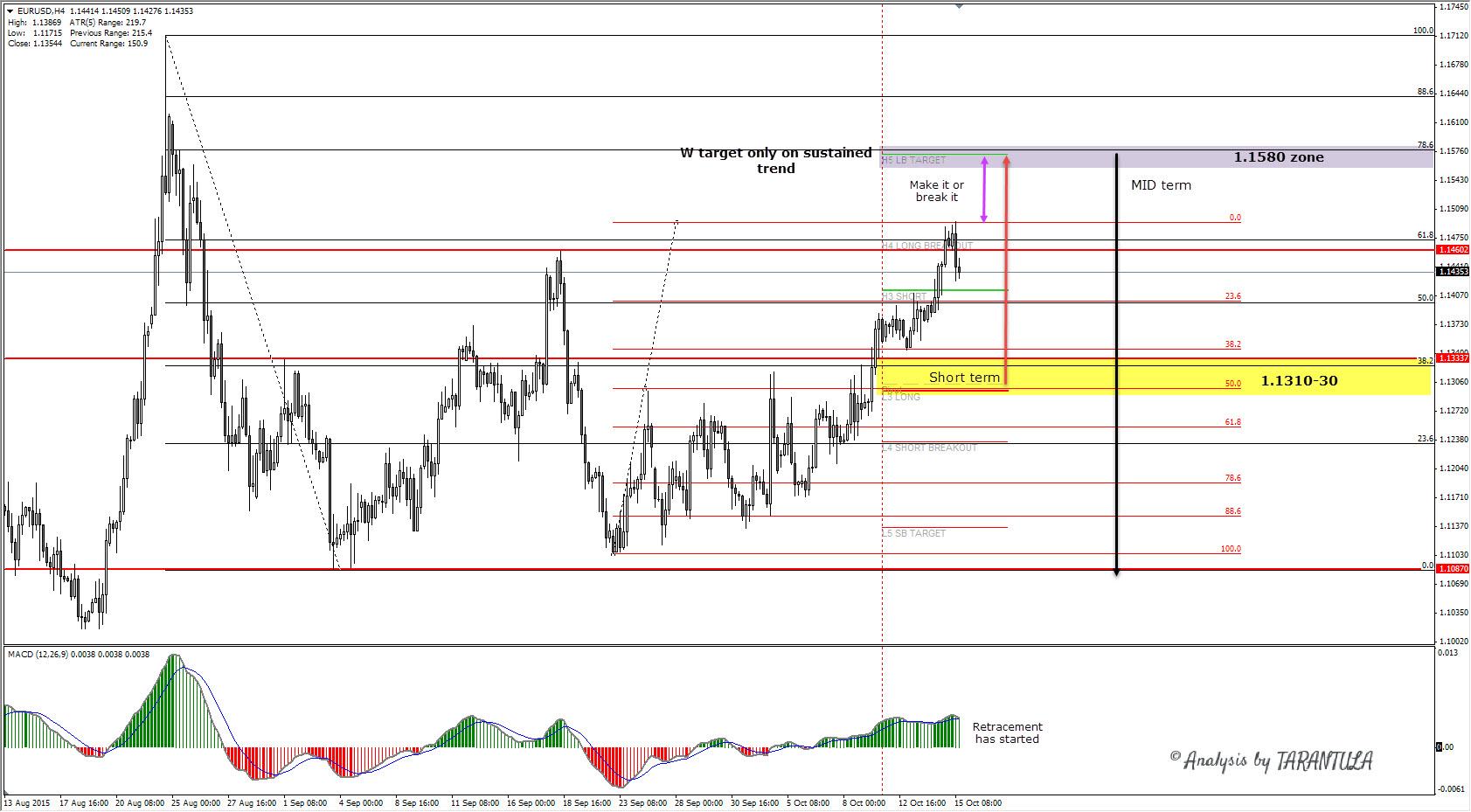

Technically speaking EURUSD has made a W pattern and we can see clearly 1.1460 resistance, as i stated a lot of times- 1.1460 IS important resistance. Mid term if W target is achieved EURUSD could reach 1.1580 then if 1.1640 holds we should see a drop towards 1.0900-1.0800 as I explained in my Fxstreet interview. A failure to complete W pattern might result in short term selling towards 1.1310-30 confluence zone ( WPP, L3, 50.0, previous breakout-retest point ) where EURUSD could be bought towards 1.1460 and 1.1580 if 1.1230 stands strong.

I have marked bot MID term and SHORT term views with different colors ( Red arrow/fib for short term, black arrow/fib for mid-term ).

The analysis and the article presents Nenad's opinion. Remember, financial trading is highly speculative & may lead to the loss of your funds. Proper risk management is the Holy Grail of trading.

Recommended Content

Editors’ Picks

EUR/USD regains traction, recovers above 1.0700

EUR/USD regained its traction and turned positive on the day above 1.0700 in the American session. The US Dollar struggles to preserve its strength after the data from the US showed that the economy grew at a softer pace than expected in Q1.

GBP/USD returns to 1.2500 area in volatile session

GBP/USD reversed its direction and recovered to 1.2500 after falling to the 1.2450 area earlier in the day. Although markets remain risk-averse, the US Dollar struggles to find demand following the disappointing GDP data.

Gold holds around $2,330 after dismal US data

Gold fell below $2,320 in the early American session as US yields shot higher after the data showed a significant increase in the US GDP price deflator in Q1. With safe-haven flows dominating the markets, however, XAU/USD reversed its direction and rose above $2,340.

XRP extends its decline, crypto experts comment on Ripple stablecoin and benefits for XRP Ledger

Ripple extends decline to $0.52 on Thursday, wipes out weekly gains. Crypto expert asks Ripple CTO how the stablecoin will benefit the XRP Ledger and native token XRP.

After the US close, it’s the Tokyo CPI

After the US close, it’s the Tokyo CPI, a reliable indicator of the national number and then the BoJ policy announcement. Tokyo CPI ex food and energy in Japan was a rise to 2.90% in March from 2.50%.