The Bank of Japan’s decision to keep both its interest rate and its asset purchase program unchanged, could mean that negative rates will mainly be tested in Europe. Following the negative reaction in Japan from both the banking sector as well as the wider public, the Bank was reluctant to push rates lower so soon after pushing them below zero for the first time in history back in January. Therefore, it looks like the Bank of Japan is going to keep charging certain balances held by financial institutions by -0.1% but not drive that rate further into negative territory. A negative rate of -0.1% is unlikely to mean that negative rates are going to be used more widely in the Japanese banking system, although it should be noted that the country’s 10-year bond also has a slightly negative yield.

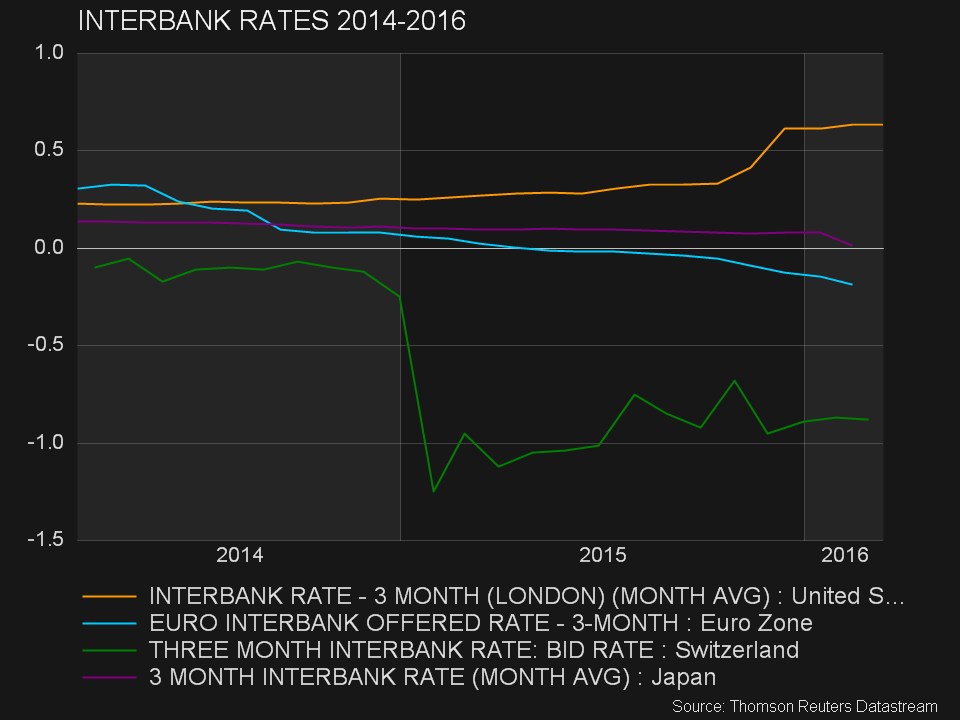

This leaves Europe as the main testing ground where negative rates are being used. Depending on the success of the experiment, negative rates might be used more broadly by other central banks outside of Europe in the case of a future crisis. Specifically, negative rates are present in the Eurozone (now at a deposit rate of -0.4%), Sweden (-0.5% repo rate) and Switzerland (-0.75% target mid-point for 3-month London interbank rate). Denmark also has a -0.65% rate on certificates of deposit, but the country’s currency has to track the euro, which makes it necessary to follow the ECB in terms of monetary policy.

Therefore these are the countries that will be closely watched as the experiment is running its course. Of course even in Europe the banks are careful not to charge retail customers with positive balances, as this could create a backlash. It is possible therefore, because of the reluctance to pass on negative rates to all their customers, the profitability of the banking sector might be hurt.

Financial markets are sceptical as to whether negative rates are going to have an impact on stimulating lending and boosting growth. The adoption of negative rates can signal an economy that is in deep distress rather than bolster confidence about the future. In addition negative rates tend to hit savers and pension and insurance funds, which have come to expect an income from cash and safe fixed income investments. Instead such investors are forced to undertake more risks in lower-quality bonds or to invest in volatile equity markets; a recipe that could lead to a bubble. Therefore it remains to be seen if such instruments are going to be effective or damaging in the long-run.

In currency markets, the adoption of negative rates (Bank of Japan – January) or the driving of rates even deeper into negative territory (ECB – March) did not lead to the expected depreciation of either the yen or the euro. Perhaps this is due to the realization that negative rates have a limit and medium-term expectations of future policy – which is what usually drives exchange rate movements – imply very limited scope for additional action such as even more negative rates.

Forex trading and trading in other leveraged products involves a significant level of risk and is not suitable for all investors.

Recommended Content

Editors’ Picks

EUR/USD clings to daily gains above 1.0650

EUR/USD gained traction and turned positive on the day above 1.0650. The improvement seen in risk mood following the earlier flight to safety weighs on the US Dollar ahead of the weekend and helps the pair push higher.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD reversed its direction and advanced to the 1.2450 area after touching a fresh multi-month low below 1.2400 in the Asian session. The positive shift seen in risk mood on easing fears over a deepening Iran-Israel conflict supports the pair.

Gold holds steady at around $2,380 following earlier spike

Gold stabilized near $2,380 after spiking above $2,400 with the immediate reaction to reports of Israel striking Iran. Meanwhile, the pullback seen in the US Treasury bond yields helps XAU/USD hold its ground.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Week ahead – US GDP and BoJ decision on top of next week’s agenda

US GDP, core PCE and PMIs the next tests for the Dollar. Investors await BoJ for guidance about next rate hike. EU and UK PMIs, as well as Australian CPIs also on tap.