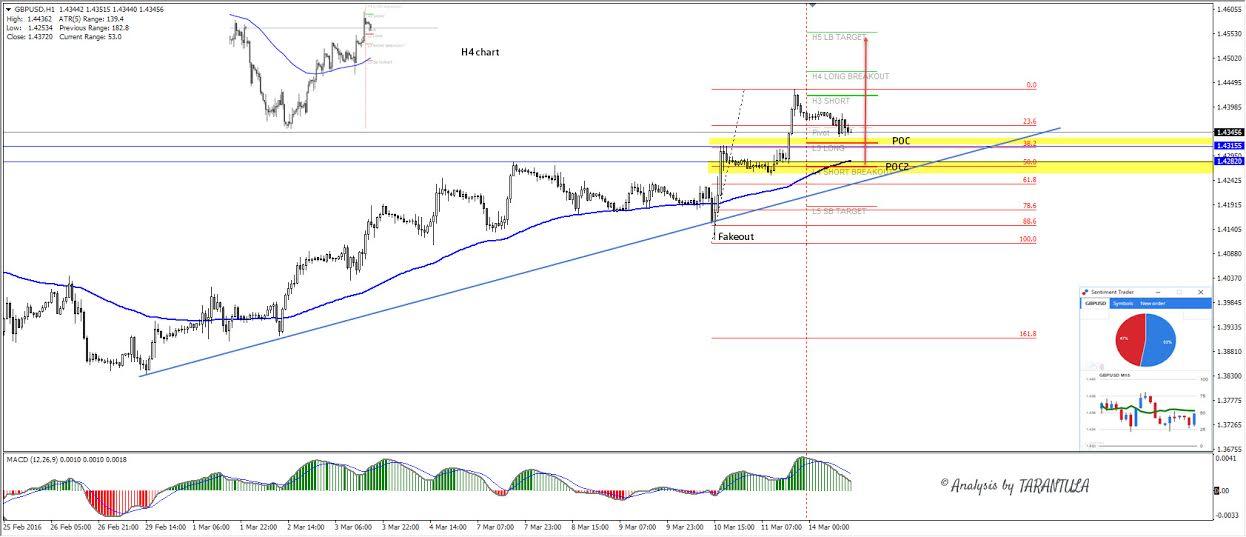

GBPUSD ascending scallop on H4 time frame suggests further bullish continuation. If we drill down to H1 time frame we will see a solid uptrend where GBPUSD has been bought on pullbacks. The first POC (L3, 38.2, triple top breakout) comes within 1.4315-25 zone and the pair could reject towards 1.4440. A 4h close above 1.4420 (H3 cam PP) would signal a continuation towards 1.4550. POC2 (EMA89, L4, 50.0, trend line) comes within 1.4260-80 zone and the deeper pullback below 1.4310 could target POC2. If POC2 zone is reached GBPUSD will still be bullish targeting 1.4420-40 and above ant only the real close below a Fakeout candle at 1.4115 would initiate sellers for another break below 1.4000.

However 1.4550 is the interim resistance and should the pair reach it we could see now momentum sellers and the price could reject from it.

The analysis and the article presents Nenad's opinion. Remember, financial trading is highly speculative & may lead to the loss of your funds. Proper risk management is the Holy Grail of trading.

Recommended Content

Editors’ Picks

EUR/USD clings to gains near 1.0700, awaits key US data

EUR/USD clings to gains near the 1.0700 level in early Europe on Thursday. Renewed US Dollar weakness offsets the risk-off market environment, supporting the pair ahead of the key US GDP and PCE inflation data.

USD/JPY keeps pushing higher, eyes 156.00 ahead of US GDP data

USD/JPY keeps breaking into its highest chart territory since June of 1990 early Thursday, recapturing 155.50 for the first time in 34 years as the Japanese Yen remains vulnerable, despite looming intervention risks. The focus shifts to Thursday's US GDP report and the BoJ decision on Friday.

Gold price lacks firm intraday direction, holds steady above $2,300 ahead of US data

Gold price remains confined in a narrow band for the second straight day on Thursday. Reduced Fed rate cut bets and a positive risk tone cap the upside for the commodity. Traders now await key US macro data before positioning for the near-term trajectory.

Injective price weakness persists despite over 5.9 million INJ tokens burned

Injective price is trading with a bearish bias, stuck in the lower section of the market range. The bearish outlook abounds despite the network's deflationary efforts to pump the price. Coupled with broader market gloom, INJ token’s doomed days may not be over yet.

Meta takes a guidance slide amidst the battle between yields and earnings

Meta's disappointing outlook cast doubt on whether the market's enthusiasm for artificial intelligence. Investors now brace for significant macroeconomic challenges ahead, particularly with the release of first-quarter gross domestic product (GDP) data on Thursday.