EUR/GBP

The dollar traded mixed against its G10 peers during the European morning Friday. It was higher against JPY, while it was lower against AUD, GBP and NZD, in that order.

UK GDP rose 0.7% qoq in Q3, weaker than the +0.9% qoq expansion in Q2, according to today’s first estimate. The slowing in the pace of growth raise concerns that the recovery is losing steam and may push market expectations for the Bank of England tightening further back. Unless there is a strong compelling reason, the BoE is unlikely to raise rates ahead of the country’s general election in May. This suggests that further soft UK data could result in rate expectations getting pushed back even further, leaving GBP vulnerable. Nonetheless, GBP/USD strengthened at the release as the figure was in line with market expectations and there was some relief that the rate didn’t fall more. However, the pair’s rejection at around 1.6070 creates the possibility for a technical push lower in the near-term, especially if the psychological 1.6000 zone is broken.

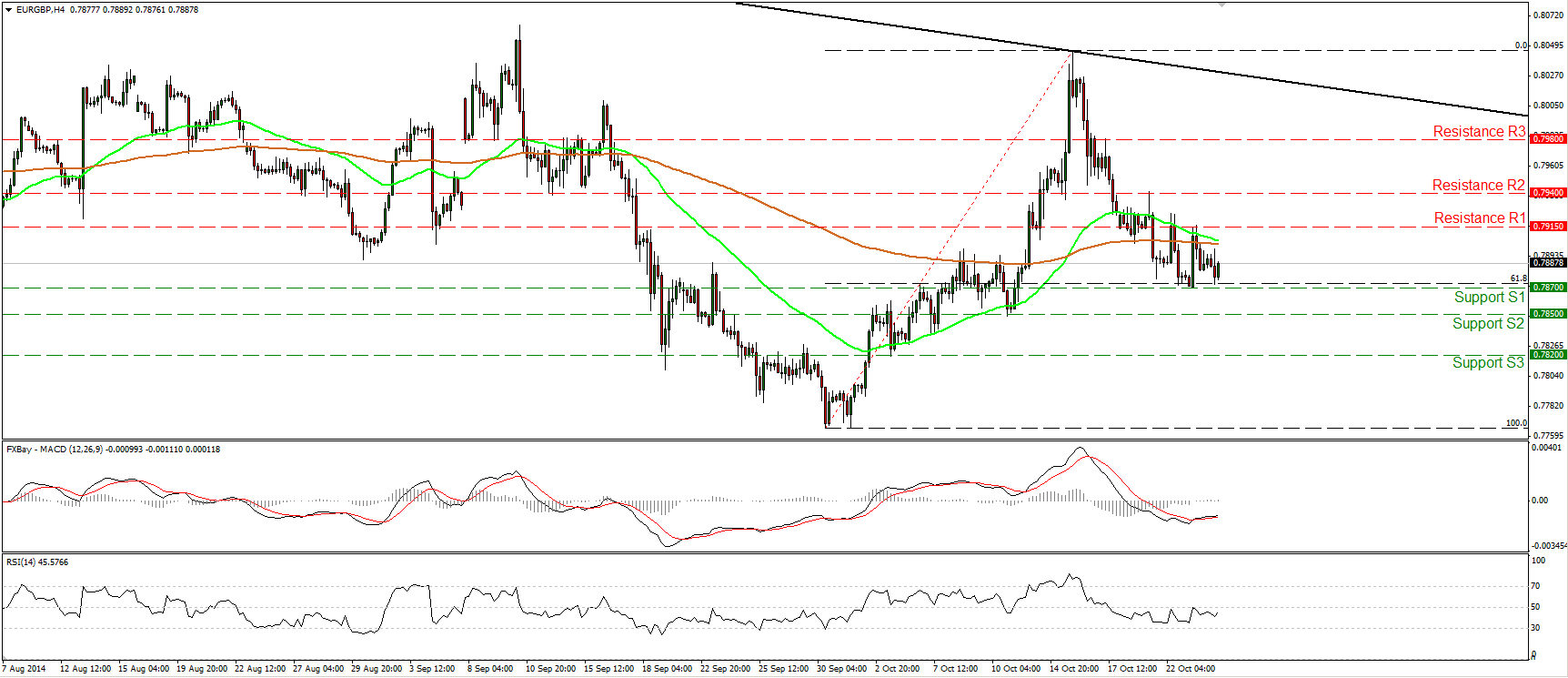

EUR/GBP moved lower during the European morning, but remained above the support line of 0.7870 (S1). In my view, as long as the resistance of 0.7915 (R1) holds, the short-term bias remains to the downside. However, our short-term oscillators point to weakening downside momentum. The MACD, although negative, lies above its trigger, while the RSI lies below 50 but is pointing up again. This together with the fact that the 0.7870 (S1) barrier happens to be pretty close to the 61.8% retracement level of the 30th September – 15th October up leg, give me reasons to wait for a dip below the 0.7870 (S1) zone before getting more confident about the downside. As for the broader trend, on the daily chart the pair is trading below the longer-term black downtrend line (taken from back at the high of the 1st of August), keeping the overall technical picture negative. Actually, on the 15th of October, the rate found resistance at that line before falling again sharply.

Support: 0.7870 (S1), 0.7850 (S2), 0.7820 (S3) .

Resistance: 0.7915 (R1), 0.7940 (R2), 0.7980 (R3) .

Recommended Content

Editors’ Picks

EUR/USD clings to daily gains above 1.0650

EUR/USD gained traction and turned positive on the day above 1.0650. The improvement seen in risk mood following the earlier flight to safety weighs on the US Dollar ahead of the weekend and helps the pair push higher.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD reversed its direction and advanced to the 1.2450 area after touching a fresh multi-month low below 1.2400 in the Asian session. The positive shift seen in risk mood on easing fears over a deepening Iran-Israel conflict supports the pair.

Gold holds steady at around $2,380 following earlier spike

Gold stabilized near $2,380 after spiking above $2,400 with the immediate reaction to reports of Israel striking Iran. Meanwhile, the pullback seen in the US Treasury bond yields helps XAU/USD hold its ground.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Week ahead – US GDP and BoJ decision on top of next week’s agenda

US GDP, core PCE and PMIs the next tests for the Dollar. Investors await BoJ for guidance about next rate hike. EU and UK PMIs, as well as Australian CPIs also on tap.