USD/SEK

The dollar traded higher against almost all of its G10 peers during the European morning Thursday, ahead of the US employment report to be released later in the day. It was higher against AUD, SEK, NZD, CAD and JPY, in that order, while it was lower only against NOK. The greenback was stable vs GBP, CHF and EUR.

The Swedish krona plunged after the country's central bank surprised the markets and cut its key rate further into negative territory and expanded its bond purchases program. The key rate was cut to -0.35% from -0.25% and the QE program was expanded by SEK 45bln. Even though the country escaped from deflation recently, the krona has become stronger than the Bank had forecast, which remains a risk to the upturn in inflation. Given that the Bank maintained the option to cut rates further, I would expect SEK to remain under selling pressure in the short-term. On the medium-term however, I would expect the relatively high Swedish bond yields to keep the currency supported.

The pound strengthened after Britain's construction PMI rose to 58.1 in June from 55.9 previously, beating expectations of 56.2. Following the soft manufacturing PMI on Wednesday, the positive surprise eased concerns over growth in Q2 and strengthened GBP somewhat. The service-sector PMI, to be released on Friday, will shed further light on the likelihood of a rebound in Q2.

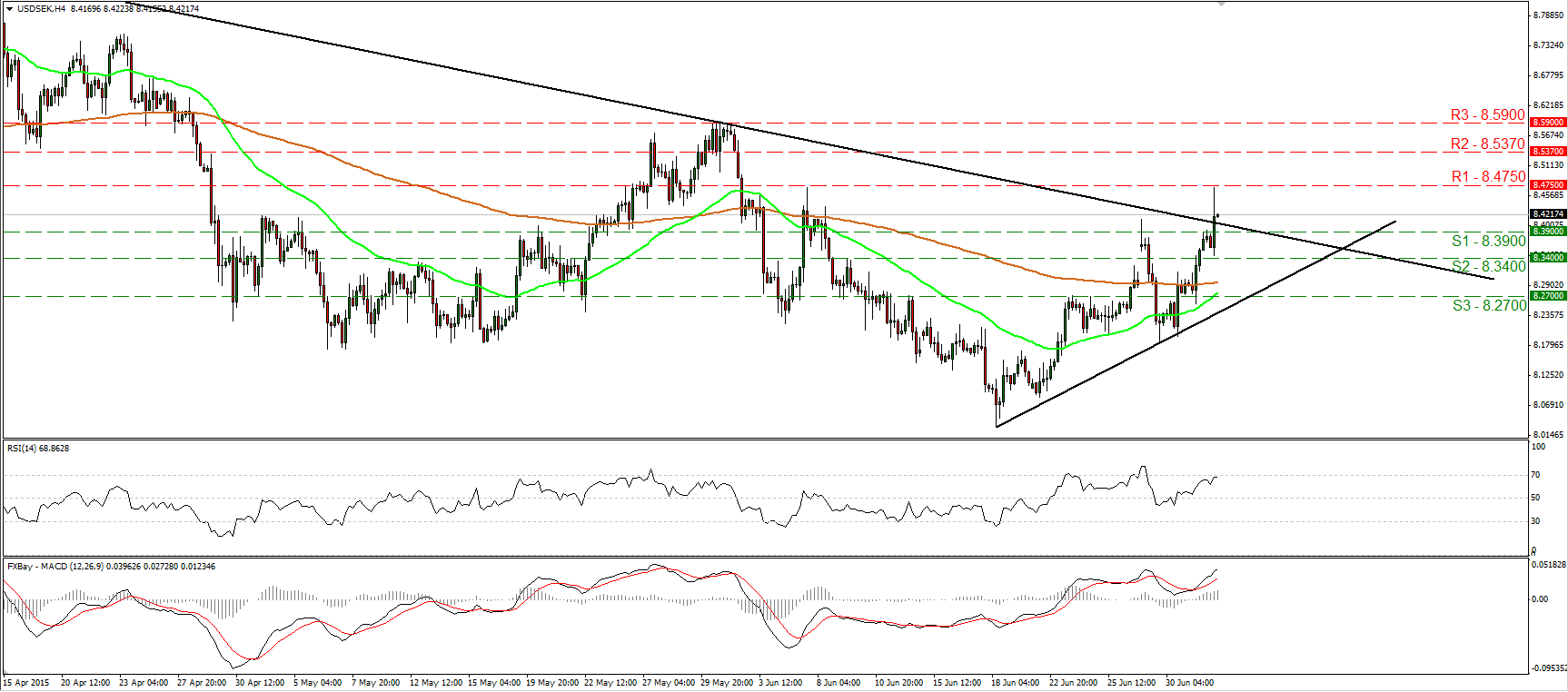

USD/SEK surged during the European morning Thursday after the Riksbank's unexpected interest rate decision. The pair emerged above the resistance (now turned into support) territory of 8.3900 (S1) and above the medium-term downtrend line taken from the peak of the 13th of April. Subsequently, USD/SEK hit the resistance barrier of 8.4750 (R1) and then retreated somewhat. Bearing in mind that the pair is now trading above the aforementioned downtrend line and above the short-term uptrend line drawn from the low of the 18th of June, I would see a positive near-term outlook. A clear move above the 8.4750 (R1) hurdle could prompt extensions towards the next one at 8.5370 (R2). The trigger for such a rally could be a strong US employment report later in the day. Our short-term oscillators support the notion as well. The RSI raced higher and now looks ready to challenge its 70 line, while the MACD, already positive stands well above its trigger line and points north.

Support: 8.3900 (S1), 8.3400 (S2), 8.2700 (S3)

Resistance: 8.4750 (R1), 8.5370 (R2), 8.5900 (R3)

Recommended Content

Editors’ Picks

AUD/USD remained bid above 0.6500

AUD/USD extended further its bullish performance, advancing for the fourth session in a row on Thursday, although a sustainable breakout of the key 200-day SMA at 0.6526 still remain elusive.

EUR/USD faces a minor resistance near at 1.0750

EUR/USD quickly left behind Wednesday’s small downtick and resumed its uptrend north of 1.0700 the figure, always on the back of the persistent sell-off in the US Dollar ahead of key PCE data on Friday.

Gold holds around $2,330 after dismal US data

Gold fell below $2,320 in the early American session as US yields shot higher after the data showed a significant increase in the US GDP price deflator in Q1. With safe-haven flows dominating the markets, however, XAU/USD reversed its direction and rose above $2,340.

Bitcoin price continues to get rejected from $65K resistance as SEC delays decision on spot BTC ETF options

Bitcoin (BTC) price has markets in disarray, provoking a broader market crash as it slumped to the $62,000 range on Thursday. Meanwhile, reverberations from spot BTC exchange-traded funds (ETFs) continue to influence the market.

US economy: slower growth with stronger inflation

The dollar strengthened, and stocks fell after statistical data from the US. The focus was on the preliminary estimate of GDP for the first quarter. Annualised quarterly growth came in at just 1.6%, down from the 2.5% and 3.4% previously forecast.