GBP/USD

The dollar traded mixed against its G10 peers during the European morning Friday. It was higher against CAD, GBP, NOK, AUD and NZD, in that order, while it was lower vs JPY, SEK, EUR and CHF.

In Germany, the regional CPIs for August generally fell or decelerated on a monthly basis, and decelerated on an annual basis. These figures indicate that the national inflation rate, due out later this afternoon, is likely to be lower on a yoy basis as well. This also increases the likelihood that next week's Eurozone CPI rate is likely to decline. Such disappointing data ahead of the ECB meeting, could add to expectations that the Bank may have to keep QE in place for longer. This may put EUR under selling pressure.

The British pound continued its plunge even after the 2nd estimated of the UK GDP confirmed the initial estimate and showed that economy expanded 0.7% qoq in Q2. The figure was in line with expectations. Strong growth alongside accelerating wages, could encourage hawkish MPC members to join the lone dissenter McCafferty in voting to raise rates. The speech of the BoE Governor Carney at the Jackson Hole Economic Symposium tomorrow will be of a particular interest. We would be looking for any hints regarding the Bank's stance, given the recent developments in China. Any hawkish comments by the Governor will bring forward expectations for a rate hike, and the pound could strengthen. For now I would expect the negative move to continue, at least temporarily.

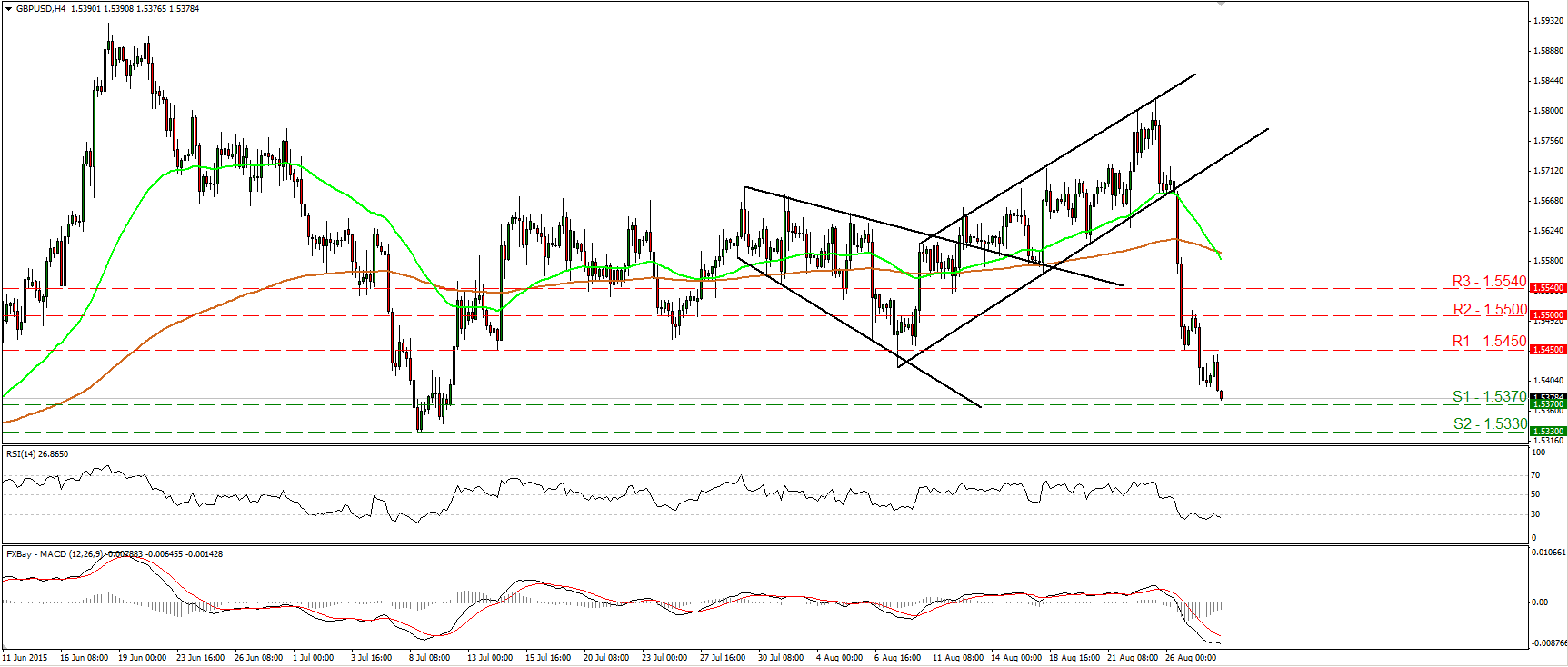

GBP/USD trade lower during the European morning Friday, after it hit resistance marginally below the 1.5450 (R1) hurdle. At midday, the rate is headed towards the support of 1.5370 (S1), where a clear break is likely to target the 1.5330 (S2) area, defined by the low of the 8th of July. Our short-term oscillators detect strong downside speed and support the case that Cable could continue trading lower. The RSI, already within its oversold territory, hit resistance at its 30 line and turned down, while the MACD stands well below both its zero and signal lines, pointing south as well. As for the bigger picture, Wednesday's collapse brought the rate back below the 80-day exponential moving average. As a result, I would change my view to neutral as far as the overall outlook of Cable is concerned.

Support: 1.5370 (S1), 1.5330 (S2), 1.5270 (S3)

Resistance: 1.5450 (R1), 1.5500 (R2), 1.5540 (R3)

Recommended Content

Editors’ Picks

AUD/USD keeps the red below 0.6400 as Middle East war fears mount

AUD/USD is keeping heavy losses below 0.6400, as risk-aversion persists following the news that Israel retaliated with missile strikes on a site in Iran. Fears of the Israel-Iran strife translating into a wider regional conflict are weighing on the higher-yielding Aussie Dollar.

USD/JPY recovers above 154.00 despite Israel-Iran escalation

USD/JPY is recovering ground above 154.00 after falling hard on confirmation of reports of an Israeli missile strike on Iran, implying that an open conflict is underway and could only spread into a wider Middle East war. Safe-haven Japanese Yen jumped, helped by BoJ Governor Ueda's comments.

Gold price pares gains below $2,400, geopolitical risks lend support

Gold price is paring gains to trade back below $2,400 early Friday, Iran's downplaying of Israel's attack has paused the Gold price rally but the upside remains supported amid mounting fears over a potential wider Middle East regional conflict.

WTI surges to $85.00 amid Israel-Iran tensions

Western Texas Intermediate, the US crude oil benchmark, is trading around $85.00 on Friday. The black gold gains traction on the day amid the escalating tension between Israel and Iran after a US official confirmed that Israeli missiles had hit a site in Iran.

Dogwifhat price pumps 5% ahead of possible Coinbase effect

Dogwifhat price recorded an uptick on Thursday, going as far as to outperform its peers in the meme coins space. Second only to Bonk Inu, WIF token’s show of strength was not just influenced by Bitcoin price reclaiming above $63,000.