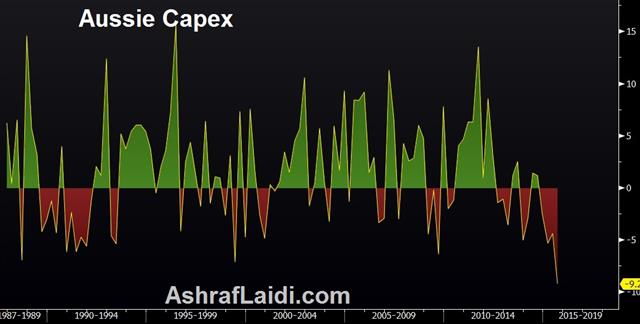

The major story on Wednesday was a leak from the ECB but with just 8 days to go, it's concerning how little has been decided. The kiwi was the top performer while the Swiss franc lagged. Aussie is falling across the board following worse than expected decline in Q3 and plannned 2015-2016 capex.

Click To Enlarge

ECB sources spoke to Reuters and it was revealing how many soft ideas they touched on. A two-tier deposit rate depending on how much is parked at the ECB, municipal/regional bond buying and buying bank loans were floated in a story that sent the euro more than 120 pips lower to a fresh seven-month low.

The market may have gotten the initial reaction wrong. In a week the ECB needs to make a decision and implement a plan. There might not be enough time to sort through these ideas. If there are complications, the ECB may be comforted by the euro at 1.06 and decide to only unveil part of the plan while hinting at more in January when more work is done. That could create a quick EUR/USD short squeeze to 1.10.

The US headed away for a long weekend on Wednesday and that leaves flows to dominate ahead of month end and the major announcements next week. Crowded USD longs were closed out in the final hour of European trading creating a minor reversal.

US economic data included new home sales (soft), U Mich final sentiment (soft), jobless claims (soft), Markit services (strong), PCE inflation (soft), consumption (soft) and durable goods orders (strong). The US dollar showed no strong reaction to any of the numbers.

The Australian dollar is falling across the board after Q3 capex tumbled 9.2% --the biggest fall since 1989--vs an expected decline of 2.9%--from -4.4% in Q2. Planned capex for 2015-16 came at A$120.4 bn, matching consensus of A$120 bn.

AUD has been resilient in the past day despite a soft construction report. That data puts a downside skew into today's number because it samples from the same industries.

Trading foreign exchange on margin carries a high level of risk and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to trade foreign exchange you should carefully consider your investment objectives, level of experience and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

AUD/USD posts gain, yet dive below 0.6500 amid Aussie CPI, ahead of US GDP

The Aussie Dollar finished Wednesday’s session with decent gains of 0.15% against the US Dollar, yet it retreated from weekly highs of 0.6529, which it hit after a hotter-than-expected inflation report. As the Asian session begins, the AUD/USD trades around 0.6495.

USD/JPY finds its highest bids since 1990, approaches 156.00

USD/JPY broke into its highest chart territory since June of 1990 on Wednesday, peaking near 155.40 for the first time in 34 years as the Japanese Yen continues to tumble across the broad FX market.

Gold stays firm amid higher US yields as traders await US GDP data

Gold recovers from recent losses, buoyed by market interest despite a stronger US Dollar and higher US Treasury yields. De-escalation of Middle East tensions contributed to increased market stability, denting the appetite for Gold buying.

Ethereum suffers slight pullback, Hong Kong spot ETH ETFs to begin trading on April 30

Ethereum suffered a brief decline on Wednesday afternoon despite increased accumulation from whales. This follows Ethereum restaking protocol Renzo restaked ETH crashing from its 1:1 peg with ETH and increased activities surrounding spot Ethereum ETFs.

Dow Jones Industrial Average hesitates on Wednesday as markets wait for key US data

The DJIA stumbled on Wednesday, falling from recent highs near 38,550.00 as investors ease off of Tuesday’s risk appetite. The index recovered as US data continues to vex financial markets that remain overwhelmingly focused on rate cuts from the US Fed.