USD/CAD

The dollar traded unchanged or higher against almost all of its G10 peers during the European morning Friday as the FX market got back to normal following the Scottish referendum. It was higher vs its early European levels against GBP, SEK, EUR, CHF and NOK, in that order, while it remained stable vs CAD, NZD and AUD. The greenback was lower only against JPY.

The Canadian dollar remained resilient during the European morning despite the broad rebound from the USD. A reason for this could be the recent robust Canadian data as well as Tuesday’s comments from Bank of Canada Governor Stephen Poloz that they are cautiously optimistic about the future for exports. During his speech the Governor also acknowledged signs of early recovery and strong data to be released later Friday could confirm the Bank’s view. However, a soft reading would likely to put CAD under selling pressure and USD/CAD to follow the broad USD-strength sentiment.

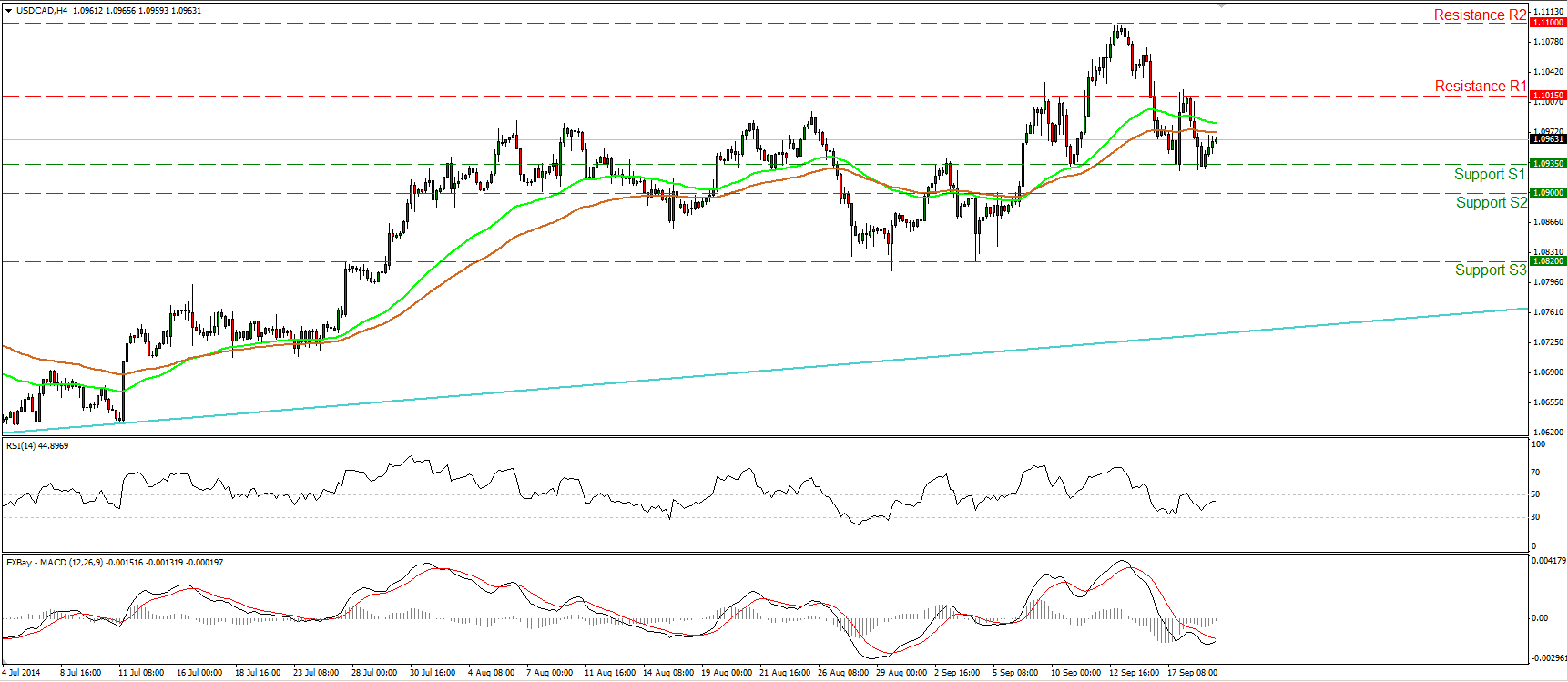

USD/CAD moved slightly higher on Friday after finding once again support near the 1.0935 (S1) barrier. Today we get Canada’s CPI data for August. Although the headline rate is forecast to have remained unchanged, the core CPI is expected to have accelerated, something that could trigger a leg down in USD/CAD. A clear move below 1.0935 (S1) is likely to challenge our support line at 1.0900 (S2). Taking a look on the daily chart, the pair declined after forming a bearish harami candlestick pattern, while I see negative divergence between both our daily momentum studies and the price action. These signs amplify the case for further declines in the near-term. However, on the longer-term timeframes, I still see a major uptrend marked by the light blue trend line, connecting the lows on the weekly chart from back the beginning of September 2012. As a result, I would consider the recent declines or any future ones as a corrective phase of the larger trend. I believe that any future setbacks are likely to provide renewed buying opportunities.

Support: 1.0935 (S1), 1.0900 (S2), 1.0820 (S3).

Resistance: 1.1015 (R1), 1.1100 (R2), 1.1200 (R3).

Recommended Content

Editors’ Picks

EUR/USD clings to daily gains above 1.0650

EUR/USD gained traction and turned positive on the day above 1.0650. The improvement seen in risk mood following the earlier flight to safety weighs on the US Dollar ahead of the weekend and helps the pair push higher.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD reversed its direction and advanced to the 1.2450 area after touching a fresh multi-month low below 1.2400 in the Asian session. The positive shift seen in risk mood on easing fears over a deepening Iran-Israel conflict supports the pair.

Gold holds steady at around $2,380 following earlier spike

Gold stabilized near $2,380 after spiking above $2,400 with the immediate reaction to reports of Israel striking Iran. Meanwhile, the pullback seen in the US Treasury bond yields helps XAU/USD hold its ground.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Week ahead – US GDP and BoJ decision on top of next week’s agenda

US GDP, core PCE and PMIs the next tests for the Dollar. Investors await BoJ for guidance about next rate hike. EU and UK PMIs, as well as Australian CPIs also on tap.