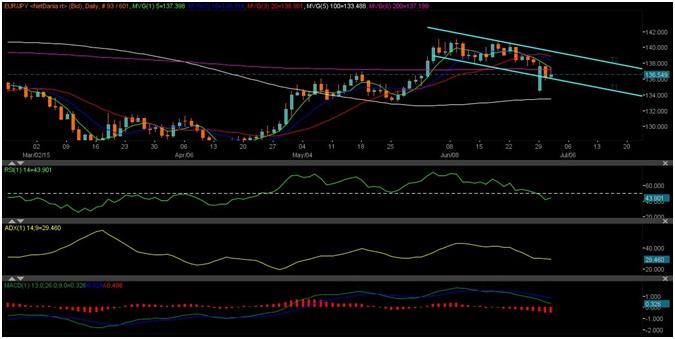

Technically, on the daily chart,EUR/JPY trades in a short-term downtrend channel with the cross clinging to the crucial channel trend-line support located at 136 levels. Although the trend line has been breached on a couple of occasions this week, the cross has managed to reclaim those levels on daily closing basis. The upside remains capped by the 10-DMA and 20-DMA confluence zone at 137-90-138.50 zone.In the week ahead, it is expected EUR/JPY may once again give a channel bearish breakout and fall to 100-DMA located at 133.33 levels.Bolstering further case for downside, the cross trades below most moving averages while the daily RSI around also struggles to inch higher. Moreover, the ADX standing at 29.50 shows that the downside momentum in the cross is slowly picking strength, while the MACD aims lower below the signal line further supporting bearish bias.

Fundamentally, Greece saga is going to continue later this week, while markets now turn focus towards crucial US fundamentals to be released today and tomorrow which may provide fresh cues on EUR/JPY. Later today, traders await June's ADP jobs report ahead of the crucial non-farm payrolls data due on Thursday.The ADP employment report may reveal that some 218,000 new jobs were created in the US private sector in June, following the 201,000 recorded in May.

The figure will be important ahead of non-farm payrolls data - due to be released unusually on Thursday as Friday marks the Independence Day holiday - where markets forecast about 230,000 new job creations for last month, with the jobless rate sliding to 5.4%.Moreover, fresh figures for average hourly earnings will be eyed as well for guessing when the Federal Reserve will begin to lift its interest rates.

Any miss on today’s ADP will add to further nervousness in markets before tomorrow’s NFP figures. While a better show at NFP tomorrow will bolster USD bulls further, raising expectations of Fed rate hike as early as this Sept back on the table. Markets are expecting a stronger reading which is likely to weigh on the EUR/JPY cross with losses in the EUR/USD pair expected to overshadow the gains in USD/JPY on NFP release. This seems to hold true as the European currency will face double whammy on Greece worries as also on the back of divergent monetary policy stance becoming more imminent amid strengthening US labour market.

To conclude:

EUR/JPY looks to display descending channel bearish breakout below 136 levels for a second time this week

The cross is expected to test 100-DMA placed at 133.33 on the back a stronger NFP print while Greece concerns linger

A failure to sustain below 136 levels, the pair may rebound for a retest of 200-DMA at 137.02 beyond which doors open for 137.87 (10-DMA). This may hold true if the NFP figures miss estimates or come in line with market forecasts.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

EUR/USD retreats below 1.0700 after US GDP data

EUR/USD came under modest bearish pressure and retreated below 1.0700. Although the US data showed that the economy grew at a softer pace than expected in Q1, strong inflation-related details provided a boost to the USD.

GBP/USD declines below 1.2500 as USD rebounds

GBP/USD declined below 1.2500 and erased the majority of its daily gains with the immediate reaction to the US GDP report. The US economy expanded at a softer pace than expected in Q1 but the price deflator jumped to 3.4% from 1.8%.

Gold drops below $2,320 as US yields shoot higher

Gold lost its traction and turned negative on the day below $2,320 in the American session on Thursday. The benchmark 10-year US Treasury bond yield is up more than 1% on the day above 4.7% after US GDP report, weighing on XAU/USD.

XRP extends its decline, crypto experts comment on Ripple stablecoin and benefits for XRP Ledger

Ripple extends decline to $0.52 on Thursday, wipes out weekly gains. Crypto expert asks Ripple CTO how the stablecoin will benefit the XRP Ledger and native token XRP.

After the US close, it’s the Tokyo CPI

After the US close, it’s the Tokyo CPI, a reliable indicator of the national number and then the BoJ policy announcement. Tokyo CPI ex food and energy in Japan was a rise to 2.90% in March from 2.50%.