Today, there will be an important ECB meeting where ECB should announce a minimum bid rate which is expected to remain on hold. But as always, ECB conference is very important as investors are actually waiting for any additional cues from mr.Draghi about further economic measures. China slowdown, Oil price, Stock markets, among other things have influenced a strong risk aversion and after the initial drop the EURUSD has been ranging for 6 weeks. The ECB bid rate announcement is scheduled for 12:45 GMT and conference will start 45 minutes later.

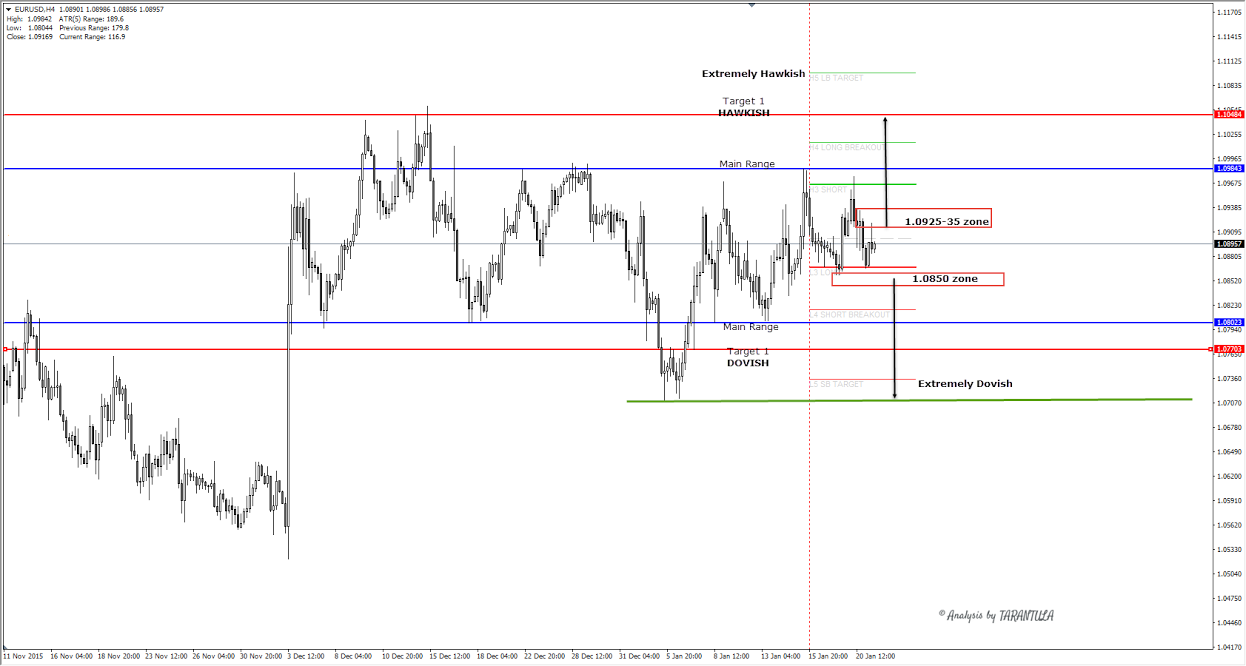

The range can be easily spotted on H4 chart. The main range is 1.0984-1.0802. Now depending how investors interpret mr.Draghi speech we might see either a break of 1.0984 or 1.0802- the main range. A hawkish stance could propel the pair within 1.0925-35 zone and above it we should see 1.0984 and 1.1050. Extremely HAWKISH stance might even target 1.1100.

Dovish stance should tank the pair towards 1.0850 zone and below 1.0850 we should see 1.0802 with 1.0770 if it breaks. Extremely dovish stance could pull the pair down to 1.0700 zone.

We need to pay attention to these levels as today's ECB conference would probably mark a new trend.

-------Who were the best experts in 2015? Have your say and vote for FXStreet's Forex Best Awards 2016! Cast your vote now!

-------

The analysis and the article presents Nenad's opinion. Remember, financial trading is highly speculative & may lead to the loss of your funds. Proper risk management is the Holy Grail of trading.

Recommended Content

Editors’ Picks

EUR/USD clings to daily gains above 1.0650

EUR/USD gained traction and turned positive on the day above 1.0650. The improvement seen in risk mood following the earlier flight to safety weighs on the US Dollar ahead of the weekend and helps the pair push higher.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD reversed its direction and advanced to the 1.2450 area after touching a fresh multi-month low below 1.2400 in the Asian session. The positive shift seen in risk mood on easing fears over a deepening Iran-Israel conflict supports the pair.

Gold holds steady at around $2,380 following earlier spike

Gold stabilized near $2,380 after spiking above $2,400 with the immediate reaction to reports of Israel striking Iran. Meanwhile, the pullback seen in the US Treasury bond yields helps XAU/USD hold its ground.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Week ahead – US GDP and BoJ decision on top of next week’s agenda

US GDP, core PCE and PMIs the next tests for the Dollar. Investors await BoJ for guidance about next rate hike. EU and UK PMIs, as well as Australian CPIs also on tap.