USD/CAD

The dollar traded mixed against its G10 counterparts during the European morning Wednesday. It was higher against CHF and SEK, in that order, while it was lower against CAD and GBP. The greenback remained unchanged vs JPY, NZD, EUR, AUD and NOK.

The minutes of the Swedish Riksbank September meeting revealed that a number of policy members emphasized that easier policy remains an option. Karolina Ekholm, one of six executive board members, said that as inflation remains low there are still reasons for attaching a higher probability to repo-rate cut than a repo-rate increase in the near term. The current rate path indicates a first increase towards the end of 2015. The Swedish krona strengthened slightly at the release but gave back all the gains and retreated even more in the following minutes. The dovish tone of the statement supports our view that SEK could weaken further in the near future.

The British pound weakened even though the minutes of the Bank of England latest policy meeting showed that the same two members voted for a second month for a 25bps rate increase despite the Scottish referendum. At the same time, the unemployment rate fell to 6.2% in July and although average weekly earnings accelerated, the real wages are still falling. But perhaps more important was that the several polls on Scottish independence released this morning showed a small lead for the “no” camp, albeit one generally within the margin of error. The bet makers are even more confident: “no” is now a 2-9 favorite, while a “yes” vote is 19-5. Net net, sterling kept above its early morning levels.

The Canadian dollar rallied after Bank of Canada Governor Stephen Poloz Tuesday said that they are cautiously optimistic about the future for exports and acknowledged early signs of recovery. He also repeated that the central bank does not try to manipulate the value of the Canadian currency. However, as the US economy appears to be back on track and the FOMC members are expected to revise their forecasts later in the day and discuss about the timing of the rate hike, USD/CAD could move up if the news proves USD-supportive.

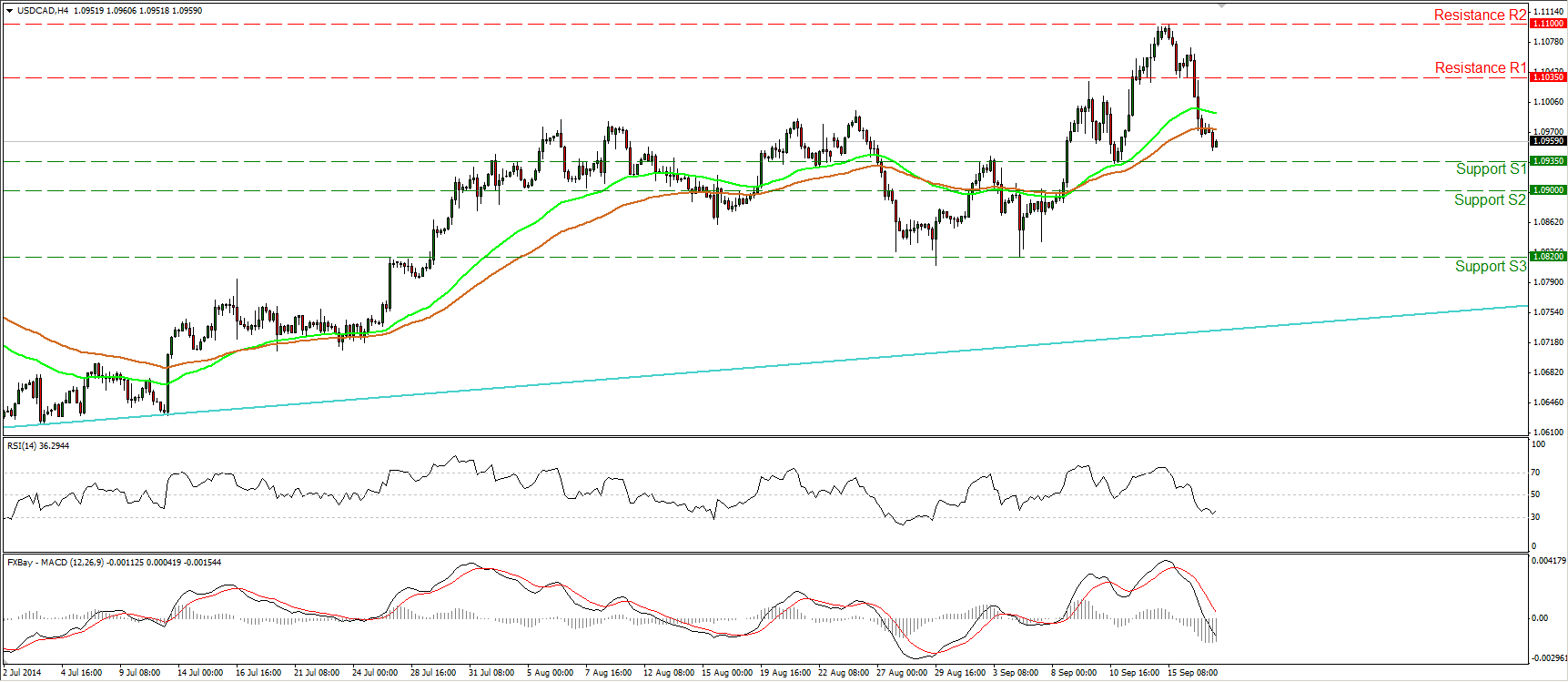

USD/CAD is now back below 1.1000, slightly above the support of 1.0935 (S1) determined by the low of the 11th of September. A further dip below that barrier is likely to challenge our next support line at 1.0900 (S2). On the daily chart I see a bearish harami candlestick pattern that favors the continuation of the down wave. However on the longer-term timeframes, I still see a major uptrend, marked by the light blue trend line, connecting the lows on the weekly chart from back the beginning of September 2012. As a result I would consider the recent declines as corrective move of the larger trend and I believe that any future setbacks are likely to provide renewed buying opportunities. Indeed, the fundamentals also support the notion, since the Fed has already started considering its first rate hike while the BoC remains neutral and seems to be waiting for more evidence to confirm that the recovery is sustainable.

Support: 1.0935 (S1), 1.0900 (S2), 1.0820 (S3).

Resistance: 1.1035 (R1), 1.1100 (R2), 1.1200 (R3).

Recommended Content

Editors’ Picks

EUR/USD clings to daily gains above 1.0650

EUR/USD gained traction and turned positive on the day above 1.0650. The improvement seen in risk mood following the earlier flight to safety weighs on the US Dollar ahead of the weekend and helps the pair push higher.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD reversed its direction and advanced to the 1.2450 area after touching a fresh multi-month low below 1.2400 in the Asian session. The positive shift seen in risk mood on easing fears over a deepening Iran-Israel conflict supports the pair.

Gold holds steady at around $2,380 following earlier spike

Gold stabilized near $2,380 after spiking above $2,400 with the immediate reaction to reports of Israel striking Iran. Meanwhile, the pullback seen in the US Treasury bond yields helps XAU/USD hold its ground.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Week ahead – US GDP and BoJ decision on top of next week’s agenda

US GDP, core PCE and PMIs the next tests for the Dollar. Investors await BoJ for guidance about next rate hike. EU and UK PMIs, as well as Australian CPIs also on tap.