USD/CAD

Even though there was little news or events during the European morning Friday, currency market enjoyed some decent intraday movement. The dollar was higher against SEK, AUD, NZD, CAD and JPY, in that order, while it was lower only against NOK. The greenback was stable vs EUR, CHF and GBP.

German PPI for November fell at a slower pace than in the previous month, which was better than the forecast of an acceleration in deflation. Nonetheless it still shows that the risk of deflation in the Eurozone’s largest economy continues. EUR/USD reacted little to this event, staying well entrenched above our 1.2250 support level. A break of that support line is necessary to make me confident about further declines.

The Norwegian krone was the only gainer at midday in Europe after the country’s official unemployment rate for December came right on the 2.7% consensus. Although this was a marginal increase from the previous month, investors’ relief that the falling oil prices haven’t yet deteriorated Norway’s labor market pushed USD/NOK down to 7.3800 from the earlier 7.400 area. I would treat the current setback as a renewed buying opportunity given the unexpected rate cut recently and the prevailing oil prices, which could have a long-term negative impact on the country’s economy.

Canada’s CPI for November is due to be released later in the day and expectations are for the headline CPI to decelerate, while the core CPI accelerates. Although the BoC inflation target is specified in terms of the headline CPI, for policy purposes the Bank also monitors the “core” CPI. Both headline and core CPIs are within the Bank’s target range and therefore the country is one of the few that isn’t worried about deflation. I would therefore expect the rise in core inflation to be CAD-supportive. Retail sales for October are also due to be out.

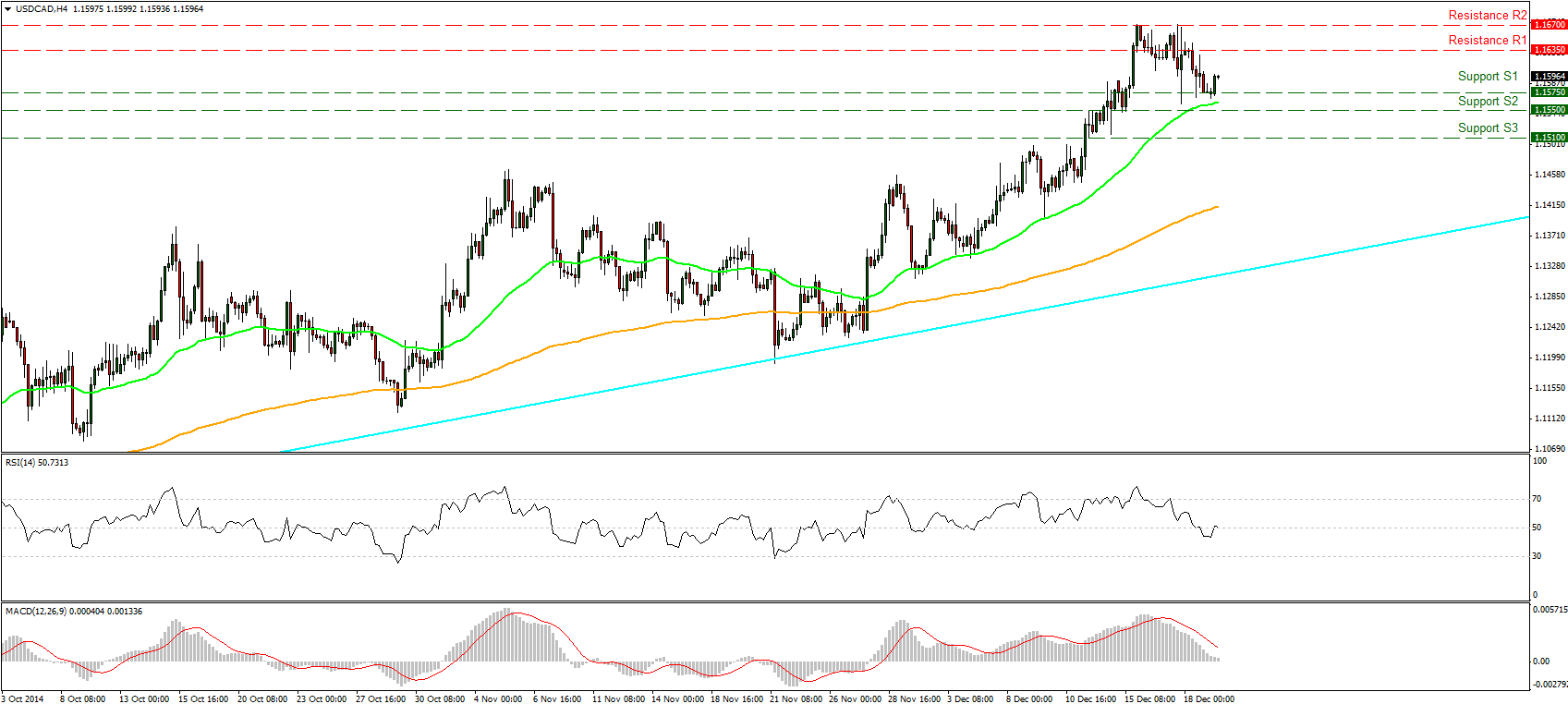

USD/CAD advanced somewhat during the European morning Friday after finding support near the 1.1575 (S1) support line. Bearing in mind our short-term momentum indicators, I would expect another test of that zone. The RSI stands just above its 50 line pointing down, while the MACD lies below its trigger line and seems willing to enter its negative territory. This momentum signals accelerating bearish momentum, thus amplifying the case for a decline, at least temporarily. The CPI release could be the trigger market expects to push the rate lower. However, on the daily chart, the dollar/loonie rate is still trading above both the 50- and the 200-day moving averages, and above the light blue uptrend line drawn from back at the low of the 11th of July. Hence, I still see a longer-term uptrend and I would expect any possible future setbacks to provide renewed buying opportunities..

Support: 1.1575 (S1), 1.1550 (S2), 1.1510 (S3)

Resistance: 1.1635 (R1), 1.1670 (R2), 1.1715 (R3)

Recommended Content

Editors’ Picks

EUR/USD clings to daily gains above 1.0650

EUR/USD gained traction and turned positive on the day above 1.0650. The improvement seen in risk mood following the earlier flight to safety weighs on the US Dollar ahead of the weekend and helps the pair push higher.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD reversed its direction and advanced to the 1.2450 area after touching a fresh multi-month low below 1.2400 in the Asian session. The positive shift seen in risk mood on easing fears over a deepening Iran-Israel conflict supports the pair.

Gold holds steady at around $2,380 following earlier spike

Gold stabilized near $2,380 after spiking above $2,400 with the immediate reaction to reports of Israel striking Iran. Meanwhile, the pullback seen in the US Treasury bond yields helps XAU/USD hold its ground.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Week ahead – US GDP and BoJ decision on top of next week’s agenda

US GDP, core PCE and PMIs the next tests for the Dollar. Investors await BoJ for guidance about next rate hike. EU and UK PMIs, as well as Australian CPIs also on tap.