EUR/JPY

The dollar traded mixed against the other G10 currencies during the European morning Tuesday. The greenback gained against CHF, AUD and NZD, in that order, while it was lower vs NOK, JPY, CAD and GBP. EUR and SEK were the currencies which had a relatively quiet morning.

The only noteworthy release we had so far was the German Ifo survey for August. All three indices unexpectedly rose from July, confounding expectations of further declines. The expectations index, although it was above the forecast, it declined from the previous month similar to the weak expectations index seen in the ZEW survey. The overall improved Ifo survey helped to recede fears over Germany's recovery path and Eurozone seems to be on track to gather momentum in Q3. At the time of the release, EUR/USD declined a bit, only to find some buy orders slightly above our 1.1500 support level. The rate subsequently jumped towards 1.1550 and maintained its choppy price action established in the Asian trading session. We will need to see the pair breaking either above 1.1625 or below 1.440 for any hope of a nice move into the end of the week.

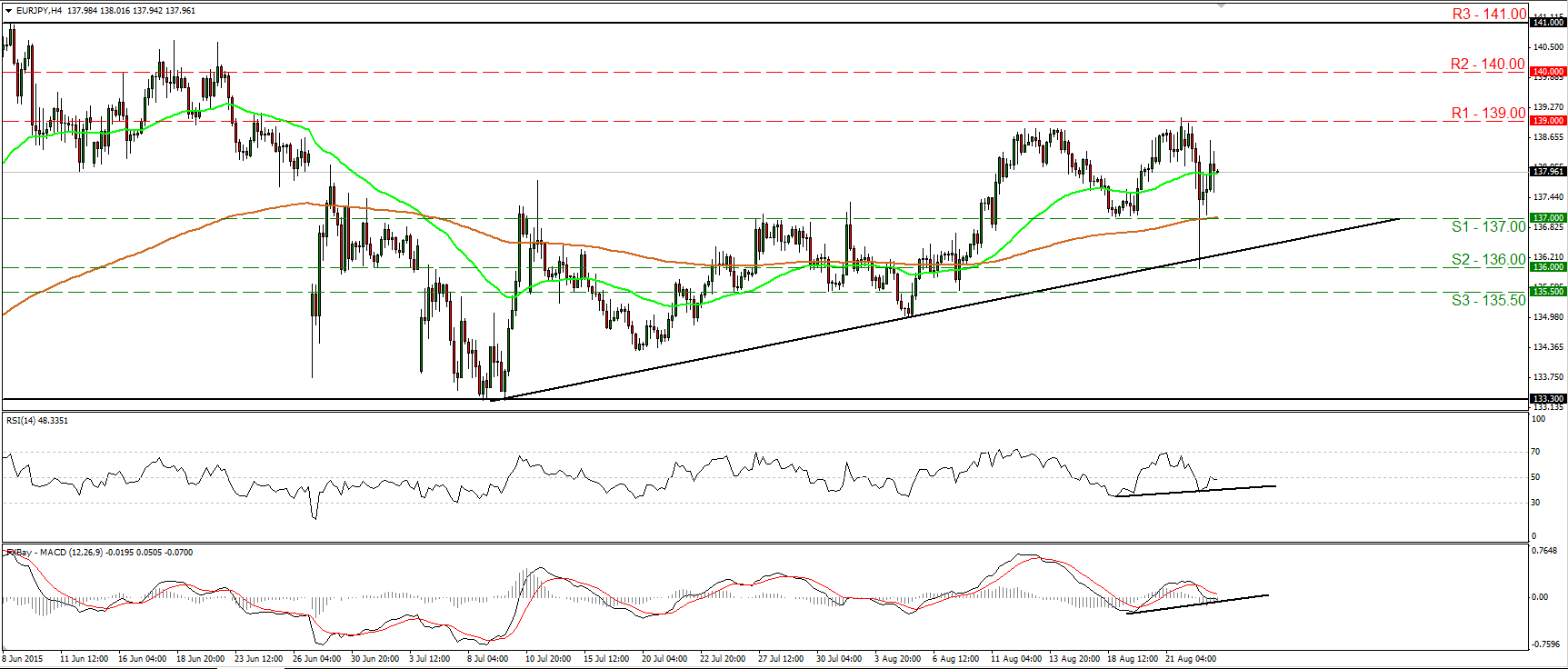

EUR/JPY traded higher during the European morning Tuesday, after it hit support slightly above the 137.00 (S1) hurdle. As long as the rate is trading above the uptrend line taken from the low of the 9th of July, I would consider the outlook to be cautiously positive. However, I would like to see a clear and decisive move above 139.00 (R1) before I get confident on the upside again. Such a move would confirm a forthcoming higher high on the daily chart and perhaps set the stage for extensions towards the psychological round figure of 140.00 (R2). Our short-term oscillators support the somewhat positive picture as well. The RSI edged higher but hit resistance slightly above its 50 line, while the MACD, although slightly below zero, shows signs of bottoming. Furthermore, there is positive divergence between both these indicators and the price action.

Support: 137.00 (S1), 136.00 (S2), 135.50 (S3)

Resistance: 139.00 (R1), 140.00 (R2), 141.00 (R3)

Recommended Content

Editors’ Picks

EUR/USD climbs to 10-day highs above 1.0700

EUR/USD gained traction and rose to its highest level in over a week above 1.0700 in the American session on Tuesday. The renewed US Dollar weakness following the disappointing PMI data helps the pair stretch higher.

GBP/USD extends recovery beyond 1.2400 on broad USD weakness

GBP/USD gathered bullish momentum and extended its daily rebound toward 1.2450 in the second half of the day. The US Dollar came under heavy selling pressure after weaker-than-forecast PMI data and fueled the pair's rally.

Gold rebounds to $2,320 as US yields turn south

Gold reversed its direction and rose to the $2,320 area, erasing a large portion of its daily losses in the process. The benchmark 10-year US Treasury bond yield stays in the red below 4.6% following the weak US PMI data and supports XAU/USD.

Here’s why Ondo price hit new ATH amid bearish market outlook Premium

Ondo price shows no signs of slowing down after setting up an all-time high (ATH) at $1.05 on March 31. This development is likely to be followed by a correction and ATH but not necessarily in that order.

Germany’s economic come back

Germany is the sick man of Europe no more. Thanks to its service sector, it now appears that it will exit recession, and the economic future could be bright. The PMI data for April surprised on the upside for Germany, led by the service sector.