EURGBP

The dollar traded higher against almost all of its G10 counterparts during the European morning Wednesday. It was lower against NOK and AUD, in that order, while it was stable vs GBP.

The UK’s unemployment rate remained unchanged at 6.0% in October, its lowest level since September 2008. More importantly, average weekly earnings including bonuses rose 1.4% yoy, up from +1.0% yoy in September and higher than expected. The figure was the most important development as it was higher than inflation and therefore real wages are growing. At the same time, the Bank of England released the minutes of its early December policy meeting. The vote remained 7-2 in favor of no change in interest rates. The majority saw heightened risk that growth may soften more than expected or that inflation may stay below target for longer than expected. The latter risk has been intensified by the collapse in oil prices.

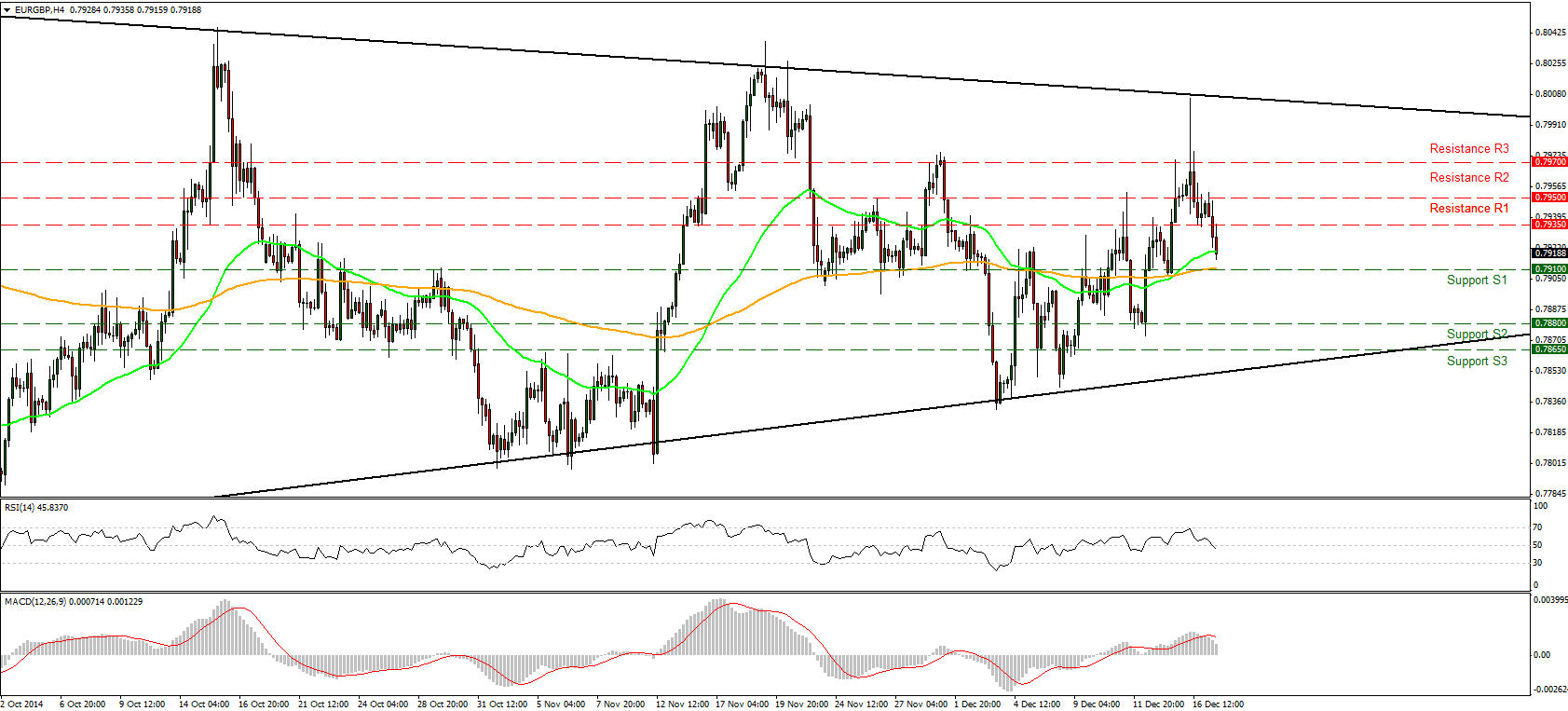

EUR/GBP moved lower following the strong labor data but the move was halted few pips above the 200-period moving average. I would expect the rate to test the 0.7910 (S1) support line, where a break of that hurdle could trigger further extensions towards our next support of 0.7880 (S2) line. Our short-term momentum studies support this notion. The RSI crossed the 50 line and is pointing down, while the MACD, crossed below its trigger line and is also pointing down. Although these signs designate accelerating bearish momentum, I would wait for a break below the 0.7910 (S1) support level to get more confident for the decline. On the daily chart, although the overall path of the pair is to the downside, it seems to be forming a symmetrical triangle formation reflecting investors’ indecisiveness in recent months. Usually, symmetrical triangles are thought of as a continuation pattern and a break in either direction is likely to determine the subsequent bias.

Support: 0.7910 (S1), 0.7880 (S2), 0.7865 (S3).

Resistance: 0.7935 (R1), 0.7950 (R2), 0.7970 (R3) .

Recommended Content

Editors’ Picks

EUR/USD holds gains above 1.0700, as key US data loom

EUR/USD holds gains above 1.0700 in the European session on Thursday. Renewed US Dollar weakness offsets the risk-off market environment, supporting the pair ahead of the key US GDP and PCE inflation data.

GBP/USD extends recovery above 1.2500, awaits US GDP data

GBP/USD is catching a fresh bid wave, rising above 1.2500 in European trading on Thursday. The US Dollar resumes its corrective downside, as traders resort to repositioning ahead of the high-impact US advance GDP data for the first quarter.

Gold price edges higher amid weaker USD and softer risk tone, focus remains on US GDP

Gold price (XAU/USD) attracts some dip-buying in the vicinity of the $2,300 mark on Thursday and for now, seems to have snapped a three-day losing streak, though the upside potential seems limited.

XRP extends its decline, crypto experts comment on Ripple stablecoin and benefits for XRP Ledger

Ripple extends decline to $0.52 on Thursday, wipes out weekly gains. Crypto expert asks Ripple CTO how the stablecoin will benefit the XRP Ledger and native token XRP.

US Q1 GDP Preview: Economic growth set to remain firm in, albeit easing from Q4

The United States Gross Domestic Product (GDP) is seen expanding at an annualized rate of 2.5% in Q1. The current resilience of the US economy bolsters the case for a soft landing.