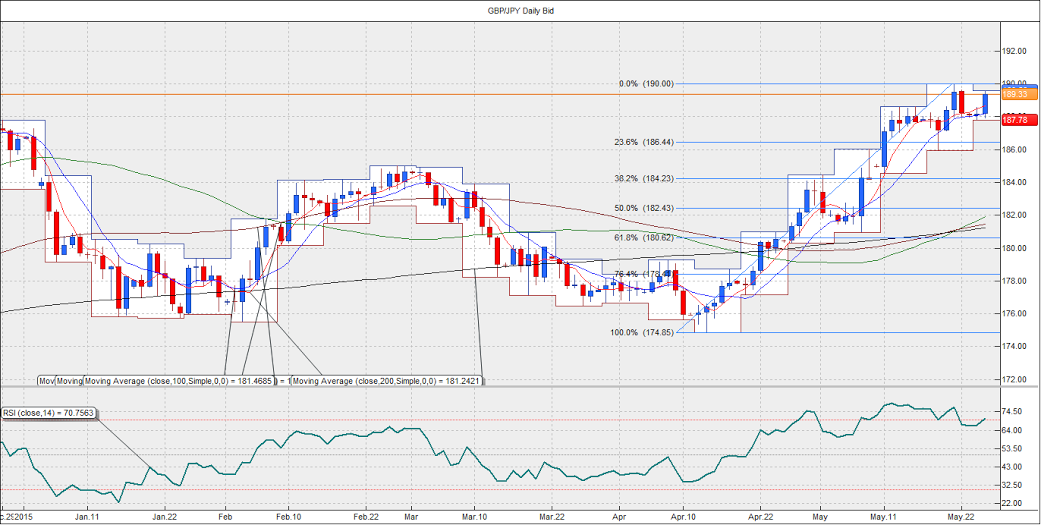

The GBP/JPY pair clocked a high of 190.00 last week, before falling back to 187.78 levels. Fresh bids were seen today, which pushed the pair to a high of 189.56.

The pair has rallied from the low of 174.86 (seen in Mid-April) to a high of 189.95 without a meaningful correction. The major part of the rally was due to the sharp rise in the GBP/USD pair from the low of 1.4564 to 1.5813. Moreover, the British Pound contradicted the widespread expectation of pre-election and post-election weakness.

Meanwhile, the latest rise in the GBP/JPY cross has been triggered by a rise in the USD/JPY pair over and above 122.00 levels.

Ahead in the week, the fate of the GBP/JPY cross is dependent on the UK first quarter GDP report due on Thursday, followed by the US first quarter GDP report on Friday.

Pound could rise ahead of Thursday’s preliminary Q1 UK GDP

The UK first quarter GDP is expected to be revised higher to 2.5% year-on-year from 2.4%. On similar lines, Quarter-on-quarter GDP is expected to be revised higher to 0.4% from 0.3%. An upward revision of the UK GDP is likely to lend support to the British Pound. We may very well see the GBP being bid higher ahead of the report on Thursday.

US GDP could be a non-event

On the other hand, the US first quarter GDP is likely to be revised lower to -0.9% from the previous estimate of 0.2%. However, the Friday’s strong core CPI numbers and an upbeat US core durable goods number are likely to overshadow Friday’s US GDP report. Moreover, by now, it is well-known fact that US economy slowed down considerably in the first quarter. Thus, we may not see much reaction in the FX markets, until and unless the actual print is significantly higher/lower than the consensus estimates.

Greek issue could help strengthen JPY and weaken GBP

An EU official was quoted saying today that no deal is likely to be reached between Greece and its international creditors by this Thursday. The official said Grece’s VAT proposal was not good enough and that no deal is expected by Thursday's teleconference with deputy finance ministers. Greece is due to make a payment to the IMF on June 5th and we have repeatedly heard Greek government complaining about the shortage of funds and increasing possibility of a default.

So far, the financial markets have been complacent. However, the German 10-year is showing signs of weakness today, indicating a rise in demand for safe haven German bunds. In case the Greece issue flares up, a further sell-off in the EUR/USD would also drag the GBP/USD pair lower. Meanwhile, funding currency like the Japanese Yen may gain on risk aversion.

GBP/JPY: Could test 23.6% Fib retracement at 186.44

As said earlier, the British Pound may rally in anticipation of an upward revision of the first quarter GDP. In case, the pair fails to break above 190.00 on a daily closing basis, a renewed selling pressure could push the pair back to 187.78.

The said level would also act at as neckline for the double top formation in case the pair reverses from 190.00. Thus, a break below 187.78 would shift risk in favor a fall to 186.44 (23.6% Fib R of 174.86-190.00)

A spinning top candle for the previous week indicates the bulls may be losing interest and we may have a reversal on the cards.

Overall, Fresh sell-off could be expected anywhere between 189.50-190.00 levels for the downside target of 187.78 and 186.44 with stop orders seen above 190.00 levels.

However, a daily close above 190.00 could bring in fresh bids that may push the pair higher to 192.00 levels.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

EUR/USD retreats below 1.0700 after US GDP data

EUR/USD came under modest bearish pressure and retreated below 1.0700. Although the US data showed that the economy grew at a softer pace than expected in Q1, strong inflation-related details provided a boost to the USD.

GBP/USD declines below 1.2500 as USD rebounds

GBP/USD declined below 1.2500 and erased the majority of its daily gains with the immediate reaction to the US GDP report. The US economy expanded at a softer pace than expected in Q1 but the price deflator jumped to 3.4% from 1.8%.

Gold holds near $2,330 despite rising US yields

Gold stays in positive territory near $2,330 in the second half of the day on Thursday. The benchmark 10-year US Treasury bond yield is up more than 1% on the day above 4.7% after US GDP report, making it difficult for XAU/USD to extend its daily rally.

XRP extends its decline, crypto experts comment on Ripple stablecoin and benefits for XRP Ledger

Ripple extends decline to $0.52 on Thursday, wipes out weekly gains. Crypto expert asks Ripple CTO how the stablecoin will benefit the XRP Ledger and native token XRP.

After the US close, it’s the Tokyo CPI

After the US close, it’s the Tokyo CPI, a reliable indicator of the national number and then the BoJ policy announcement. Tokyo CPI ex food and energy in Japan was a rise to 2.90% in March from 2.50%.