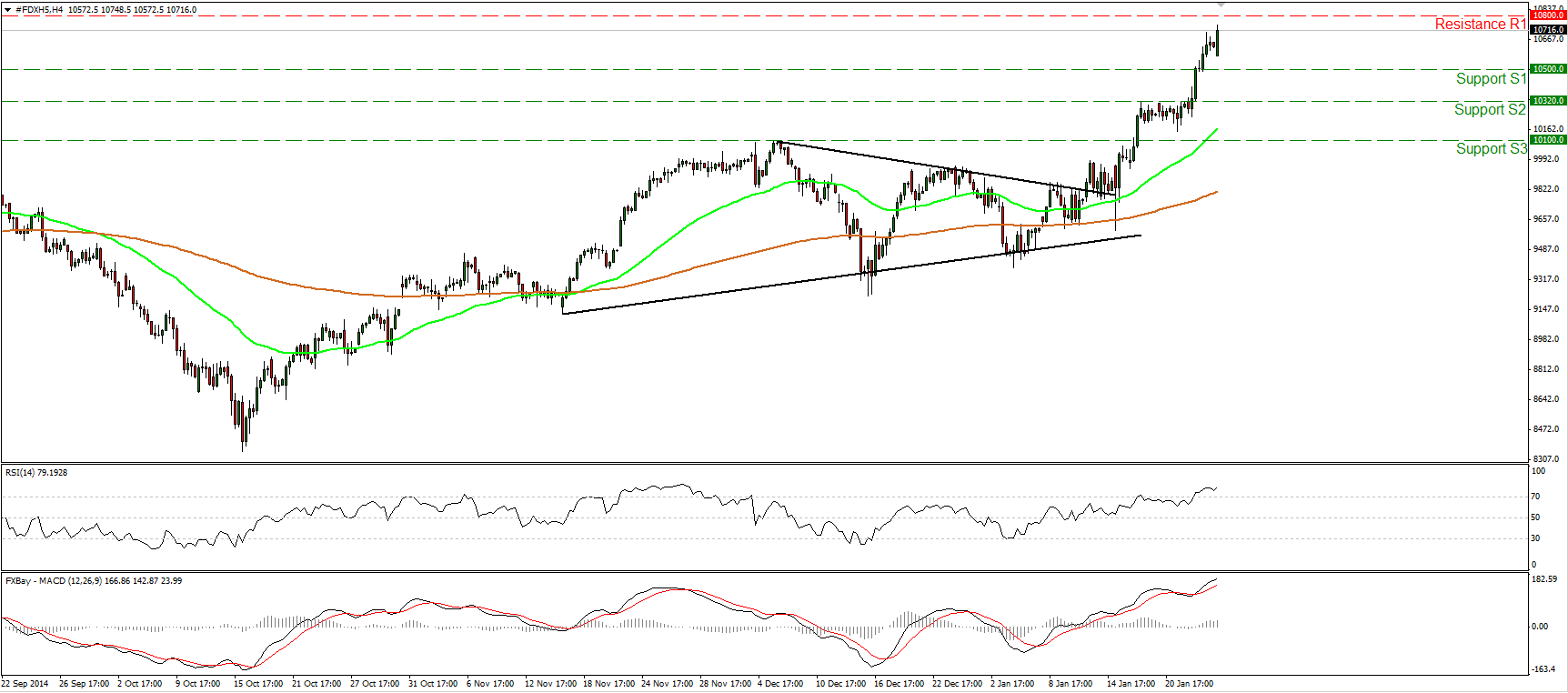

DAX futures

The dollar traded lower against most of its G10 peers during the European morning Monday. It was higher against CHF and JPY, in that order, while it was stable against CAD.

The German Ifo Business climate index rose for the third consecutive month in January, driven probably by low oil prices and anticipation of the ECB’s QE program. The expectations index also rose in line with the strong ZEW survey released last Wednesday. The overall increase in the Ifo indices suggest that German business investment could pick up in Q1 and lift optimism about an economic recovery. Today’s rise can be seen as an optimistic sign added to the recent encouraging German data, although the indices remain below last year’s level.

Greece’s SYRIZA party gained the backing they needed and formed a governing coalition with the right-wing party Greek Independents. The coalition will have a comfortable majority as SYRIZA with 149 MPs and ANEL (Independent Greeks) with 13 MPs have the majority in the 300-seat parliament. Although it is an alliance between two ideologically opposed parties who share only their opposition to the bailout, it boosted the stock market across the Europe as fears of a second election had disappeared. SYRIZA’s coalition with ANEL, which sits with the British Conservative Party in the European Parliament, also ameliorated somewhat the fears that their win would result in a lurch to the left throughout Europe – as symbolized by the presence of the leader of Spain’s Podemos Party, Pablo Iglesias, on the podium with SYRIZA’s Alexis Tsipras (see photo). The boost could also be attributed to investors’ hopes that a compromise over Greece’s bailout terms may be found at the regular Ecofin meeting later in the day. EUR/USD recovered a bit on these developments but stayed below our 1.1315 resistance line.

DAX futures continued to race higher during the European morning Monday, as Syriza’s victory in Greek elections failed to derail the surge in European stock markets (the only exception was FTSE 100) driven by ECB’s QE announcement. The index is trading well above the psychological area of 10500 (S1), and now appears able to challenge 10800 (R1), the 1st price objective of the triangle formation. As long as the price structure stays higher highs and higher lows, I would consider the near-term bias to remain positive and I would expect a clear move above 10800 (R1) to open the way for the next psychological area of 11000 (R2). Our daily momentum studies detect strong upside momentum and support the continuation of the uptrend. The 14-day RSI entered its overbought territory and is pointing up, while the MACD, already above both its zero and signal lines, accelerated higher.

Support: 10500 (S1), 10320 (S2), 10100 (S3).

Resistance: 10800 (R1) 11000 (R2).

Recommended Content

Editors’ Picks

EUR/USD clings to daily gains above 1.0650

EUR/USD gained traction and turned positive on the day above 1.0650. The improvement seen in risk mood following the earlier flight to safety weighs on the US Dollar ahead of the weekend and helps the pair push higher.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD reversed its direction and advanced to the 1.2450 area after touching a fresh multi-month low below 1.2400 in the Asian session. The positive shift seen in risk mood on easing fears over a deepening Iran-Israel conflict supports the pair.

Gold holds steady at around $2,380 following earlier spike

Gold stabilized near $2,380 after spiking above $2,400 with the immediate reaction to reports of Israel striking Iran. Meanwhile, the pullback seen in the US Treasury bond yields helps XAU/USD hold its ground.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Week ahead – US GDP and BoJ decision on top of next week’s agenda

US GDP, core PCE and PMIs the next tests for the Dollar. Investors await BoJ for guidance about next rate hike. EU and UK PMIs, as well as Australian CPIs also on tap.