DAX futures

The dollar traded unchanged or higher against its major G10 peers during the European morning Monday. It was higher against AUD, NZD, JPY, GBP and CAD, in that order, while it was lower against SEK, NOK, EUR and CHF.

The German Ifo Business climate index rose to 104.7 in November from 103.2 in October, exceeding estimates of a moderate decline to 103.0. The expectations index also rose, in line with the rise in the ZEW survey earlier this month. Even though it is too early to talk about a turnaround in the Ifo indices, today’s rise can be seen as an optimistic sign amid the recent disappointing German data. The increase in the expectations index was of particular importance as it was the first increase after six successive months of declines. Since investments are driven mainly by expectations, this could suggest that business investment can pick up again at the end of this year. The euro edged up to 1.2400 again where a move higher could test the 1.2440 resistance zone, while the German DAX surged approximately 0.30% to reach levels last seen in September 22.

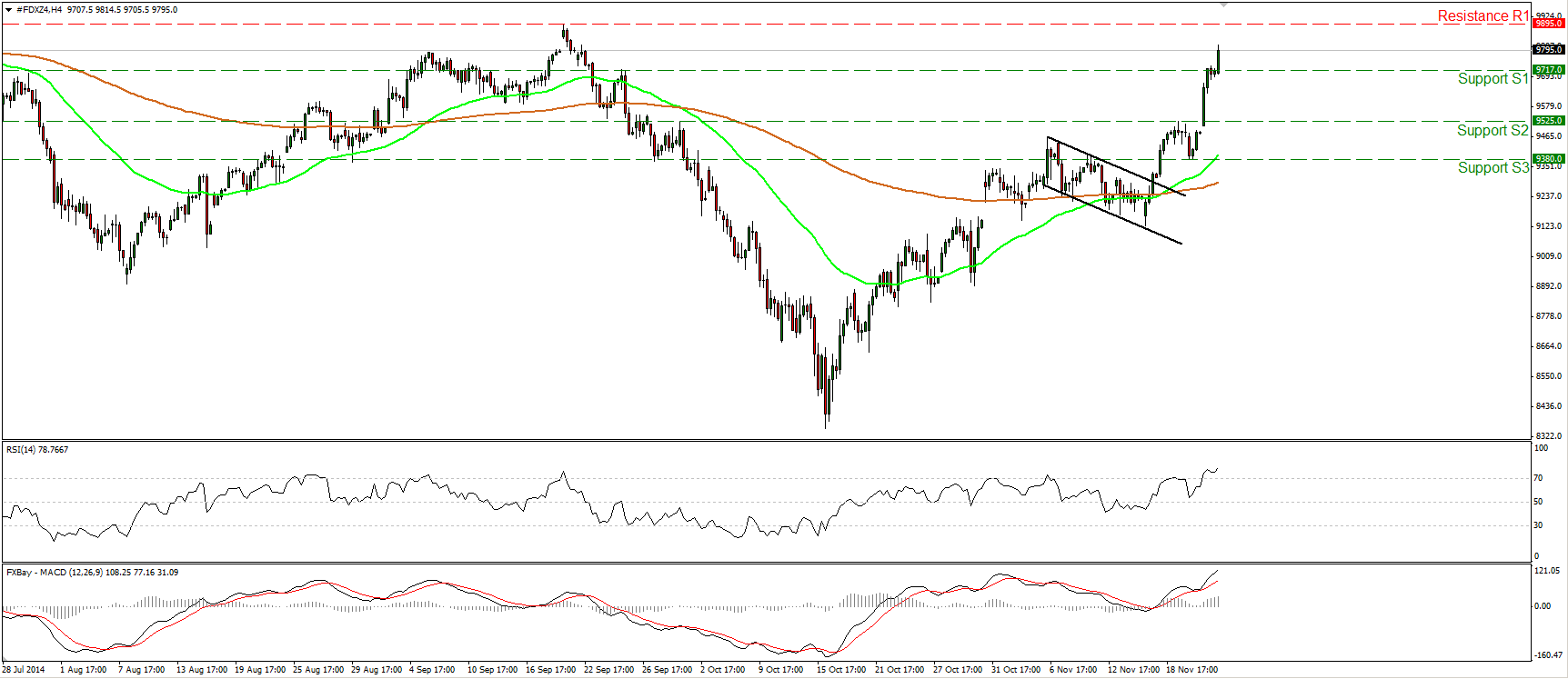

After exiting from a falling flag on the 17th of November, DAX futures surged and today, during the European morning, the price managed to move above the resistance (turned into support) line of 9717 (S1). As long as the price structure on the 4-hour chart remains higher highs and higher lows, I see a positive near-term picture and I would expect DAX to challenge our resistance hurdle of 9895 (R1), defined by the high of the 19th of September. If the bulls are strong enough to overcome that resistance zone, I would expect them to pull the trigger for the all-time highs, at 10055 (R2). Shifting my attention to our near-term momentum studies, I see that the RSI lies within its overbought territory and is pointing up, while the MACD stands above both its zero and signal lines. This designates accelerating bullish momentum in my view and magnifies the case for further advances in the close future.

Support: 9717 (S1), 9525 (S2), 9380 (S3) .

Resistance: 9895 (R1), 10055 (R2) ( All-time highs).

Recommended Content

Editors’ Picks

EUR/USD stays below 1.0700 after US data

EUR/USD stays in a consolidation phase below 1.0700 in the early American session on Wednesday. The data from the US showed a strong increase in Durable Goods Orders, supporting the USD and making it difficult for the pair to gain traction.

USD/JPY refreshes 34-year high, attacks 155.00 as intervention risks loom

USD/JPY is renewing a multi-decade high, closing in on 155.00. Traders turn cautious on heightened risks of Japan's FX intervention. Broad US Dollar rebound aids the upside in the major. US Durable Goods data are next on tap.

Gold trades on the back foot, manages to hold above $2,300

Gold struggles to stage a rebound midweek following Monday's sharp decline but manages to hold above $2,300. The benchmark 10-year US Treasury bond yield stays in the green above 4.6% after US data, not allowing the pair to reverse its direction.

Worldcoin looks set for comeback despite Nvidia’s 22% crash Premium

Worldcoin price is in a better position than last week's and shows signs of a potential comeback. This development occurs amid the sharp decline in the valuation of the popular GPU manufacturer Nvidia.

Three fundamentals for the week: US GDP, BoJ and the Fed's favorite inflation gauge stand out Premium

While it is hard to predict when geopolitical news erupts, the level of tension is lower – allowing for key data to have its say. This week's US figures are set to shape the Federal Reserve's decision next week – and the Bank of Japan may struggle to halt the Yen's deterioration.