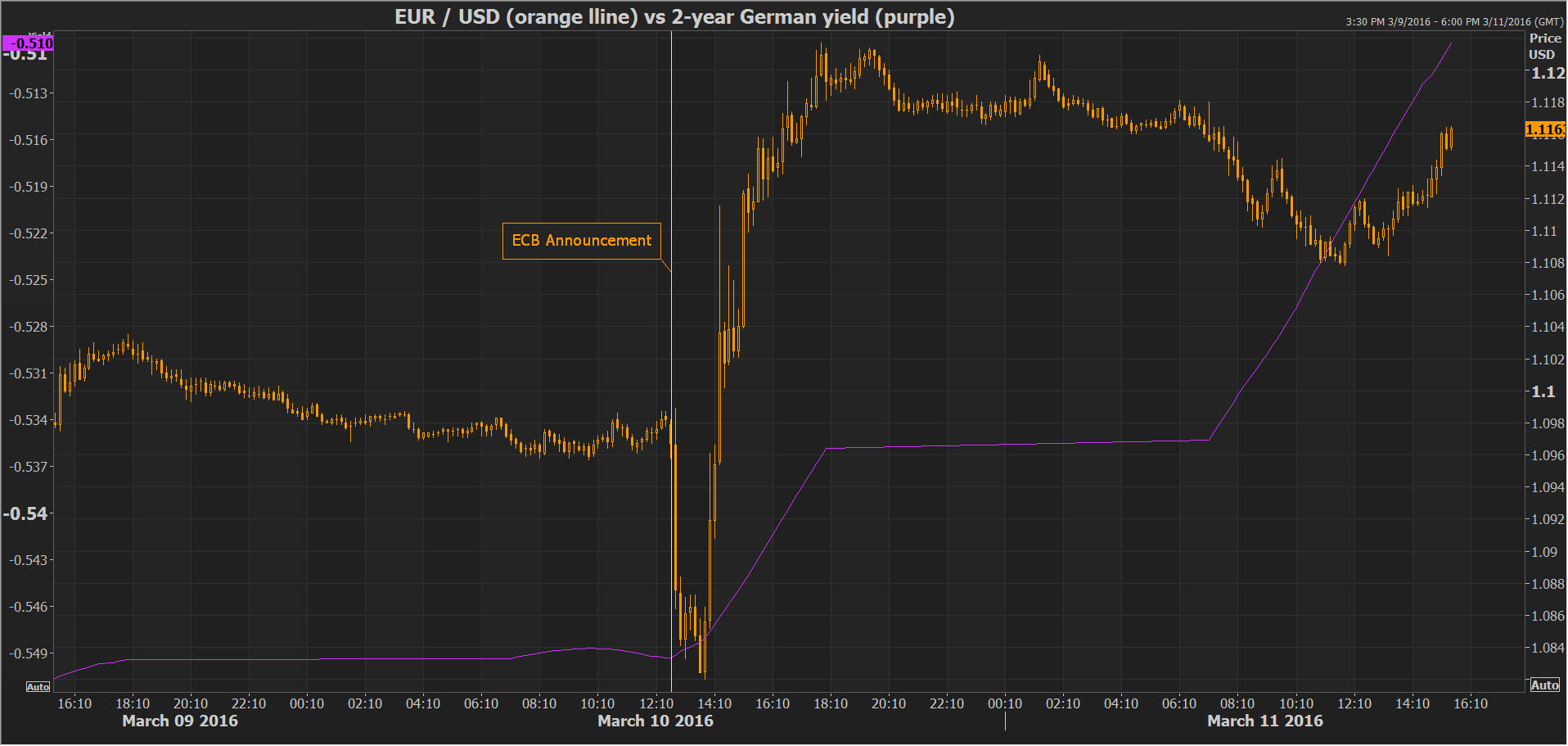

Why markets behaved as they did was the subject of a lot of discussion among analysts. It was suggested that the latest action by the ECB smacked of desperation and that the unused ammunition available to central banks in a similar position, was extremely limited. Indeed the ECB could be taking a big risk in using measures that should normally be reserved for conditions of deep economic recession or depression. What happens if there is a sudden and unexpected economic downturn? What will be the tools available then? Of course forecasters do not see a recession ahead, but it is rare for economic forecasts to capture turning points before they actually occur.

Another criticism of the ECB measures is that monetary policy by itself will not solve the many problems that the Eurozone economy is facing. The ECB President has of course admitted this himself and called on Eurozone leaders to take advantage of the breathing space that the Bank was offering them in order to enact much-needed reforms. However, it appears that politicians across the Eurozone might be using the breathing space that the ECB is providing exactly to avoid much-needed reforms. Plans for reforms that would boost competitiveness, allow for greater labor and goods and services markets flexibility, enhance the capital markets union, enhance the banking union and deal with the banking sector problems such as the high level of non-performing loans and use targeted fiscal policy such as investment in infrastructure, remain safely tucked away in the drawers of bureaucrats as politicians remain afraid of the high political cost they may entail. In this way, the ECB’s ultra-loose policies could be delaying the very policies that the Bank has been consistently asking for.

Another reason for the negative reaction is that maybe markets are starting to doubt the effect this stimulus will ultimately have on the economy and on inflation. Although the ECB has claimed that without QE and negative rates the Eurozone would be deeply mired in deflation, a whole year’s worth of QE and low rates has done little to boost inflation as the ECB has intended. This has also been demonstrated in Japan where the QE program is actually much larger than the ECB’s. Therefore despite the well-meaning efforts, one could be excused for doubting the effectiveness of such measures. Comparing the United States’ experience with QE is also interesting as the US has deeper and better integrated financial markets, which are central to the functioning of its economy in which central bank intervention may bring benefits. In the Eurozone’s case, the banking system is much more important than financial markets in providing capital to firms.

To sum up, the fact that the ECB’s ambitious measures did not have the intended effect on markets, could have some ominous implications. It could be that markets are starting to dispute the power that central banks ultimately have in shaping economic developments. The myth of the all-powerful central bank that can stabilize and bring an economy out of a crisis seems to be challenged; in the Eurozone on Thursday it looked like the ECB was pushing on a string. Economic policymakers around the world would do well to take this message into account and perhaps reassess calls for more and more aggressive monetary policy action in the form of ever more negative interest rates and additional quantitative easing.

Forex trading and trading in other leveraged products involves a significant level of risk and is not suitable for all investors.

Recommended Content

Editors’ Picks

AUD/USD stands firm above 0.6500 with markets bracing for Aussie PPI, US inflation

The Aussie Dollar begins Friday’s Asian session on the right foot against the Greenback after posting gains of 0.33% on Thursday. The AUD/USD advance was sponsored by a United States report showing the economy is growing below estimates while inflation picked up. The pair traded at 0.6518.

EUR/USD faces a minor resistance near at 1.0750

EUR/USD quickly left behind Wednesday’s small downtick and resumed its uptrend north of 1.0700 the figure, always on the back of the persistent sell-off in the US Dollar ahead of key PCE data on Friday.

Gold soars as US economic woes and inflation fears grip investors

Gold prices advanced modestly during Thursday’s North American session, gaining more than 0.5% following the release of crucial economic data from the United States. GDP figures for the first quarter of 2024 missed estimates, increasing speculation that the US Fed could lower borrowing costs.

Bitcoin price continues to get rejected from $65K resistance as SEC delays decision on spot BTC ETF options

Bitcoin (BTC) price has markets in disarray, provoking a broader market crash as it slumped to the $62,000 range on Thursday. Meanwhile, reverberations from spot BTC exchange-traded funds (ETFs) continue to influence the market.

US economy: Slower growth with stronger inflation

The dollar strengthened, and stocks fell after statistical data from the US. The focus was on the preliminary estimate of GDP for the first quarter. Annualised quarterly growth came in at just 1.6%, down from the 2.5% and 3.4% previously forecast.