NZD/USD

The dollar traded mixed against its G10 counterparts during the European morning Thursday. It was higher against AUD, CHF, NZD, in that order, while it was lower against SEK, NOK and EUR. The greenback was stable vs GBP, CAD and JPY.

The euro was resilient ahead of the preliminary national German CPI for January, despite all of the regional CPIs entering deflationary territory on a yoy basis. These figures indicate that the national inflation rate, due out late this afternoon, is also likely to fall to deflation. The data raise the likelihood that Friday’s Eurozone CPI is likely to fall further into deflationary territory as forecast. This may put further selling pressure on EUR. In the meantime, the German unemployment rate declined to 6.5% from 6.6% in December, and the unemployment change declined 9k, a better performance than -25k previously, showing that the labor market in Germany remains strong.

Eurozone’s M3 money supply grew 3.6% yoy in December, at a faster pace than +3.1% yoy previously and better than expected. Loans to private sectors fell on a yoy basis in December, but at a slower pace than in November. The ECB’s massive QE program is probably the last thing left to support lending and boost growth and prices in the Eurozone.

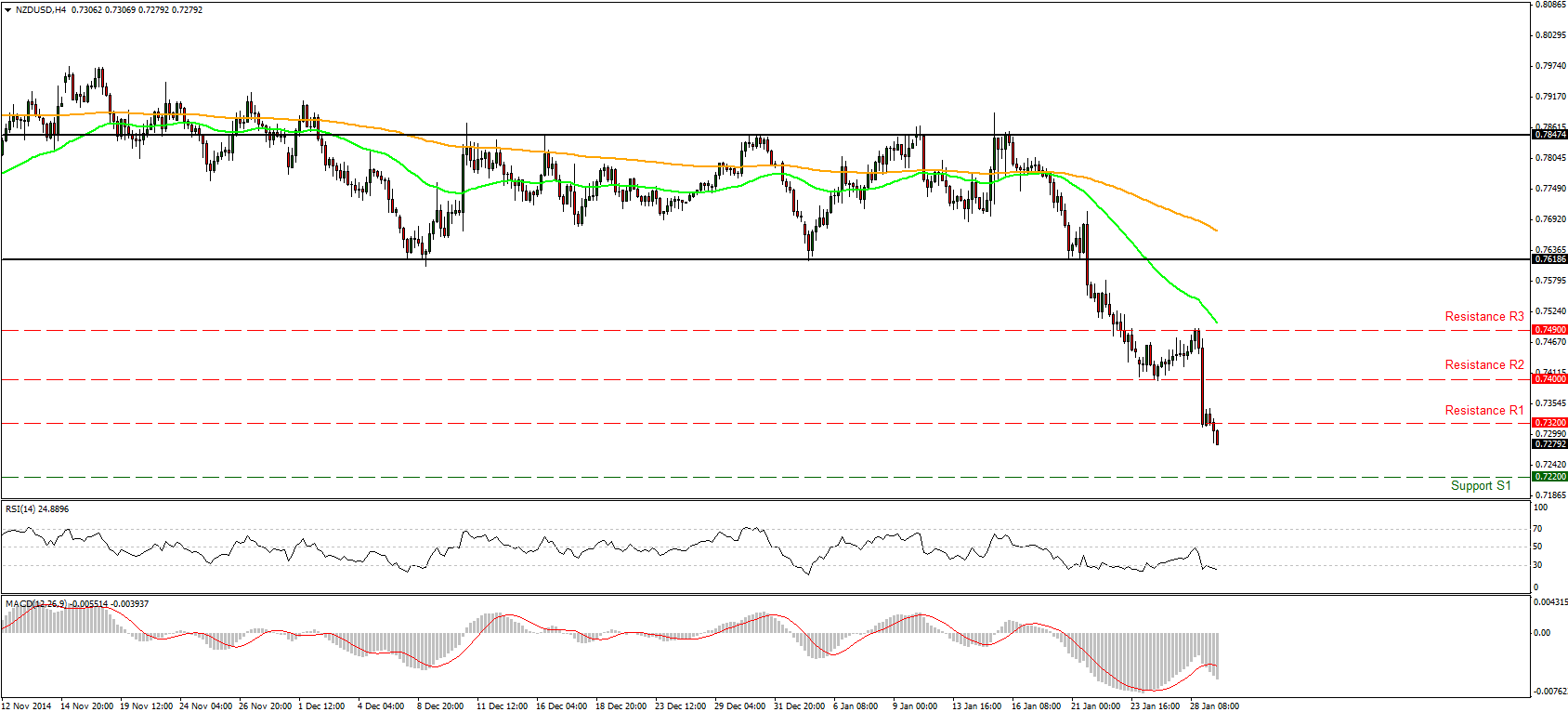

NZD/USD collapsed after the Reserve Bank of New Zealand shifted from a tightening bias to a neutral bias and even held out the possibility that the next move in rates would be a cut. The pair found an initial support near the 0.7320 zone, but broke that line and declined even more during the European morning Thursday. Given the negative sentiment towards kiwi, I would expect the pair to fall further at least until our 0.7220 (S1) support line. Our momentum studies support the notion. The RSI fell sharply below its 30 line and is pointing down, while the MACD, already negative, crossed below its trigger line. On the daily chart, the recent break below the black channel the pair has been trading in since December switched the bias to the downside, confirming the trend mode of this pair.

Support: 0.7220 (S1), 0.7180 (S2), 0.7120 (S3).

Resistance: 0.7320 (R1), 0.7400 (R2), 0.7490 (R3).

Recommended Content

Editors’ Picks

EUR/USD extends gains above 1.0700, focus on key US data

EUR/USD meets fresh demand and rises toward 1.0750 in the European session on Thursday. Renewed US Dollar weakness offsets the risk-off market environment, supporting the pair ahead of the key US GDP and PCE inflation data.

USD/JPY keeps pushing higher, eyes 156.00 ahead of US GDP data

USD/JPY keeps breaking into its highest chart territory since June of 1990 early Thursday, recapturing 155.50 for the first time in 34 years as the Japanese Yen remains vulnerable, despite looming intervention risks. The focus shifts to Thursday's US GDP report and the BoJ decision on Friday.

Gold closes below key $2,318 support, US GDP holds the key

Gold price is breathing a sigh of relief early Thursday after testing offers near $2,315 once again. Broad risk-aversion seems to be helping Gold find a floor, as traders refrain from placing any fresh directional bets on the bright metal ahead of the preliminary reading of the US first-quarter GDP due later on Thursday.

Injective price weakness persists despite over 5.9 million INJ tokens burned

Injective price is trading with a bearish bias, stuck in the lower section of the market range. The bearish outlook abounds despite the network's deflationary efforts to pump the price.

US Q1 GDP Preview: Economic growth set to remain firm in, albeit easing from Q4

The United States Gross Domestic Product (GDP) is seen expanding at an annualized rate of 2.5% in Q1. The current resilience of the US economy bolsters the case for a soft landing.