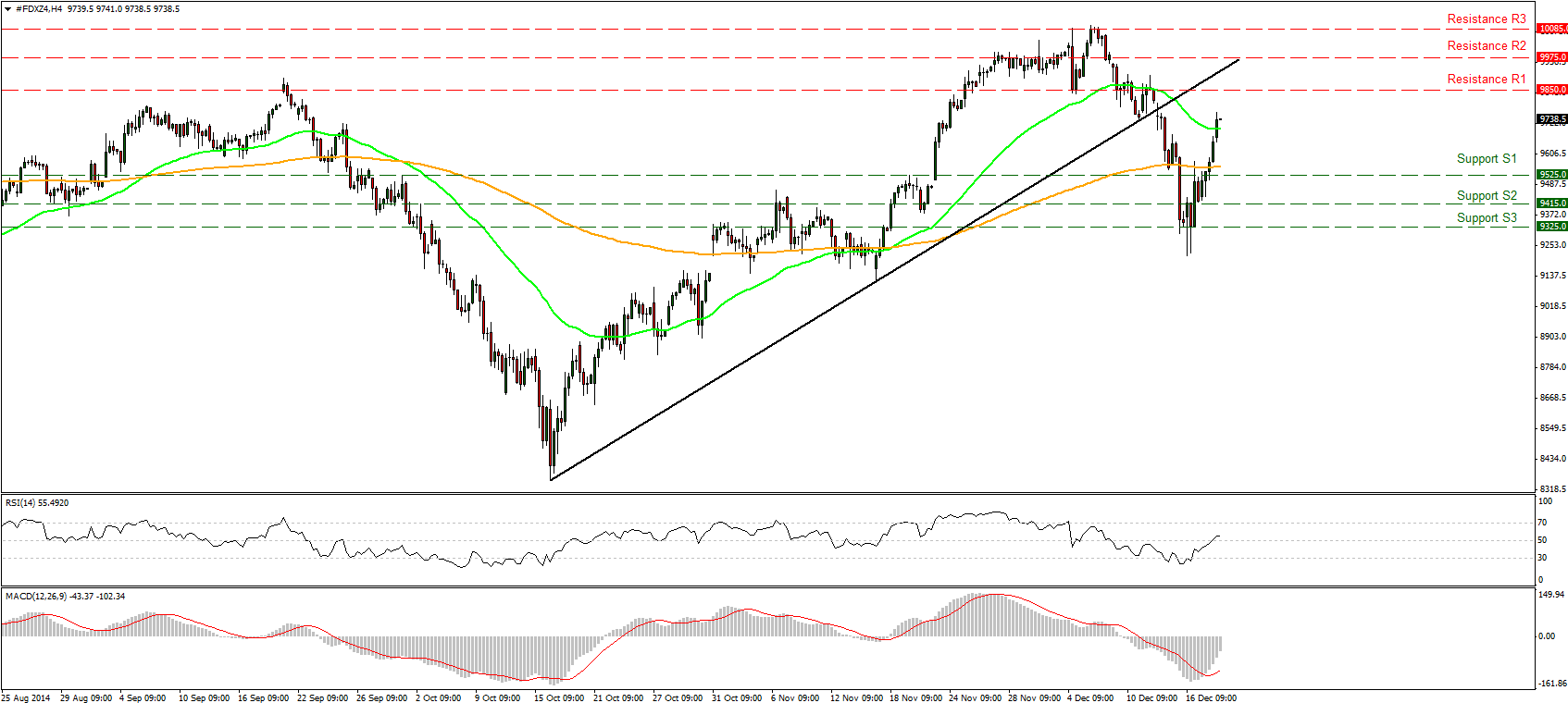

DAX futures

The dollar traded lower against most of its G10 counterparts during the European morning Thursday. It was higher against CHF and EUR, in that order, while it remained stable vs JPY.

The Swiss franc plunged after the country’s central bank imposed negative interest rates on sight deposit account balances. The aim of this move was to take the 3-month Libor into negative territory and to defend the currency’s floor against the EUR. USD/CHF surged approximately 1%, while EUR/CHF 0.70%.

The German Ifo Business climate index rose to 105.5 in December from 104.7 in November, in line with the forecast. The expectations index also rose, but the overall increase in the Ifo indices were disappointing compared with the unexpected surge in ZEW on Tuesday. The increase in the expectations index was of particular importance as it was the second increase after six successive months of declines. Since investments are driven mainly by expectations, this could suggest that German business investment picks up in Q4. Even though it is too early to talk about a turnaround in the Ifo indices, today’s rise can be seen as an optimistic sign added to the recent positive German data. Nevertheless, the SNB’s decision kept EUR under pressure and pushed EUR/USD briefly below 1.2300. The pair managed to recover some of the movement but it seems to me that there is still plenty room to the downside.

UK retail sales beat expectations and rose 1.7% mom in November from 1% mom previously. Consumers are exploiting the cheaper fuel prices as well as the holiday deals by spending more. The pace of the annual rate growth was the highest since May 2004 and this strengthened the GBP, which has almost recovered the losses following the FOMC meeting. GBP/USD at midday in Europe is heading towards our 1.5655 resistance line, where a break could push the rate higher to our next resistance hurdle of 1.5740.

DAX futures firmed up following the strong Ifo expectations index but still traded below the near-term uptrend line taken from back at the low of the 16th of October. I would expect for the move to continue at least until the 9850 (R1) resistance line. A clear move above that zone is likely to extend the bullish wave, perhaps until our next resistance of 9975 (R2). Our short-term momentum studies support this notion. The RSI crossed its 50 line is pointing up, while the MACD, already above its signal line seems willing to enter its positive territory.

Support: 9525 (S1), 9415 (S2), 9325 (S3)

Resistance: 9850 (R1), 9975 (R2), 10085 (R3)

Recommended Content

Editors’ Picks

AUD/USD failed just ahead of the 200-day SMA

Finally, AUD/USD managed to break above the 0.6500 barrier on Wednesday, extending the weekly recovery, although its advance faltered just ahead of the 0.6530 region, where the key 200-day SMA sits.

EUR/USD met some decent resistance above 1.0700

EUR/USD remained unable to gather extra upside traction and surpass the 1.0700 hurdle in a convincing fashion on Wednesday, instead giving away part of the weekly gains against the backdrop of a decent bounce in the Dollar.

Gold stays firm amid higher US yields as traders await US GDP data

Gold recovers from recent losses, buoyed by market interest despite a stronger US Dollar and higher US Treasury yields. De-escalation of Middle East tensions contributed to increased market stability, denting the appetite for Gold buying.

Ethereum suffers slight pullback, Hong Kong spot ETH ETFs to begin trading on April 30

Ethereum suffered a brief decline on Wednesday afternoon despite increased accumulation from whales. This follows Ethereum restaking protocol Renzo restaked ETH crashing from its 1:1 peg with ETH and increased activities surrounding spot Ethereum ETFs.

Dow Jones Industrial Average hesitates on Wednesday as markets wait for key US data

The DJIA stumbled on Wednesday, falling from recent highs near 38,550.00 as investors ease off of Tuesday’s risk appetite. The index recovered as US data continues to vex financial markets that remain overwhelmingly focused on rate cuts from the US Fed.