Silver

The dollar traded mixed against its G10 peers during the European morning Thursday. It was higher against EUR, CHF and NOK, in that order, while it was lower against AUD and NZD. The greenback was stable vs CAD, JPY, GBP and SEK.

The euro was lower during the European morning ahead of the preliminary German CPI for October. All of the regional CPIs were unchanged or 0.2 ppt lower on a yoy basis, indicating that the national inflation rate is also likely to be unchanged or lower. In the meantime, even though the unemployment rate remained unchanged at 6.7% in October, the unemployment change declined 22k from +9k previously, showing that the labor market in Germany remains strong. Although the labor market shows signs of improvement, the softer inflation data on top of the poor data coming out, only reinforce my opinion that the euro has plenty of room to the downside. While the gyration of EUR/USD around 1.2600 may continue, the weaker economic data could push the rate to test the psychological barrier of 1.2500 in the near future.

Silver fell sharply after the surprisingly hawkish FOMC statement and added to its losses after China said to send investigators to probe a surge in precious metal exports. Silver dropped as much as 1.50%, to reach its lowest level since early October.

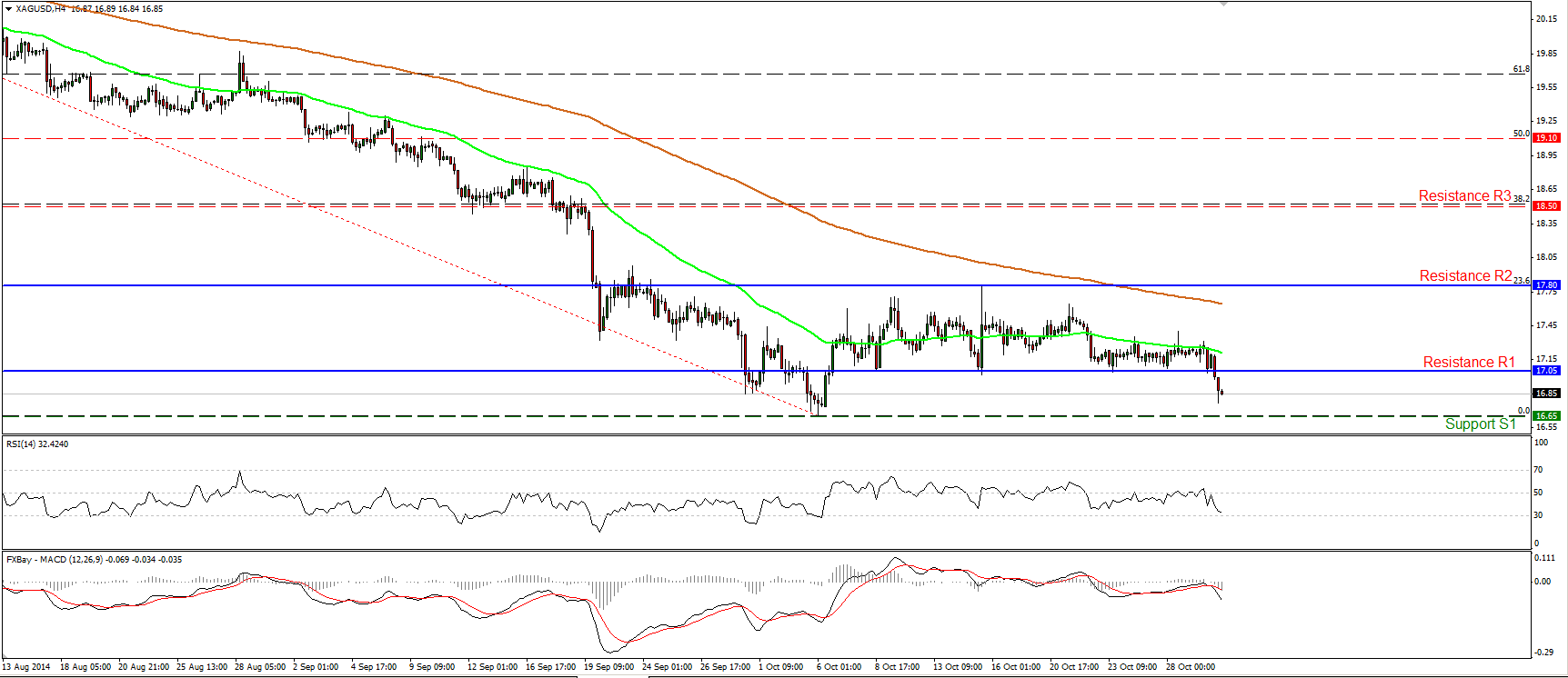

Silver continued tumbling during the European morning Thursday, breaking below 17.05, the lower boundary of the sideways path it’s been trading recently. I would now expect silver to challenge our support hurdle of 16.65 (S1), which is determined by the low of the 6th of October. In my view, the price has the necessary momentum to challenge that line, as the RSI moved lower after finding resistance at its 50 line, while the MACD, already negative, fell below its signal line. A break below the 16.65 (S1) barrier would confirm a forthcoming lower low on the daily chart and is likely to set the stage for further bearish extensions. Such a move could target the support line of 15.60 (S2), marked by the low of the 24th of February 2010. Our daily oscillators maintain a negative tone as well. The 14-day RSI is pointing down and could move again below 30 in the not-too-distant future, while the MACD, already below zero, appears willing to cross below its trigger line.

Support: 16.65 (S1), 15.60 (S2), 15.00 (S3).

Resistance: 17.05 (R1), 17.80 (R2), 18.50 (R3).

Recommended Content

Editors’ Picks

EUR/USD consolidates recovery below 1.0700 amid upbeat mood

EUR/USD is consolidating its recovery but remains below 1.0700 in early Europe on Thursday. The US Dollar holds its corrective decline amid a stabilizing market mood, despite looming Middle East geopolitical risks. Speeches from ECB and Fed officials remain on tap.

GBP/USD advances toward 1.2500 on weaker US Dollar

GBP/USD is extending recovery gains toward 1.2500 in the European morning on Thursday. The pair stays supported by a sustained US Dollar weakness alongside the US Treasury bond yields. Risk appetite also underpins the higher-yielding currency pair. ahead of mid-tier US data and Fedspeak.

Gold appears a ‘buy-the-dips’ trade on simmering Israel-Iran tensions

Gold price attempts another run to reclaim $2,400 amid looming geopolitical risks. US Dollar pulls back with Treasury yields despite hawkish Fedspeak, as risk appetite returns.

Manta Network price braces for volatility as $44 million worth of MANTA is due to flood markets

Manta Network price is defending support at $1.80 as multiple technical indicators flash bearish. 21.67 million MANTA tokens worth $44 million are due to flood markets in a cliff unlock on Thursday.

Have we seen the extent of the Fed rate repricing?

Markets have been mostly consolidating recent moves into Thursday. We’ve seen some profit taking on Dollar longs and renewed demand for US equities into the dip. Whether or not this holds up is a completely different story.