BP Plc

The dollar traded unchanged against most of its G10 peers during the European morning Tuesday.

The New Zealand dollar was the only G10 currency to lose against the dollar, after the country’s biggest dairy exporter reduced its forecast milk price for the 2014/15 season. The drop in price from last season will reduce the collective income of New Zealand dairy farmers by around 1.9% of GDP. Kiwi dropped approximately 0.40% against dollar after the announcement to trade at midday in Europe at levels last seen 10th of June. NZD/USD hit 0.8555 and moved lower. I would expect the decline to test the support barrier of 0.8478 in the near future, marked by the lows of the 9th of June.

BP Plc announced its financial results for Q2 2014. Profits were approximately 34% higher than the same period last year and up 13% from Q1 2014. The company warned however that "if further international sanctions are imposed on Rosneft or new sanctions are imposed on Russia, this could have a material adverse impact on our financial position and results of operations". BP is one of the largest foreign investors in Russia through its 19.75% stake in Russian state oil company Rosneft, one of the entities that is the target of sanctions.

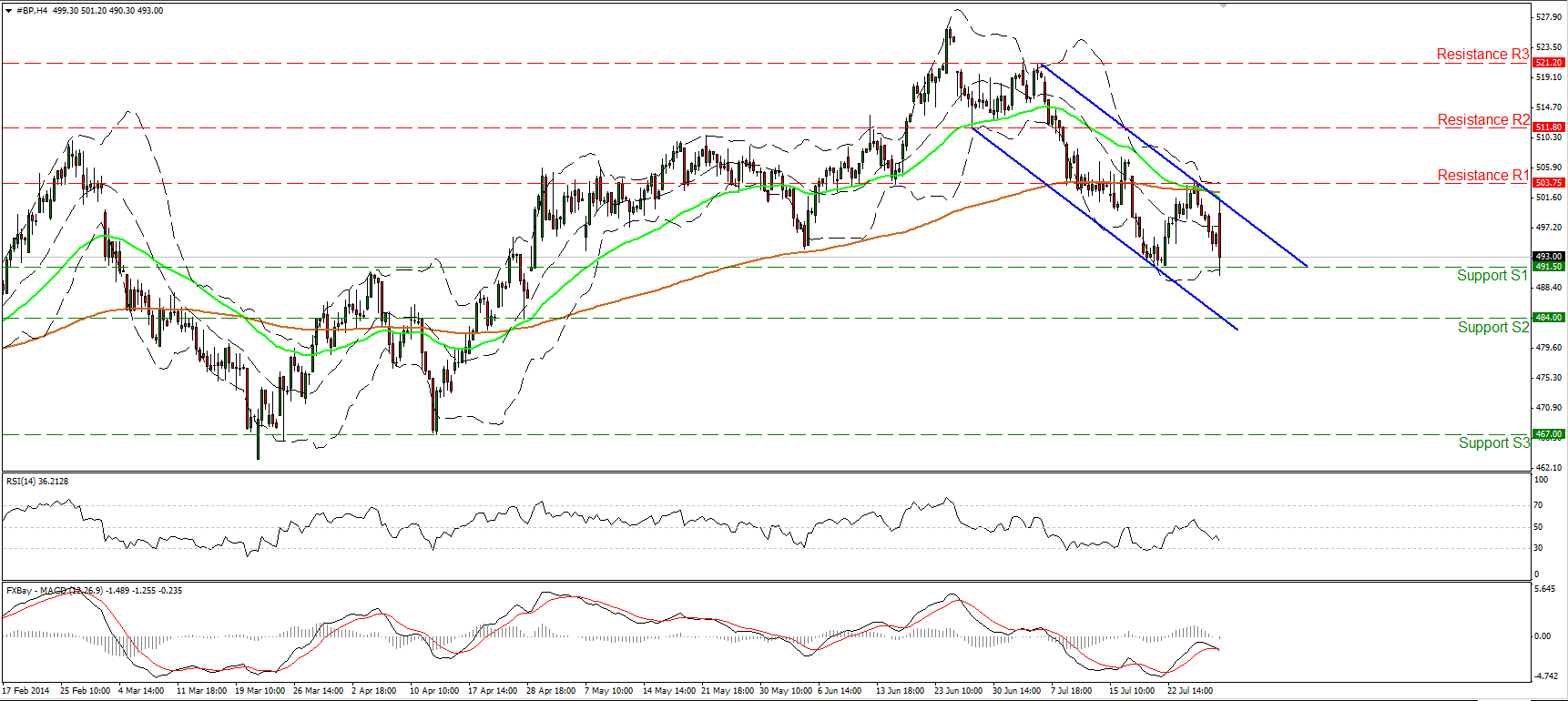

BP shares were down about 0.9% at midday. The decline was halted near the previous low at 491.50 (S1) and the price rebounded somewhat. From a technical point of view, the price has the necessary momentum to move below that barrier, since the RSI lies below 50 and has further to go before signaling oversold conditions, while the MACD, already negative, edged below its signal line. A clear move below 491.50 (S1) could trigger further extensions to target the next support at 484.00 (S2), first. As long as the price is printing lower peaks and lower troughs within the blue downside channel, I consider the near-term path to be to the downside. Moreover, the 50-period moving average fell below the 200-period one, adding to the negative picture of the stock. In the bigger picture, a weekly close below 491.50 (S1) could signal the completion of a possible head and shoulders formation on the daily chart and could reverse the overall longer-term uptrend. The daily MACD remains below both its trigger and zero lines, while the 14-RSI hit its 50 line and moved lower, corroborating my negative stance.

Support: 491.50 (S1), 484.00 (S2), 467.00 (S3).

Resistance: 503.75 (R1), 511.80 (R2), 521.20 (R3).

Recommended Content

Editors’ Picks

EUR/USD clings to daily gains above 1.0650

EUR/USD gained traction and turned positive on the day above 1.0650. The improvement seen in risk mood following the earlier flight to safety weighs on the US Dollar ahead of the weekend and helps the pair push higher.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD reversed its direction and advanced to the 1.2450 area after touching a fresh multi-month low below 1.2400 in the Asian session. The positive shift seen in risk mood on easing fears over a deepening Iran-Israel conflict supports the pair.

Gold holds steady at around $2,380 following earlier spike

Gold stabilized near $2,380 after spiking above $2,400 with the immediate reaction to reports of Israel striking Iran. Meanwhile, the pullback seen in the US Treasury bond yields helps XAU/USD hold its ground.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Week ahead – US GDP and BoJ decision on top of next week’s agenda

US GDP, core PCE and PMIs the next tests for the Dollar. Investors await BoJ for guidance about next rate hike. EU and UK PMIs, as well as Australian CPIs also on tap.