AUD/USD

The dollar traded higher against all of its G10 counterparts during the European morning Thursday.

The euro neared to low levels last seen in November 2012 against the dollar, as the ECB President Mario Draghi spoke at a conference hosted by the central bank of Lithuania less than 100 days until the country adopts the euro. However, the first move started after comments from President Draghi made to the Lithuanian business newspaper, showed that the ECB stands ready to use additional unconventional instruments within its mandate, and alter the size or composition of these unconventional interventions should it become necessary to further address risks of a too prolonged period of low inflation. EUR/USD dropped during the European morning but found some buy orders just below the 1.2700 line. The latest batch of data highlights the diverging economic outlook between Europe and the US, and supports our view that the single currency could weaken further perhaps towards the 1.2660 barrier.

The Australian dollar plunged to a new seven-month low as the currency came under renewed selling pressure, mainly driven by the Kiwi’s tumble. Even though the Reserve Bank of Australia Governor Glenn Stevens made no attempt to talk down the Aussie, his concerns about the nations overheating property market heightened the need for further steps to tighten bank lending standards and complement the Bank’s stance that the most prudent course is likely to be a period of stability in interest rates.

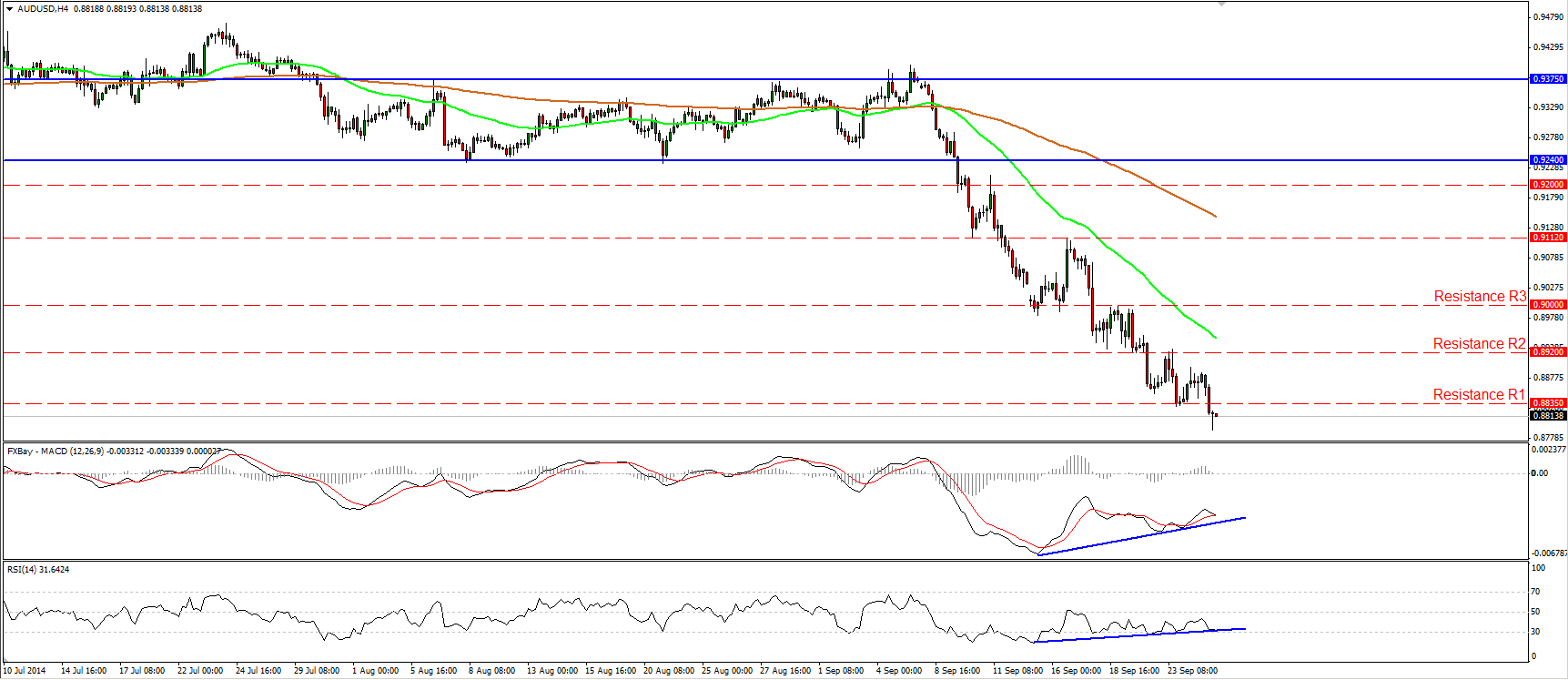

AUD/USD tumbled during the European morning Thursday, breaking below the support barrier (turned into resistance) of 0.8835. That move confirms a forthcoming lower trough and I would expect the bears to pull the trigger for extensions towards our next support area of 0.8730 (S1), defined by the low of the 4th of February. As long as the price structure remains lower lows and lower highs below both the 50- and the 200-period exponential moving averages, I see a negative overall picture. My only concern is that I still see positive divergence between the price action and both of our momentum indicators, something that designates decelerating downside momentum.

Support: 0.8730 (S1), 0.8660 (S2), 0.8600 (S3).

Resistance: 0.8835 (R1), 0.8920 (R2), 0.9000 (R3).

Recommended Content

Editors’ Picks

EUR/USD clings to daily gains above 1.0650

EUR/USD gained traction and turned positive on the day above 1.0650. The improvement seen in risk mood following the earlier flight to safety weighs on the US Dollar ahead of the weekend and helps the pair push higher.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD reversed its direction and advanced to the 1.2450 area after touching a fresh multi-month low below 1.2400 in the Asian session. The positive shift seen in risk mood on easing fears over a deepening Iran-Israel conflict supports the pair.

Gold holds steady at around $2,380 following earlier spike

Gold stabilized near $2,380 after spiking above $2,400 with the immediate reaction to reports of Israel striking Iran. Meanwhile, the pullback seen in the US Treasury bond yields helps XAU/USD hold its ground.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Week ahead – US GDP and BoJ decision on top of next week’s agenda

US GDP, core PCE and PMIs the next tests for the Dollar. Investors await BoJ for guidance about next rate hike. EU and UK PMIs, as well as Australian CPIs also on tap.