EUR/GBP

The dollar traded mixed against its G10 counterparts during the European morning Friday. It was higher against GBP, JPY and NZD, in that order, while it was lower vs SEK, NOK, EUR and CHF. The greenback was unchanged vs AUD and CAD.

The British pound was the main loser after the country’s manufacturing PMI declined to 51.9 in April from 54.0 previously. The market had expected a moderate rise to 54.6. The sharp decline signals a slowdown in growth. Coming after the weaker GDP growth rate for Q1 announced last week, the decline in the manufacturing PMI is another negative sign that the UK economy is losing momentum. With the UK general elections less than a week away and the opinion polls suggesting a tight finish with no clear winner, the 2 week implied volatility spiked above 14, a level last seen before the Scottish referendum in September. The increased uncertainty is likely to put GBP under pressure and the recent appetite for euros could halt the advances in GBP/USD due to stronger EUR/GBP.

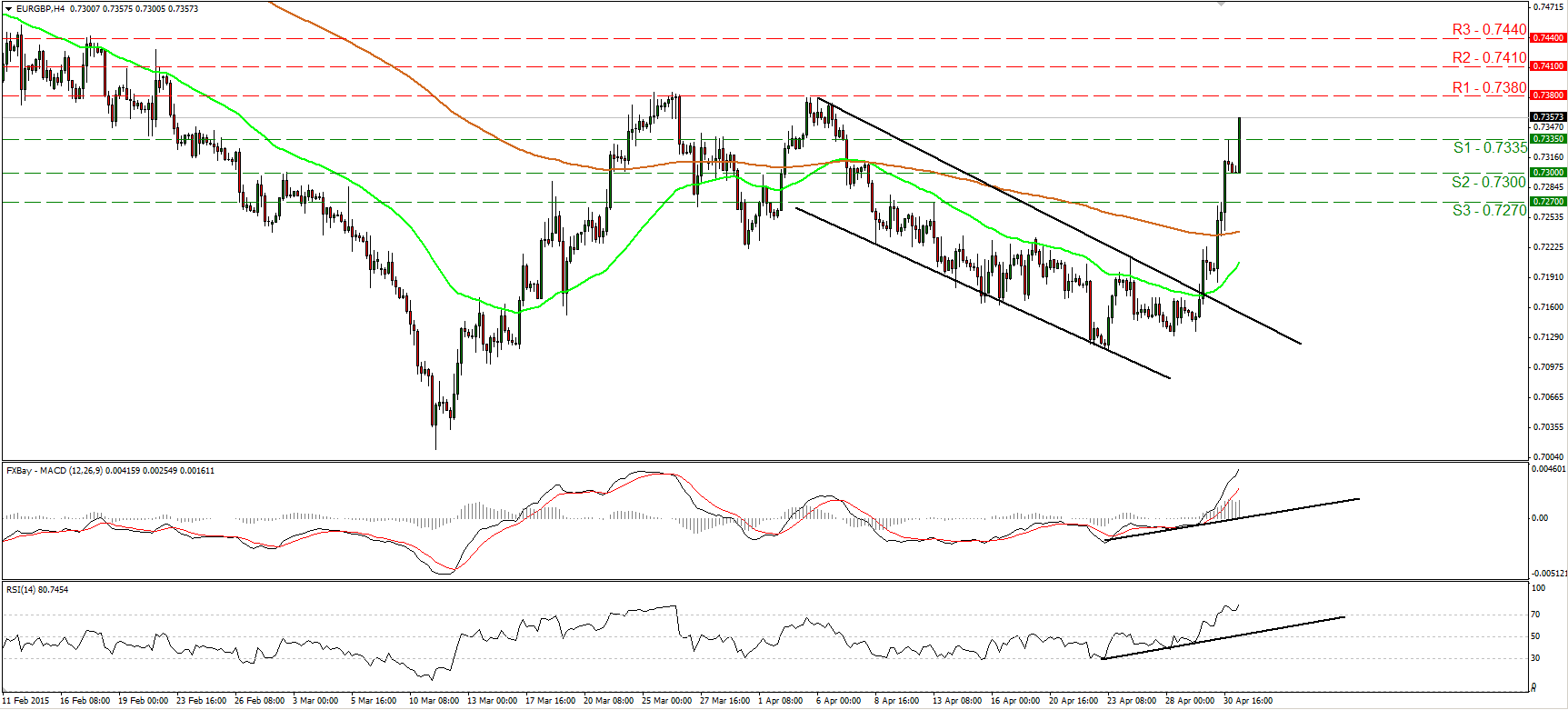

EUR/GBP accelerated higher during the European morning Friday, breaking above the resistance (now turned into support) barrier of 0.7335 (S1). After the break above the downside resistance line on the 29th of April, the price structure has been higher highs and higher lows, and therefore I have switched my short-term view to positive. I believe that we are likely to see the rate challenging the 0.7380 (R1) barrier soon, where a clear upside break could signal extensions towards the next hurdle at 0.7410 (R2). Our short-term oscillators detect strong bullish momentum and amplify the case for the continuation of the positive leg. The RSI already within its overbought zone has turned again up, while the MACD, already above both its zero and signal lines, accelerated higher and keeps pointing north. On the daily chart, the recent rally brings into question the continuation of the larger downtrend. A clear move above the 0.7380 (R1) territory, which stands very close to the 38.2% retracement level of the 16th of December – 11th of March decline, could signal the completion of a possible double bottom formation. That could bring a medium-term trend reversal.

Support: 0.7335 (S1), 0.7300 (S2), 0.7270 (S3).

Resistance: 0.7380 (R1), 0.7410 (R2), 0.7440 (R3).

Recommended Content

Editors’ Picks

EUR/USD holds gains near 1.0650 amid risk reset

EUR/USD is holding onto its recovery mode near 1.0650 in European trading on Friday. A recovery in risk sentiment is helping the pair, as the safe-haven US Dollar pares gains. Earlier today, reports of an Israeli strike inside Iran spooked markets.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD is rebounding toward 1.2450 in early Europe on Friday, having tested 1.2400 after the UK Retail Sales volumes stagnated again in March, The pair recovers in tandem with risk sentiment, as traders take account of the likely Israel's missile strikes on Iran.

Gold price defends gains below $2,400 as geopolitical risks linger

Gold price is trading below $2,400 in European trading on Friday, holding its retreat from a fresh five-day high of $2,418. Despite the pullback, Gold price remains on track to book the fifth weekly gain in a row, supported by lingering Middle East geopolitical risks.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Geopolitics once again take centre stage, as UK Retail Sales wither

Nearly a week to the day when Iran sent drones and missiles into Israel, Israel has retaliated and sent a missile into Iran. The initial reports caused a large uptick in the oil price.