USD/CAD

In the absence of any material events to drive the markets, the dollar traded higher or unchanged against the other G10 currencies during the European morning Thursday. It traded virtually unchanged against AUD and NZD, while it gained the most against NOK, CHF and EUR.

One day after a not-so-exciting ECB meeting, sellers of the euro are back in the game. I believe that after the ECB meeting, the market attention has switched to Grexit possibilities again after the FT ran a front-page headline “Germany dashes hope of cash deal for Athens at high-stakes meeting.” German Finance Minister Wolfgang Shaeuble ruled out further grants and noted that it’s up to Greece to commit to the reforms needed to unlock the much desired aid. Furthermore, reports in Greek newspaper Ekathimerini say that New Democracy believes that a Greek exit is possible. These news follow yesterday’s move from Standard & Poor’s to downgrade Greece – I didn’t realize that was possible.

The loonie declined somewhat against the dollar, but this looks more like a pause in the CAD rally following the BoC policy meeting and the astonishing surge in oil prices. Tomorrow, we get Canada’s CPI data for March. Both the headline and the core rates are forecast to have remained unchanged. A positive surprise and a further rise in oil prices could add to the recent positive sentiment towards CAD.

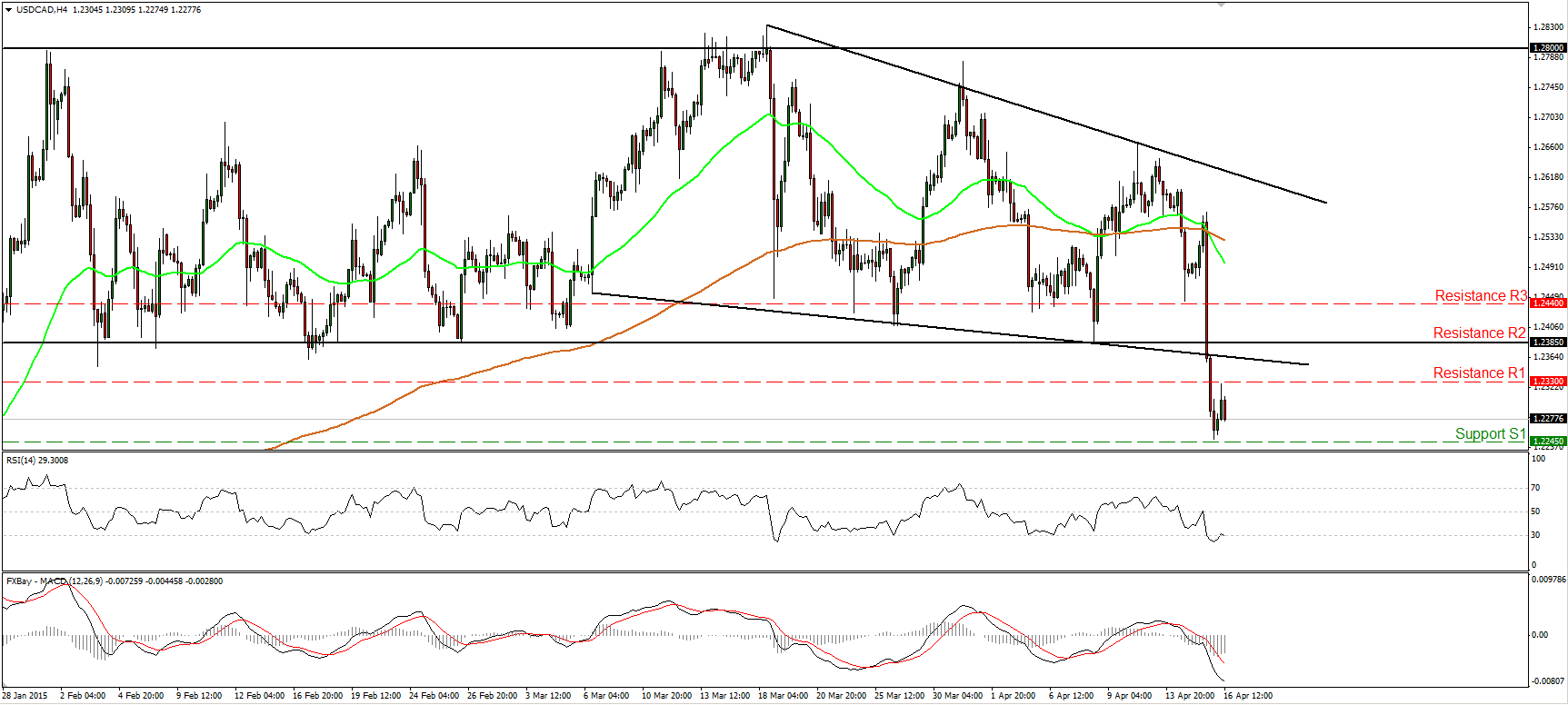

USD/CAD plunged yesterday but the decline was halted near 1.2245 (S1). Today during the European morning, the rate rebounded somewhat as USD/CAD (inversely) tracked WTI pretty closely, but the bounce remained limited to 1.2330 (R1). Yesterday’s free fall caused a break below the key support line now turned into resistance of 1.2385 (R2), which is the lower bound of the sideways range that had been containing the price action since the 26th of January. Therefore I would expect the rate to continue lower and if the bears are strong enough to drive it below 1.2245 (S1), I would expect extensions towards the psychological zone of 1.2000 (S2). The fall also confirmed the negative divergence between the daily oscillators and the price action, and brought into question the major uptrend of this pair. My view is that, at least the medium term picture has now turned negative for USD/CAD and that a test at 1.2000 (S2) looks very likely, assuming no major reversal in the new uptrend in oil prices.

Support: 1.2245 (S1), 1.2000 (S2), 1.1900 (S3).

Resistance: 1.2330 (R1), 1.2385 (R2), 1.2440 (R3).

Recommended Content

Editors’ Picks

EUR/USD consolidates gains below 1.0700 amid upbeat mood

EUR/USD is consolidating its recovery below 1.0700 in the European session on Thursday. The US Dollar holds its corrective decline amid improving market mood, despite looming Middle East geopolitical risks. Speeches from ECB and Fed officials remain on tap.

GBP/USD clings to moderate gains above 1.2450 on US Dollar weakness

GBP/USD is clinging to recovery gains above 1.2450 in European trading on Thursday. The pair stays supported by a sustained US Dollar weakness alongside the US Treasury bond yields. Risk appetite also underpins the higher-yielding currency pair. ahead of mid-tier US data and Fedspeak.

Gold price shines amid fears of fresh escalation in Middle East tensions

Gold price rebounds to $2,380 in Thursday’s European session after posting losses on Wednesday. The precious metal holds gains amid fears that Middle East tensions could worsen and spread beyond Gaza if Israel responds brutally to Iran.

Ripple faces significant correction as former SEC litigator says lawsuit could make it to Supreme Court

Ripple (XRP) price hovers below the key $0.50 level on Thursday after failing at another attempt to break and close above the resistance for the fourth day in a row.

Have we seen the extent of the Fed rate repricing?

Markets have been mostly consolidating recent moves into Thursday. We’ve seen some profit taking on Dollar longs and renewed demand for US equities into the dip. Whether or not this holds up is a completely different story.